- Donald Trump attempts to remove Fed Governor Cook to place ally Miran and shift policy.

- Fed independence is challenged, impacting market confidence and interest rate expectations.

- Economists fear long-term financial instability due to political influence on monetary policy.

President Trump has intensified his battle with the Federal Reserve, seeking to dismiss Governor Lisa Cook and appoint Stephen Miran to influence interest rate decisions.

This move risks undermining Fed independence, potentially leading to economic instability marked by short-term prosperity but long-term inflation and market volatility.

Trump Aims for Fed Leadership Overhaul Amid Court Block

Donald Trump formally announced the dismissal of Governor Lisa Cook from the Federal Reserve, alongside plans to appoint Stephen Miran. These steps are aimed at creating a supportive majority for substantial interest rate cuts. Cook, who has resisted her removal, cites the Federal Reserve Act’s legal protections. The Supreme Court has temporarily blocked Trump’s attempt, highlighting the ongoing tension in this high-stakes confrontation.

With potential changes looming in the Federal Reserve, analysts from JPMorgan and other institutions signal concerns over diminishing Fed independence. Trump’s actions, if successful, might disrupt current monetary policy, leading to short-term economic growth but at the risk of re-emerging stagflation challenges reminiscent of the 1970s.

“President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so. I will not resign and will continue to carry out my duties to help the American economy as I have been doing since 2022.” – Lisa Cook, Fed Governor

Economic Uncertainty Drives Investors to Cryptocurrencies

Did you know? Recent historical parallels suggest that political manipulation of monetary policy can lead to a rapid economic downturn. The 1970s showcased similar risks, when initial prosperity quickly spun into inflationary pressure and economic stagnation.

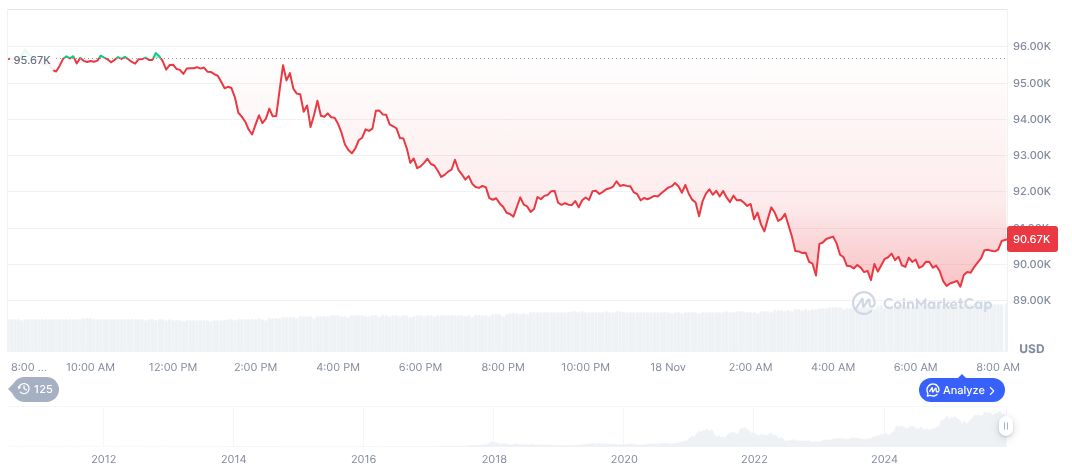

According to CoinMarketCap, Bitcoin (BTC) is currently valued at $91,186.76 with a market cap of $1.82 trillion. The cryptocurrency’s price movements over recent periods indicate volatility: it is down 11.88% over the past week and has fallen 19.77% in the last three months. These dynamics highlight its role as a hedge during economic uncertainties.

The Coincu research team highlights that the alteration in Fed leadership could trigger shifts across financial market regulations and fiscal policies. They note a significant historical pattern: reduced central bank autonomy often leads to progressively volatile economic cycles, emphasizing the need for careful monitoring and strategic market allocation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-federal-reserve-leadership-shakeup/