- Trump criticizes Fed Chair Powell, potential market disruption noted.

- Trump’s remarks heighten market focus on Fed’s future approach.

- Crypto markets react to interest rate uncertainty, potential volatility.

On August 2, 2025, President Trump indicated in an interview his willingness to potentially dismiss Federal Reserve Chairman Powell, framing criticisms around the current high-interest-rate policy.

Trump’s remarks highlight ongoing tensions influencing market expectations for potential interest rate shifts, affecting both traditional and cryptocurrency markets with sensitivity to policy changes.

Trump’s Critique of Fed Sparks Crypto Market Response

During an interview, Donald Trump issued strong criticism of Fed policies, remarking that he would “not hesitate to fire Federal Reserve Chairman Powell.” President Trump stated, “I would not hesitate to fire Federal Reserve Chairman Powell, but firing him would disrupt the market.” Trump highlighted the problems with high interest rates yet acknowledged the market disruption firing Powell would cause. Despite his harsh critique, Trump conceded that Powell is “very likely” to remain as chairman. Increased scrutiny on the Federal Reserve’s future actions is anticipated following Trump’s statements, steeped in historic criticism against Powell.

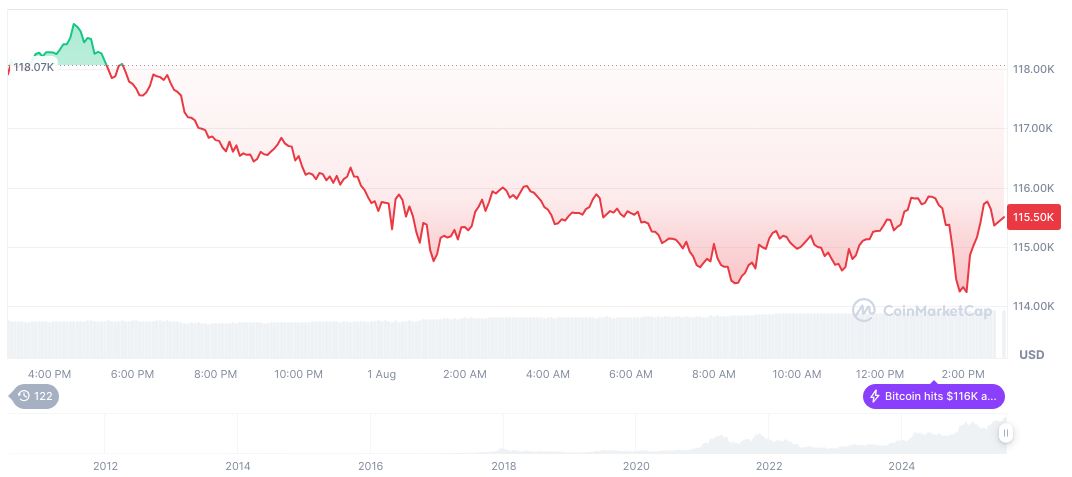

Financial markets reacted swiftly to Trump’s comments, with some investors speculating potential rate cuts. Investors already on high alert for a more dovish Federal Reserve, saw crypto markets, especially Bitcoin, react positively to the heightened rate cut expectations. However, no major incoming changes have been reported from federal sites, placing the discourse within the realm of speculative anticipations rather than confirmed policy shifts.

Political Volatility Elevates Bitcoin’s Safe Asset Appeal

Did you know? Historically, political comments on the Federal Reserve’s actions often lead to volatility in markets and increased attractiveness of decentralized assets like Bitcoin.

Bitcoin (BTC) is currently priced at $113,841.94, with a market cap of 2.27 trillion USD and a dominance of 61.22%, according to CoinMarketCap. Over the past 24 hours, Bitcoin has seen a 1.56% decrease, although it remains 18.88% higher over the last 90 days.

The Coincu research team notes potential increases in crypto market valuation during politically charged financial policies. Such developments are historically significant for Bitcoin and Ethereum, owing to their perceived independence from fiat monetary policies, which may encourage higher decentralized finance utilization amid uncertainty surrounding interest rates.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-fed-powell-market-impact/