- Tyler Winklevoss accuses JPMorgan of hindering fintech and crypto access.

- JPMorgan policy may disrupt crypto-fiat gateways.

- Market ripple effects expected for major crypto assets.

Tyler Winklevoss has accused JPMorgan Chase of anti-competitive practices following its decision to charge fintechs for access to banking data, impacting cryptocurrency platforms like Gemini.

The accusation underscores growing tensions between traditional banks and crypto-enabled fintechs, potentially affecting market dynamics and access to crypto-fiat services in the U.S.

Winklevoss Warns of JPMorgan’s Crypto Market Disruptions

Gemini’s Tyler Winklevoss has alleged that JPMorgan’s recent policies are restricting Gemini’s customer onboarding. The alleged actions trace back to JPMorgan charging fintechs like Plaid for data access, integral to crypto onramps. Winklevoss claims that JPMorgan’s policies may force fintech companies linking bank accounts to crypto exchanges toward financial insolvency. “The data-access fees could bankrupt fintechs that help you link your bank accounts to crypto companies like Gemini, Coinbase, and Kraken so you can easily fund your account w/ fiat to buy bitcoin and crypto,”

Prominent public figures in the fintech space have yet to release statements countering or confirming these claims. While JPMorgan’s leadership remains reticent, the financial community is closely monitoring potential developments.

Bitcoin Market Dynamics Amid Banking Policy Shifts

Did you know? Historical precedents of bank restrictions have caused temporary market upheavals, reminiscent of crypto firms’ challenges in accessing traditional financial ecosystems.

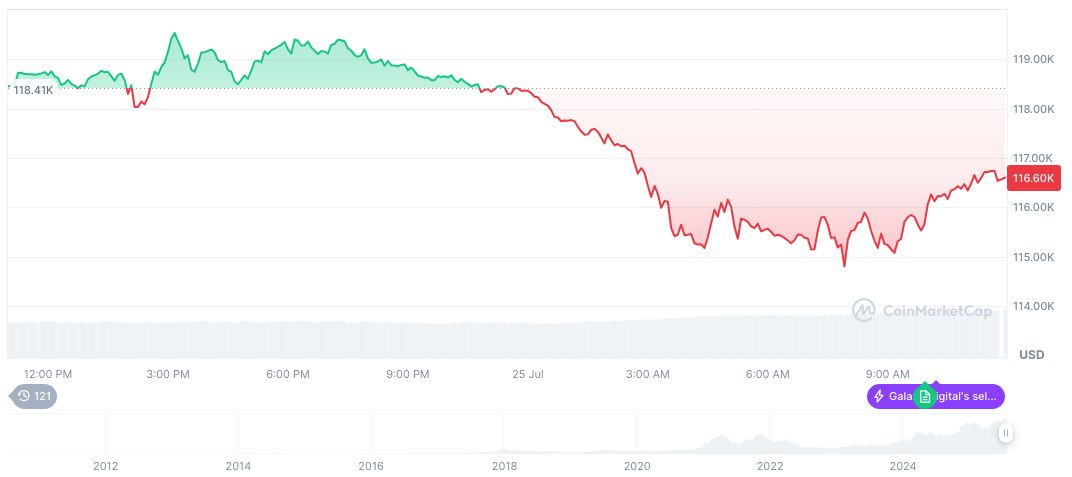

According to CoinMarketCap, Bitcoin’s current market cap stands at $2.35 trillion with a trading price of $118,075.82. Despite a 30.55% drop in 24-hour trading volume, Bitcoin has shown a 1.39% price increase over the same period, with a 60-day gain of 7.59%.

The Coincu research team highlights the potential for systemic shifts if JPMorgan’s policies discourage fiat-crypto interfacing. Continued bank-led restrictions may lead crypto firms to explore alternative financial ecosystems, impacting the broader fintech landscape. John Deaton discusses legal perspectives on cryptocurrency regulations which may become increasingly relevant if such market disruptions continue.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tyler-winklevoss-jpmorgan-policy-impact/