- President Trump promises tariffs against countries imposing tariffs on the U.S.

- No genuine Trump-related cryptocurrency project verified; scams reported.

- Market volatility expected from trade rhetoric; no specific crypto impacts noted.

President Trump has articulated plans to retaliate with tariffs against countries imposing duties on the United States. This announcement adds a layer of tension to global trade relations and could affect economic policies among trading partners. The lack of official confirmation from U.S. government sources leaves the announcement open to interpretations against potential global policy shifts.

Market analysts weigh potential volatility and asset shifts following Trump’s remarks. Historically, such rhetoric influences asset allocation strategies. Insights from Coincu’s research suggest market responses to geopolitical developments can lead to financial adjustments. These situations may also prompt regulatory considerations globally as governments navigate tariff disputes and their broader economic implications.

Market Volatility and Global Policy Implications

Communities within the cryptocurrency sector are responding to deceptive activities. Fraud alerts concerning alleged Trump-related digital currencies have been issued, notably by World Liberty Financial.

“The so-called ‘Trump new cryptocurrency project’ currently appearing in the market is false information… other tokens claiming to be related to Trump are fraudulent activities carried out by scammers exploiting information asymmetry among investors.” — WLFI Team, Official Account, World Liberty Financial, ChainCatcher. The organization has refuted claims of a Trump-linked project as fraudulent in nature, urging investors to remain vigilant against scams exploiting information gaps.

“The so-called ‘Trump new cryptocurrency project’ currently appearing in the market is false information… other tokens claiming to be related to Trump are fraudulent activities carried out by scammers exploiting information asymmetry among investors.” — WLFI Team, Official Account, World Liberty Financial, ChainCatcher. The organization has refuted claims of a Trump-linked project as fraudulent in nature, urging investors to remain vigilant against scams exploiting information gaps.

Cryptocurrency Sector Responds Amid Fraud Alerts

Did you know? During Trump’s presidency between 2017–2021, announcements of new tariffs often triggered significant market volatility, impacting cryptocurrencies indirectly as investors sought safety in risk-averse assets.

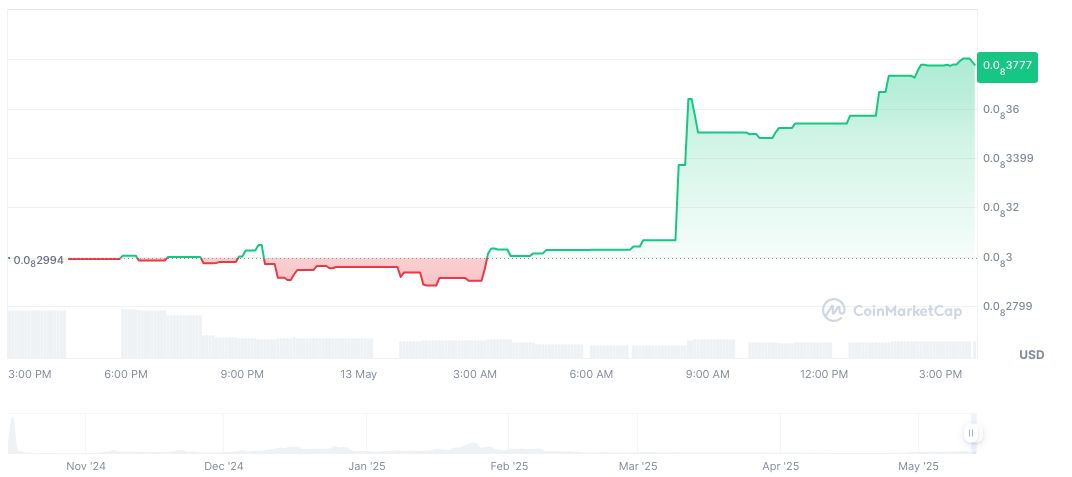

World Liberty Financial (WLFI) currently shows a market dominance of 0.00% with no circulating supply, according to CoinMarketCap. Its fully diluted market cap stands at 38.03 million, with a significant 294.96% price surge over the last 30 days, showing considerable volatility amid a context of significant scam warnings.

World Liberty Financial (WLFI) currently shows a market dominance of 0.00% with no circulating supply, according to CoinMarketCap. Its fully diluted market cap stands at 38.03 million, with a significant 294.96% price surge over the last 30 days, showing considerable volatility amid a context of significant scam warnings.

Source: https://coincu.com/337417-trump-tariffs-crypto-scam-alert/