- Kevin Hassett and Kevin Warsh considered for Fed Chair role.

- Potential rate cuts could apply downward pressure on the U.S. dollar.

- Cryptocurrencies may be indirectly affected by shifts in monetary policy.

President Trump is set to announce a new Federal Reserve Chair nomination before Christmas, with Kevin Hassett emerging as the leading candidate after recent meetings and deliberations.

Hassett’s nomination could signal more dovish monetary policies, affecting market dynamics and potentially influencing key cryptocurrencies through changes in interest rates and dollar valuations.

Trump Narrows Down Fed Chair Choices Amid Market Speculation

Kevin Hassett and Kevin Warsh have emerged as the leading candidates for the Federal Reserve Chair role, following recent meetings with Jerome Powell and scheduled discussions with Stephen Mnuchin and other White House staff. Despite indications favoring Hassett, sources suggest Trump could still change his mind.

An appointment of Hassett is expected to enhance Trump’s dovish monetary policy stance, potentially leading to increased expectations for rate cuts and thereby applying downward pressure on the U.S. dollar. Such financial movements could indirectly affect major cryptocurrencies. As Mark Haefele, CIO of UBS Global Wealth Management, states, “Hassett would likely reinforce expectations for rate cuts, pressuring the dollar downward.”

While the official announcement is forthcoming, market observers remain attentive to Trump’s decision, which could influence market dynamics across various sectors. Statements from UBS analysts suggest that a Hassett-led Fed could reinforce a direction toward rate reductions.

Potential Impact of Fed Chair Decision on Cryptocurrencies

Did you know? Jerome Powell’s initial Fed Chair confirmation under Trump in 2017, amid similar market speculation, triggered debates about political influence on the Federal Reserve’s independence.

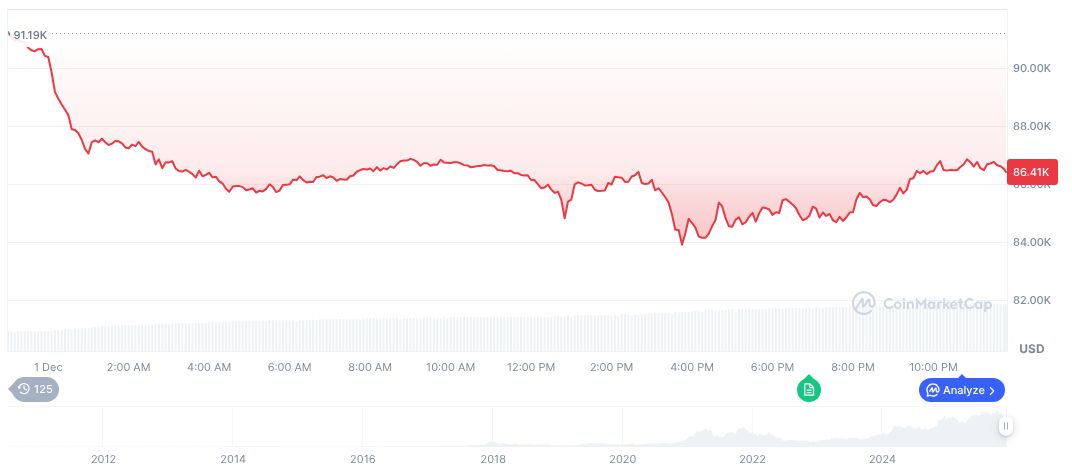

According to CoinMarketCap, Bitcoin (BTC) currently trades at $86,946.12 with a market cap of 1.73 trillion, asserting a 58.98% dominance. Recent fluctuations include a -21.22% change over the last 30 days, underlining potential market adjustments to broader fiscal policies.

Insights from Coincu suggest potential shifts in monetary policy under Hassett may place pressure on the U.S. dollar, indirectly affecting cryptocurrencies. Historical precedents highlight the significance of U.S. monetary leadership shifts as potential catalysts for market volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/trump-fed-chair-nomination-impact/