- U.S. August non-farm payrolls increase by only 22,000; unemployment rises to 4.3%.

- Market adjusts to potential interest rate cuts amid weakening labor.

- Crypto markets react speculatively, reflecting on past economic data impact.

The U.S. Bureau of Labor Statistics reported that in August 2025, non-farm payrolls increased by 22,000 and unemployment rose to 4.3%, signaling ongoing labor market weakness.

This data suggests potential shifts in Federal Reserve policy, impacting U.S. dollar valuations and cryptocurrency markets, pending official rate announcements.

August Payrolls Miss Expectations, Unemployment Hits 4.3%

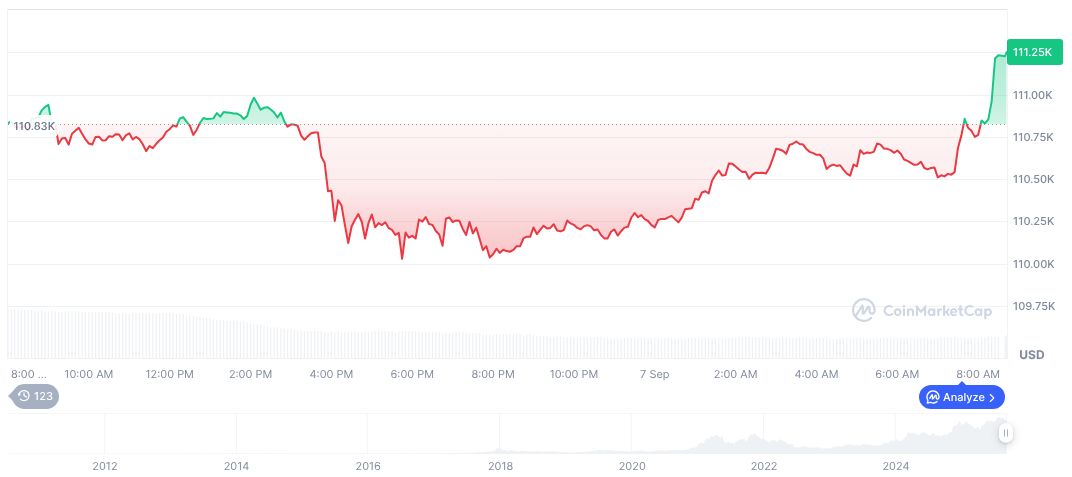

Bitcoin (BTC) currently stands at $110,945.59 with a market cap of $2.21 trillion, dominating 57.64% of the market. Over the past 24 hours, the trading volume reached $26.07 billion. Week-on-week, Bitcoin’s price rose by 3.30%, signifying cautious optimism amid broader economic uncertainties. [CoinMarketCap]

Analysts from Coincu suggest that speculative market adjustments hinge on future Federal Reserve announcements, potentially impacting regulatory and financial conditions in the cryptocurrency sector. Bold decisions in monetary policy could reshape market dynamics once official confirmations are available. For further detailed insights, you can review the Detailed Summary of Employment Situation October 2023.

No direct statements from key officials or organizations are available as of September 8, 2025, regarding the labor data.

Crypto Markets Eye Federal Reserve Amid Economic Uncertainties

Did you know? The U.S. labor market’s cooling trend in August 2025 mirrors earlier periods like March 2023, where non-farm payrolls missed expectations, triggering similar market responses yet without immediate Federal Reserve rate adjustments.

Bitcoin (BTC) currently stands at $110,945.59 with a market cap of $2.21 trillion, dominating 57.64% of the market. Over the past 24 hours, the trading volume reached $26.07 billion. Week-on-week, Bitcoin’s price rose by 3.30%, signifying cautious optimism amid broader economic uncertainties. [CoinMarketCap]

Analysts from Coincu suggest that speculative market adjustments hinge on future Federal Reserve announcements, potentially impacting regulatory and financial conditions in the cryptocurrency sector. Bold decisions in monetary policy could reshape market dynamics once official confirmations are available. For further detailed insights, you can review the Detailed Summary of Employment Situation October 2023.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-august-payroll-data-rate-cuts/