- TRUMP seemed to be testing key support at $23.88, with the RSI at 32.79 signaling oversold conditions

- Market sentiment was cautious as social volume declined and Open interest dropped by 4.54%

Official Trump [TRUMP] may be on the verge of a rebound as the TD Sequential indicator flashed a buy signal on the daily chart. After a prolonged downtrend, this could mark the start of a potential recovery phase.

If buying pressure increases, the price may attempt to reclaim key resistance levels. However, uncertainty remains as market conditions continue to fluctuate. Will this signal trigger a sustained bullish reversal in the coming days?

An ongoing controversial debate

The TRUMP token has sparked heated discussions in the crypto community, with some seeing it as a bullish catalyst and others warning of potential instability. On one hand, its launch demonstrated growing interest in political memecoins, which could attract new liquidity to the space.

However, critics argue that it has drained capital from more reputable assets, leading to volatility across multiple markets. At press time, the altcoin was trading at $24.27, down 5.98% – A sign of mixed investor sentiment.

TRUMP’s price action – Testing key support levels

The memecoin’s price has been consolidating within a critical support zone at $23.88 – A level that could determine its next major move. If bulls manage to push it above $28.13, a surge towards $40 could follow, providing traders with renewed confidence.

Additionally, the Relative Strength Index (RSI) was at 32.79, indicating that TRUMP may be nearing oversold territory. If the RSI rises above 37.51 in the short term, buying momentum could strengthen, improving the chances of a breakout.

Source: TradingView

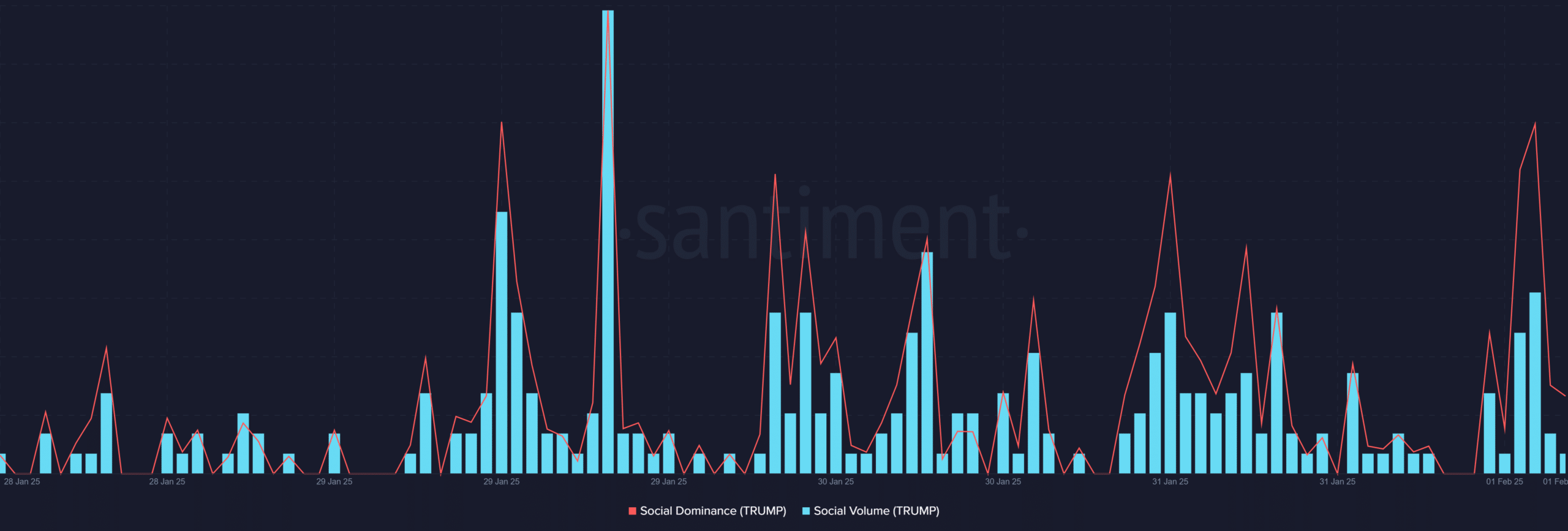

Trump social volume and dominance – A fading hype?

While TRUMP initially gained massive traction, recent data hinted at a decline in its social volume and dominance. In fact, Santiment analytics revealed that social volume peaked at 2.0 mentions per hour on 29 January. However, it has since dropped significantly.

Additionally, social dominance fell to 0.33% – A sign of a fall in trader discussions surrounding the token. This reduction in hype could mean weaker buying pressure, making it harder for bulls to sustain an uptrend on the charts.

