- President Trump’s executive order affects U.S. automotive tariffs.

- Tariff stacking relieved for automakers.

- Communities anticipate impacts on trade discussions.

President Donald Trump is set to sign an executive order modifying automotive tariffs on Tuesday, according to White House Press Secretary Karoline Leavitt.

The order aims to relieve U.S. automakers from stacked tariffs, possibly influencing trade negotiations with key partners.

Executive Order Revamps U.S. Automotive Tariff Structure

The expected executive order will modify the current automotive tariffs structure, notably omitting steel and aluminum surcharges for importation. This step involves key players such as President Trump, the U.S. International Trade Commission, and relevant federal agencies to adjust policy implementations.

Current automotive tariffs remain unchanged for imported vehicles and parts, while U.S. manufacturers gain some respite from additional tariff layers. This adjustment seeks to boost domestic production amidst ongoing international trade negotiations.

“The president has made it very clear he’s open to a deal with China. If China continues to retaliate, it’s not good for China.” — Karoline Leavitt

2018 Tariff Revisions: Context and Ethereum’s Market Status

Did you know? The 2018 tariff impositions under Trump’s administration initially targeted imports over national security concerns, set a historic precedence on U.S.-China trade relations, yet minimal crypto market disturbances.

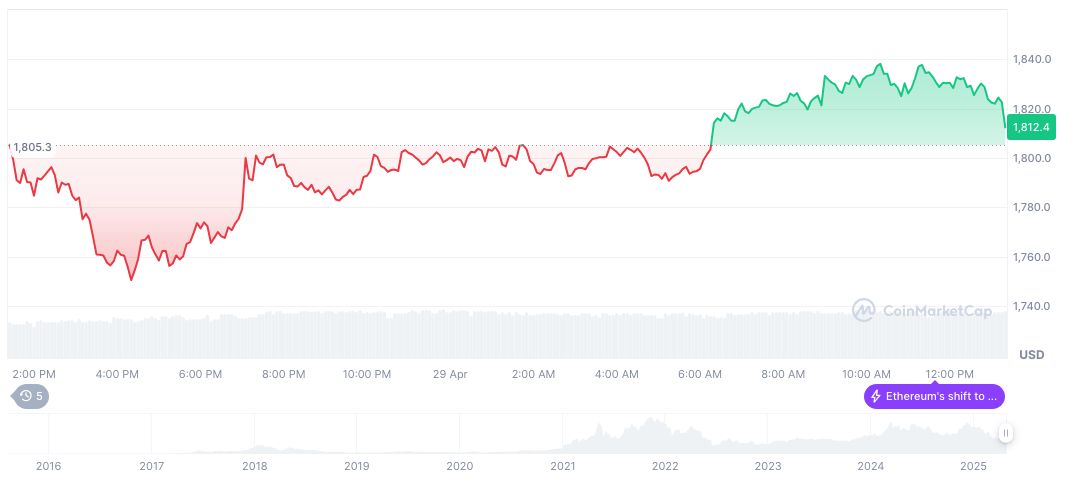

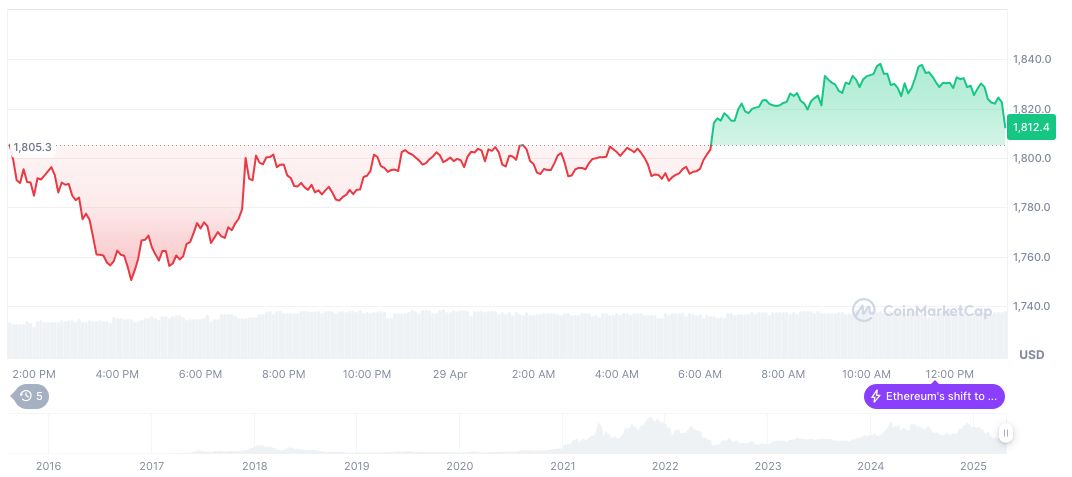

As of April 29, 2025, Ethereum (ETH) holds a market cap of $218.51 billion according to CoinMarketCap, with a price of $1,809.97. The 24-hour trading volume reached $16.11 billion, highlighting a significant 27.66% increase.

The Coincu research team notes that adjustments in U.S. tariffs may potentially sway global trade dynamics, influencing investor confidence. Historic data suggests markets could experience fluctuations dependent on trade outcomes and bilateral discussions.

Source: https://coincu.com/334871-trump-signs-auto-tariff-order/