- Treasury yield rises, market reacts to Trump’s tariffs.

- $343 million in crypto liquidations reported.

- Institutional interest in Bitcoin persists despite volatility.

On May 23, former President Trump announced significant tariffs on the EU and Apple, causing notable market shifts.

The move sparked increased volatility across financial and crypto markets, with Treasury yields rising and significant liquidations occurring.

Tariffs Trigger $343M Crypto Liquidations and Market Fluctuations

The US Treasury yield increased by 6 basis points following statements by Secretary Benson. Trump’s announcement of tariffs on the EU and Apple triggered this rise. The crypto community speculates on Trump’s intentions, given his connections with digital assets and industry figures during a private dinner.

Market and crypto volatility have increased, with $343M in crypto liquidations. Meanwhile, Benson’s promotion of a “trade agreement” on Fox News appears misaligned with the intended economic objectives. The S&P 500 index dropped significantly, echoing past tariff impacts.

The crypto community voices concern over macro-policy influences on digital assets. The Trump-hosted dinner stirred reactions, with speculation on crypto’s political role. The BlockBeats community highlighted a polarized industry as a result of these intersecting policies.

Impact on Bitcoin Prices and Regulatory Concerns

Did you know? Trump’s past media involvement in digital currencies has consistently led to market volatility, moments of instability, and temporary surges.

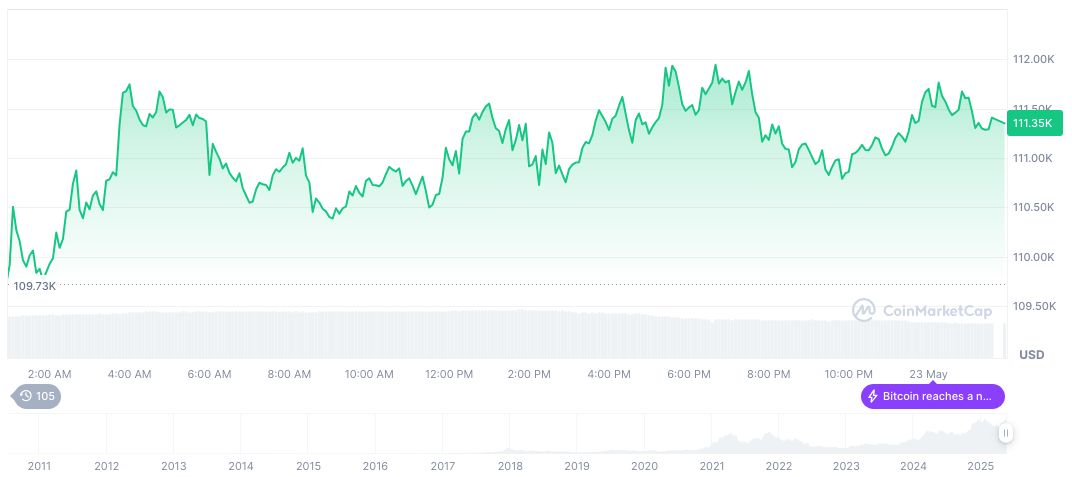

Bitcoin’s price closed at $109,743.84 on May 23, with its market cap reaching $2.18 trillion and dominance at 63.05%. The cryptocurrency’s price fell by 1.10% in 24 hours but rose 5.63% over seven days, according to data from CoinMarketCap.

Donald J. Trump, Former U.S. President, stated, “Whether genuinely wanting to help the industry rise or more inclined to create a new ATM for their family, this ‘crypto president’ is increasingly walking on the cutting edge… what kind of storm will be stirred up in the partisan struggle afterward remains unknown.”

Research by the Coincu team suggests tariff-related actions might lead to further regulatory responses and fluctuations. Technological advances and compliance measures may mitigate these effects, but industry stability remains uncertain amidst ongoing global economic shifts and political decisions.

Source: https://coincu.com/339311-trump-tariffs-impact-markets-crypto/