- President Trump signals end of tariff suspension, impacting trade negotiations.

- Markets react with increased volatility, affecting investor sentiment worldwide.

- Focus on reaching fair trade agreements with multiple nations.

U.S. President Donald Trump recently voiced his intention to cease the 90-day tariff suspension, emphasizing the need for reasonable trade agreements. The announcement was made aboard Air Force One, highlighting his administration’s focus on leveraging tariffs in negotiations.

With this move, immediate changes are anticipated in global trade dynamics. This may provoke sharp responses from foreign governments, particularly from countries directly affected by heightened tariffs, such as China, which faces rates up to 125%.

Trump’s Tariff Strategy Sparks Global Market Volatility

Following Trump’s declaration, financial markets displayed increased volatility, reflecting concerns among investors about potential trade disruptions. The U.S. stock market saw a significant downturn, marking a negative shift in market sentiment amid uncertain tariff futures.

Insights from the Coincu research team suggest that the cessation of tariff suspensions could lead to increased economic strain on U.S. trade partners. Historical data points to tariff escalations potentially spurring retaliatory actions, impacting both traditional and crypto financial markets.

“We hope to reach trade agreements with a number of countries. We will be reasonable.” — Donald J. Trump, President of the United States White House Fact Sheet

Tariff Suspension Ending: Historical Context and Future Implications

Did you know? Tariff escalations have historically led to significant shifts in international trade relations and market stability.

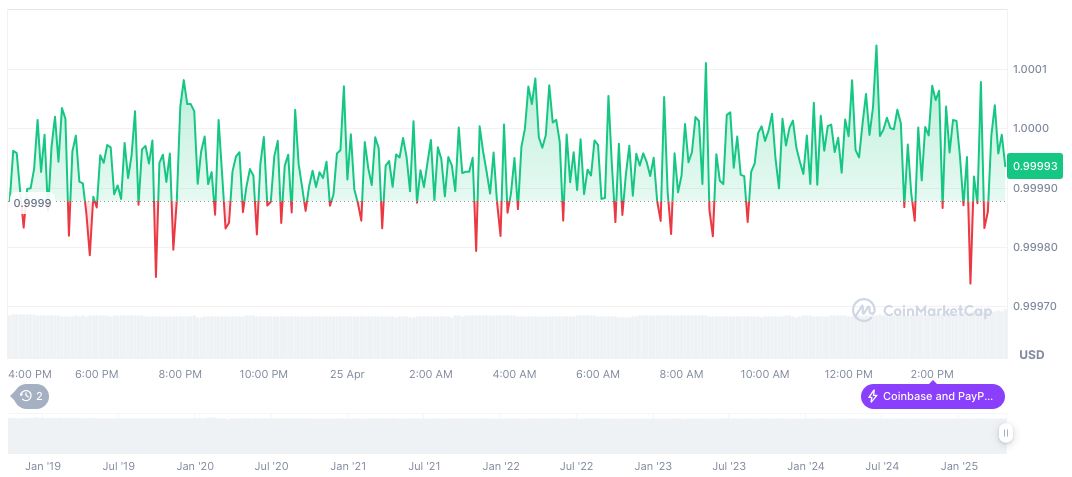

According to CoinMarketCap, USDC is priced at $1.00 with a market cap of $62.36 billion and a 24-hour trading volume of $12.94 billion, reflecting a 17.46% change. The price has remained stable over the past 24 hours, while the circulating supply stands at 62.36 billion USDC.

Insights from the Coincu research team suggest that the cessation of tariff suspensions could lead to increased economic strain on U.S. trade partners. Historical data points to tariff escalations potentially spurring retaliatory actions, impacting both traditional and crypto financial markets.

Source: https://coincu.com/334385-trump-end-tariff-suspension-2025/