- Wall Street reacts positively to the U.S.-China trade agreement.

- S&P 500 expected to rise for fifth consecutive day.

- Fed speeches are anticipated to address growth or inflation concerns.

On May 12, 2025, the United States and China reached a pivotal trade agreement, boosting market sentiment as Wall Street stock indexes closed higher.

The agreement’s temporary reduction in tariffs signifies a potential easing of U.S.-China trade tensions, sparking optimism among investors. According to Scott Bessent, Treasury Secretary, U.S. Department of the Treasury, “This agreement represents a crucial step in avoiding a generalized decoupling from China.” source

S&P 500 and Fed’s Expected Position Post-Agreement

The U.S. and China have agreed to reduce tariffs on each other’s goods, offering a temporary reprieve amid ongoing trade tensions. This agreement marks an initial 90-day suspension of 24 percentage points on ad valorem duties.

U.S. stock indexes, including the S&P 500, have experienced significant recovery, with the S&P 500 poised for its fifth consecutive trading day increase. However, it remains approximately 4% below its historical peak.

Experts anticipate upcoming speeches from Federal Reserve officials could clarify the Fed’s stance on future economic growth versus inflation concerns, amid market optimism following the trade deal announcement.

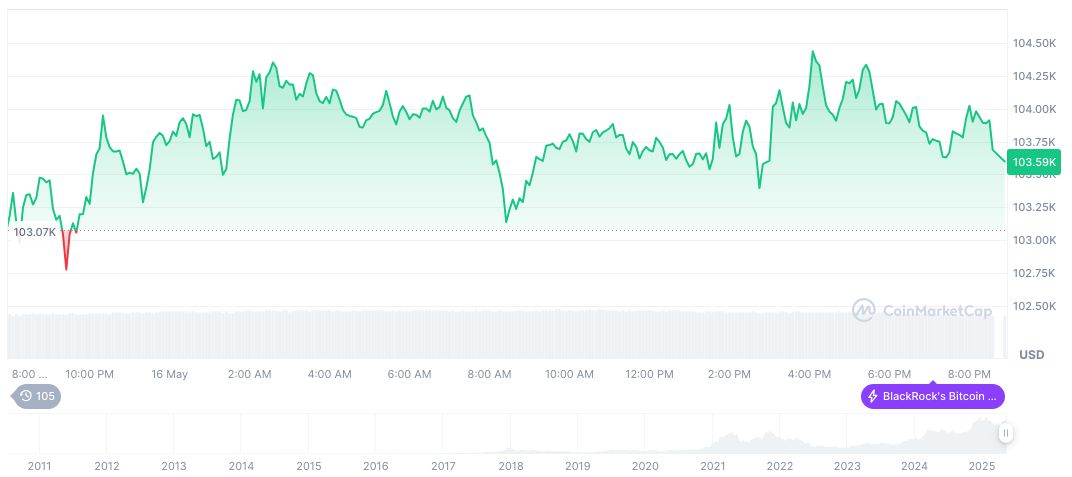

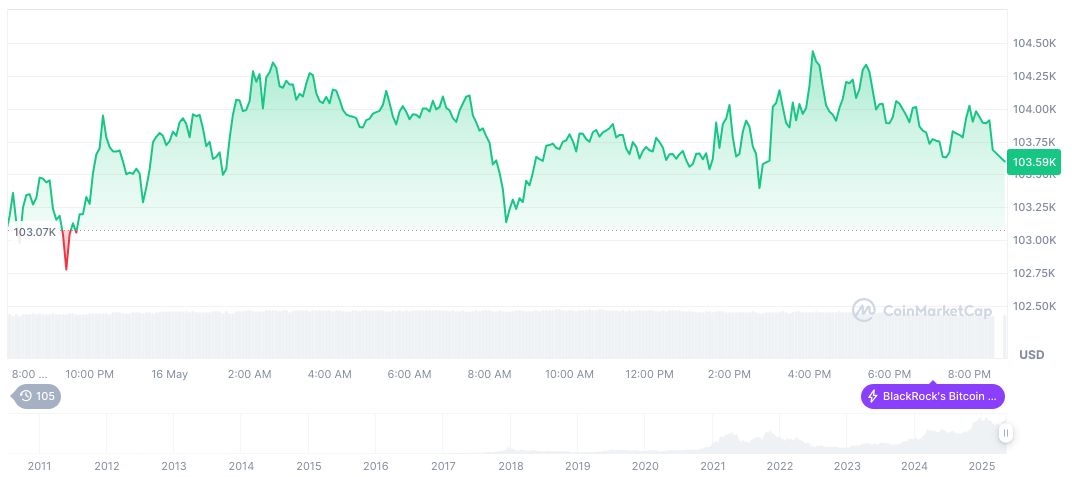

Bitcoin Market Trends Amid U.S.-China Trade Easing

Did you know? In a pivotal 2025 trade move, the U.S. and China suspended select tariffs, echoing similar 2019 agreements which also buoyed financial markets.

Bitcoin is trading at $102,984.02 with a market cap of $2.05 trillion and a 24-hour trading volume of $42.74 billion, according to CoinMarketCap. Although the price decreased by 0.78% over the past 24 hours, Bitcoin saw a 22.24% increase over 30 days.

Coincu research suggests that easing U.S.-China tensions could positively influence global trade and financial markets. This development could potentially alleviate pressure on sectors impacted by previous trade policies, encouraging a re-evaluation of strategic market positions.

Source: https://coincu.com/338083-us-china-trade-deal-boosts-market/