- Trump signed a historic cryptocurrency regulation aimed at U.S. stablecoins.

- First federal bill in the U.S. focuses on stablecoins.

- Impacts stablecoin legitimacy and regulatory clarity.

Donald Trump signed the GENIUS Act, the first U.S. federal legislation on cryptocurrency, at the White House on July 18.

This act marks a significant step in U.S. financial regulation, providing clarity and legitimacy to the stablecoin market, affecting assets like USDT and USDC.

GENIUS Act: Transforming U.S. Stablecoin Regulation

The GENIUS Act, signed into law by President Donald Trump, has made history as the first major federal bill to regulate cryptocurrency in the United States. This landmark legislation provides a comprehensive federal framework for managing stablecoins, a market worth approximately $238 billion as of April 2025. It aims to increase regulatory clarity and improve legitimacy for stablecoin issuers and users alike.

With new regulations, stablecoin issuers are expected to experience an improvement in trust, leading to broader acceptance in traditional banking and finance sectors. The clear regulatory guidance provided by the GENIUS Act is expected to stimulate further innovation and adoption in the digital asset space. Key figures, including President Trump, have labeled this a “massive validation” for the stablecoin industry, emphasizing how it positively positions the United States in the global cryptocurrency environment.

Market responses have varied, with immediate speculative movements not yet clearly emerging in on-chain data. Analysts predict that greater regulatory clarity might lead to increased stablecoin utility across decentralized finance platforms. President Trump’s support is echoed by his statements, “It’s good for the dollar, and it’s good for the country.” Many in Congress and industry celebrated this proactive legislative endeavor as a demonstration of effective political collaboration.

Impact Analysis: Stablecoin Market Poised for Growth

Did you know? {{The GENIUS Act is the first U.S. federal law to provide regulatory clarity for stablecoins, a market with a capitalization of $238 billion, changing the regulatory landscape in a way not seen since the advent of cryptocurrencies.}}

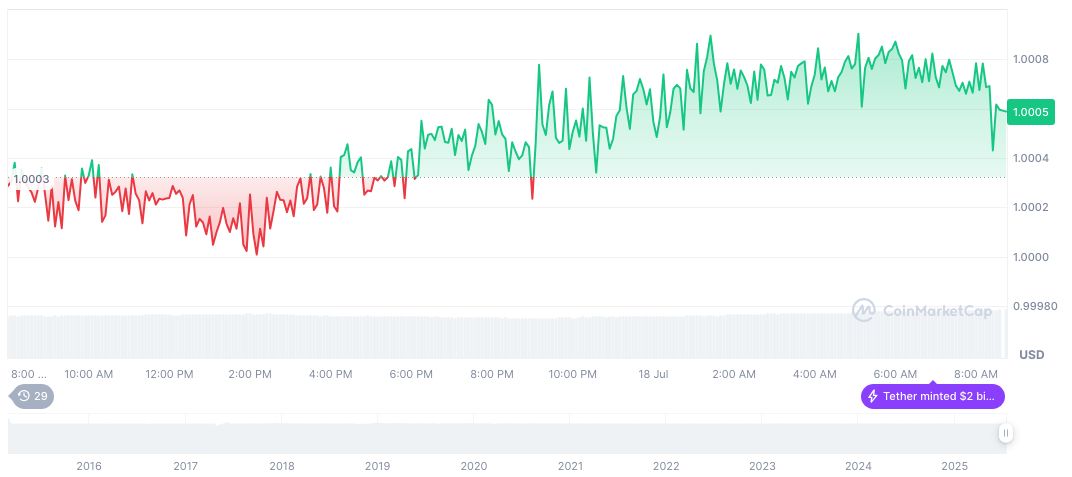

CoinMarketCap data as of July 19, 2025, shows Tether USDt (USDT) maintains a price of $1.00, with a market cap of $160.90 billion, reflecting a 4.16% market dominance. The 24-hour trading volume is $135.88 billion, a 17.98% drop, with nominal price fluctuations over recent months.

Insights from the Coincu research team suggest the GENIUS Act will likely lead to increased financial stability and security for stablecoins, paving the way for broader acceptance. Potential ripple effects could involve more robust technological advancements in blockchain infrastructure, impacted by clear regulatory frameworks and a supportive political climate.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349541-trump-signs-crypto-genuis-act/