- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Trump’s statement on Powell lacks evidence.

- No impact observed on market or Federal Reserve actions.

Reports surfaced claiming former President Trump criticized Federal Reserve Chair Jerome Powell on Truth Social, but verification from primary sources is lacking as of August 1, 2025.

This purported remark remains unverified, while market attention focuses on Federal Reserve interest rate strategies affecting crypto and macroeconomic conditions.

Trump’s Unverified Critique of Federal Reserve Chair

Reports suggested Trump posted a statement on the Truth platform calling for significant rate cuts by Powell. Yet, no official confirmations exist on Truth Social or other verified channels, creating confusion about the authenticity of the statement and raising concerns among analysts.

Without primary-source evidence, the supposed demand has not affected the Federal Reserve’s rate policy or market behavior. Mcroeconomic themes, including rate speculation, continue to shape market sentiments without direct ties to Trump’s alleged statement, keeping the environment stable for typical observers.

Reactions from major market stakeholders and government officials remain absent, reflecting the lack of implementation or discussion around the statement. The Federal Reserve Board has made no formal responses, and key industry voices have not commented publicly on this situation. BlockBeats notes that “Current macro conditions are influenced by anticipation around the Fed’s rate decisions.”

Bitcoin and Market Dynamics Amidst Unconfirmed Statements

Did you know? In historical contexts, official presidential critiques of Fed actions have sometimes briefly influenced sentiment, but current conditions show no such effects due to lacking verifiable Trump comments on Powell.

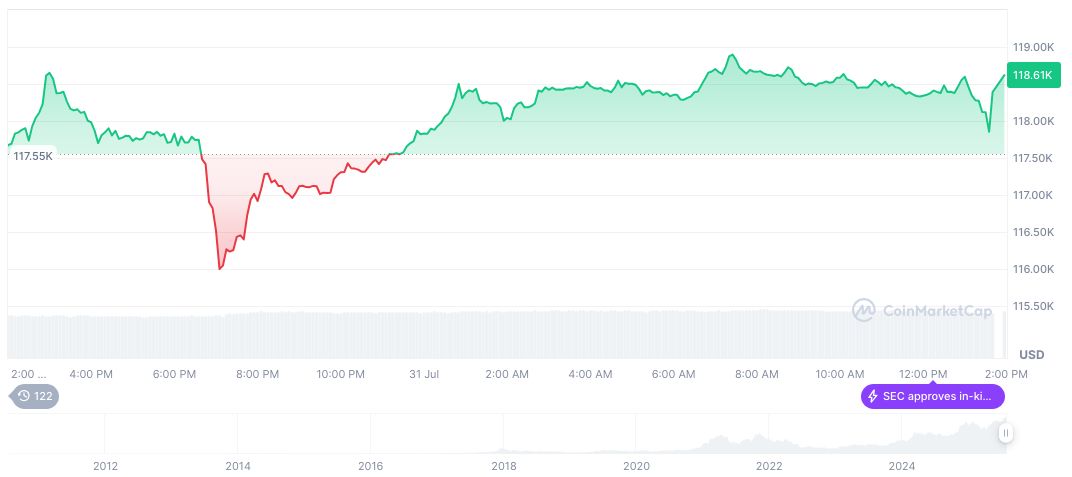

As of August 1, 2025, Bitcoin’s (BTC) price is $114,716.36, with a market cap of approximately 2.28 trillion USD, according to CoinMarketCap. Despite recent claims, BTC sees a 3.17% drop in 24 hours, amidst broader crypto dynamics, without direct ties to Trump’s statements.

The Coincu research team notes the general macroeconomic environment remains reactive primarily to Fed’s ongoing policy discussions rather than unverified statements. This underscores the importance of evidence-based scenarios influencing market trends and policy outcomes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-powell-statement-lack-evidence/