Source: Santiment

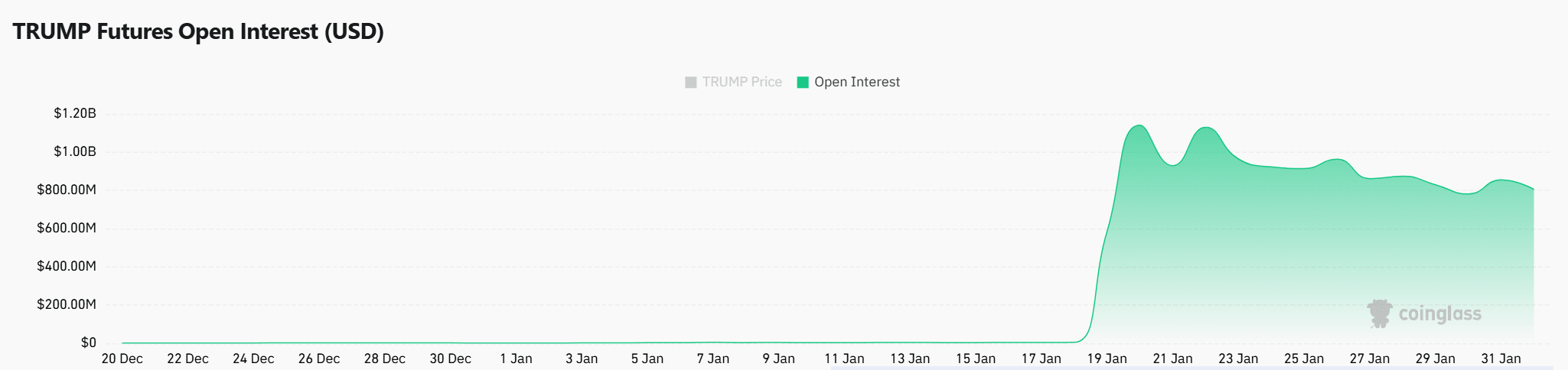

Open Interest – Are traders losing confidence?

Open Interest dropped by 4.54% to $833.39 million, indicating reduced trader activity. Typically, rising Open Interest signifies confidence in a potential move, but the latest decline seemed to hint at hesitation.

Moreover, this decline could mean that traders are closing positions, rather than betting on a major price swing. If Open Interest continues to fall, it may allude to further downside risk.

Source: Coinglass

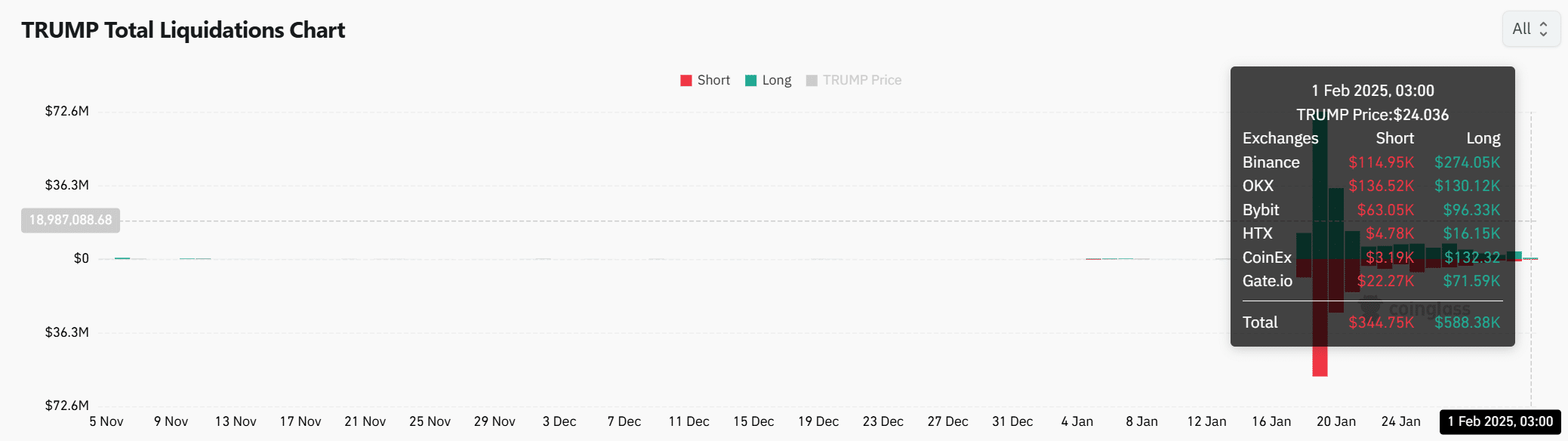

Total liquidations – What do they reveal?

Liquidations data revealed that $344.75k in short positions and $588.38k in long positions were wiped out. Simply put, both bulls and bears have been facing challenges as price volatility increased across the board.

However, if short liquidations intensify, a short squeeze could drive TRUMP’s price higher on the charts. Therefore, traders should closely monitor liquidation trends for signs of an upcoming breakout.

Source: Coinglass

TRUMP’s price remains at a critical juncture, where breaking above $28.13 could trigger a bullish reversal. On the contrary, failing to hold support might lead to more losses.

Read Official Trump’s [TRUMP] Price Prediction 2025-26

With declining social volume and Open Interest, market sentiment may appear somewhat cautious. However, if bullish momentum builds, TRUMP could reclaim lost ground in the coming days.

For now, traders should watch key levels before confirming a clear trend shift.

Source: https://ambcrypto.com/trump-price-prediction-bullish-reversal-for-the-memecoin-incoming/