- President Trump aims to create a U.S. Sovereign Wealth Fund amid internal opposition.

- Proposal faces White House rejection of parts; concerns persist.

- Potential market impacts remain undefined; no announcement expected soon.

President Donald Trump has proposed the creation of a U.S. Sovereign Wealth Fund, aiming for implementation despite facing internal challenges.

The plan’s details are still under discussion, and the White House has expressed concerns.

Trump’s Sovereign Fund Proposal Faces Internal Resistance

President Trump, along with Treasury Secretary Bessant and Commerce Secretary Lutnick, has initiated a proposal to establish a U.S. Sovereign Wealth Fund. A plan for a U.S. Sovereign Wealth Fund. The White House, however, has rejected parts of this proposal, expressing concerns about its approach. Multiple sources confirm that a draft has been submitted, yet details remain under discussion.

Though specifics of the fund’s operation are undecided, its establishment may yield significant changes in U.S. economic policies, potentially affecting markets globally. Immediate effects on financial structures remain undefined, with ongoing debates about potential outcomes.

“The White House has expressed concerns about the Treasury Department’s approach,” said an unnamed White House official.

Community reactions are mixed. While some see the fund as a step toward securing national economic interests, others are wary about its execution. The administration is not expected to announce further details imminently, as discussions continue to address White House concerns.

Global Impact of U.S. Sovereign Fund Initiative

Did you know? Sovereign Wealth Funds have managed assets worth over $13 trillion globally, with Norway’s fund topping at $1.8 trillion. The proposed U.S. fund represents a significant national interest in similar economic tools.

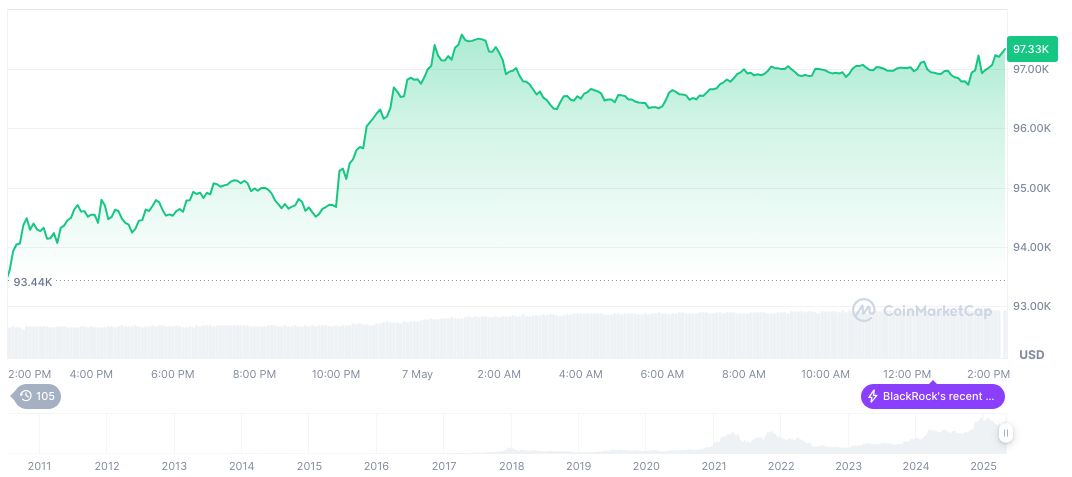

Bitcoin (BTC’s) recent performance includes a market cap of 1_927_793_851_888.10 billion, according to CoinMarketCap as of May 7, 2025. Prices recorded a 22.33% rise over the last 30 days, with a current trading price of $97,061.22. Market dominance stands at 64.39%, highlighting significant investor focus.

Insights from the Coincu research team suggest regulatory and technological challenges may affect the proposal’s success. Historically, the U.S. has not needed such funds, but shifting global dynamics and technological advances may change this landscape, demanding new financial strategies.

Source: https://coincu.com/336254-trump-sovereign-wealth-fund-proposal/