- Twenty One Capital raises $100 million for Bitcoin expansion.

- Investment reiterates focus on maximizing Bitcoin reserves.

- Strengthens position among top Bitcoin holders globally.

Twenty One Capital, led by CEO Jack Mallers and majority-owned by Tether, has secured an additional $100 million in funding through secured notes from existing investors. The move increases their total funding to $685 million.

The funding emphasizes strategic Bitcoin growth as Twenty One Capital aims to bolster their substantial Bitcoin treasury. This approach aligns with the company’s objective to provide a singular Bitcoin investment vehicle.

Twenty One Capital Bolsters Bitcoin Holdings with $100 Million

Twenty One Capital, led by CEO Jack Mallers and majority-owned by Tether, has secured an additional $100 million in funding through secured notes from existing investors, increasing their total funding to $685 million.

The proceeds will boost Bitcoin purchases, which aligns with Twenty One’s mission of maximizing ‘Bitcoin Ownership Per Share.’ With reserves already at over 42,000 Bitcoins, they are now among the largest public Bitcoin treasuries. These activities underscore a robust institutional strategy within the cryptocurrency space, similar to past strategies demonstrated by MicroStrategy.

“Twenty One is expected to offer investors a singular vehicle for Bitcoin exposure, pro-Bitcoin advocacy, and Bitcoin-focused content and media with plans to explore future expansion into Bitcoin-native financial products.” – Jack Mallers, CEO, Twenty One Capital, Inc., source

Notable reactions from the sector highlight the strategic importance of such investments, with CEO Jack Mallers stating, “Twenty One is expected to launch with over 42,000 Bitcoin and a mission to maximize Bitcoin Ownership Per Share.” In the broader market, observers highlight the potential impacts on Bitcoin supply dynamics.

Market Implications of Expanded Bitcoin Reserves

Did you know? Twenty One Capital’s approach mirrors MicroStrategy’s past strategies in leveraging corporate treasuries for Bitcoin acquisition, which influenced market strategies and attention across the cryptocurrency realm.

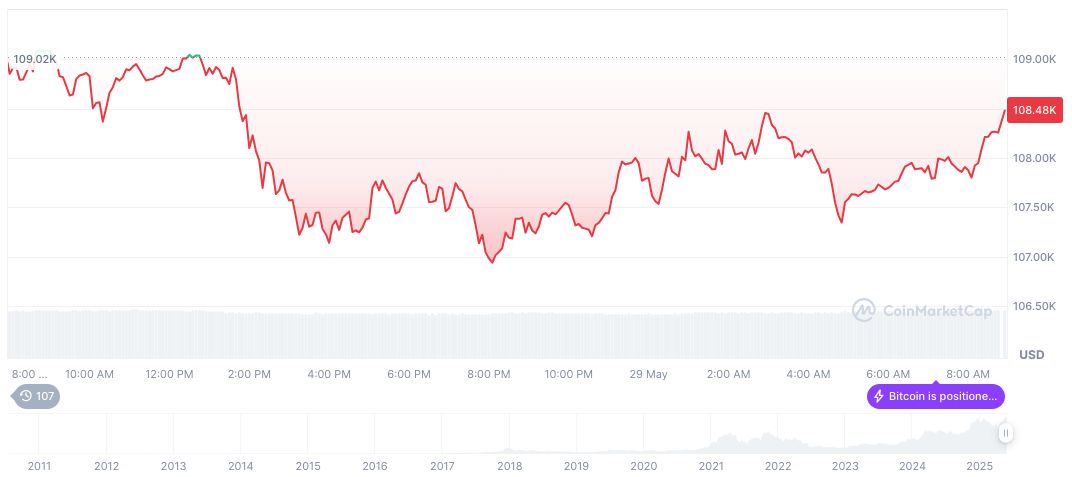

According to CoinMarketCap data as of 22:53 UTC on May 29, 2025, Bitcoin is currently valued at $106,128.50. It has experienced a 1.19% decrease in the last 24 hours and holds a market dominance of 62.62%, with a market cap of $2.11 trillion while a trading volume hit $55.87 billion in 24 hours, showing a 14.94% change.

Expert analysis from Coincu research team suggests that institutional investments such as those by Twenty One Capital could potentially lead to supply constraints, impacting Bitcoin liquidity and emphasizing its appeal as a long-term strategic asset.

Source: https://coincu.com/340579-twenty-one-capital-bitcoin-funding/