- President Trump proposes U.S. Sovereign Wealth Fund; White House debates funding approach.

- White House review delaying fund’s progress.

- No immediate crypto market impact reported from the fund’s discussions.

President Trump has advocated for the creation of a U.S. sovereign wealth fund, aiming to model it after international counterparts. Details of the proposal are under consideration, with concerns from the White House delaying its finalization.

President Trump has directed the U.S. Treasury and Commerce Departments to develop a sovereign wealth fund plan, drawing inspiration from global models like Norway’s and Saudi Arabia’s. As described by Kush Desai, the White House spokesperson, “In accordance with President Trump’s executive order, the Treasury and Commerce Departments have formulated plans for a Sovereign Wealth Fund, but no final decisions have yet been made.” The proposal, co-led by Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, remains under evaluation. Reports indicate that the White House disapproves some of its elements.

Trump’s Treasury and Commerce Team to Spearhead Fund Initiative

Market analysts speculate on potential financial shifts, although no specifics on asset utilization have emerged. While global sovereign funds often leverage surpluses for investment, the U.S. approach remains undefined. Speculation surrounds the inclusion of diversified categories, such as real estate and potentially digital assets. The absence of official funding strategies adds layers of uncertainty.

Observers note that no regulatory bodies have officially addressed the proposal’s potential market implications. Cryptocurrency market participants remain attentive but unaffected, as evident from stable price dynamics. While conjecture persists around the eventual inclusion of digital assets, only the finalized plan may clarify possible impacts.

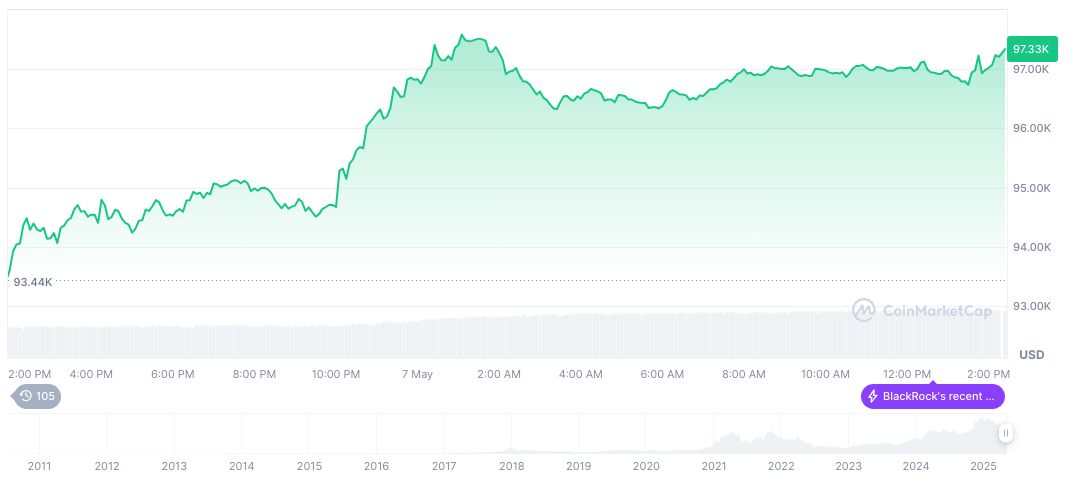

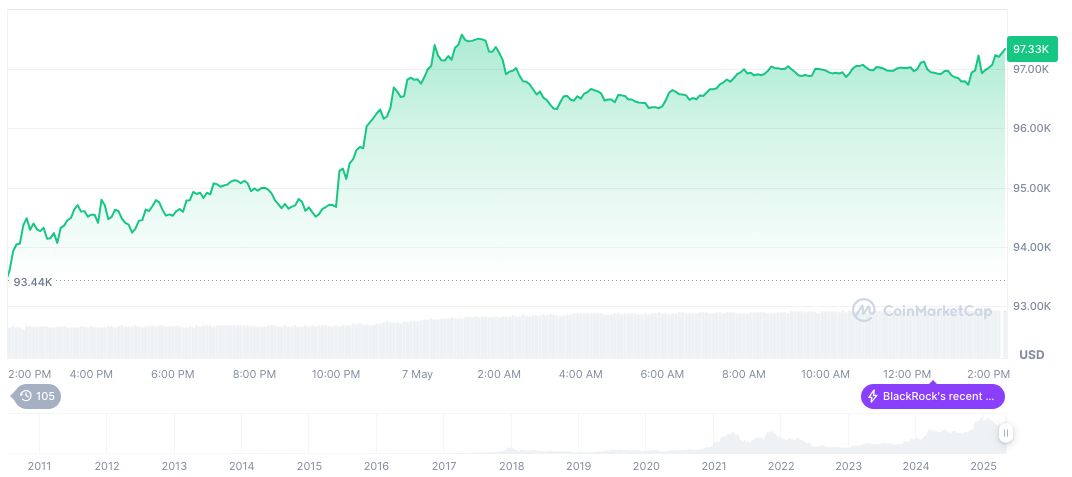

As of May 8, 2025, Bitcoin (BTC) holds a market cap of $1.97 trillion, with a price at $99,168.22. The trading volume in the last 24 hours reached $50.11 billion, reflecting a 53.01% shift. Data from CoinMarketCap indicates a 2.57% price surge in 24 hours, showcasing the dynamic nature of cryptocurrency markets.

Historical Context, Price Data, and Expert Insights

Did you know? The U.S.’s consideration of a sovereign wealth fund comes as nations like Norway have successfully utilized such funds to stabilize and grow their economies, boasting funds totaling $1.8 trillion.

Coincu research indicates potential economic implications, depending on the fund’s eventual structure. If allocated to talented asset managers, the U.S. sovereign wealth fund could play a crucial role in ensuring future economic robustness. The debate continues over potential fund utilization and impact, underscoring its significant potential to influence both traditional and digital asset sectors.

The debate continues over potential fund utilization and impact, underscoring its significant potential to influence both traditional and digital asset sectors.

Source: https://coincu.com/336316-trump-us-sovereign-wealth-fund-plan/