- Trump hints at resolving U.S.–China tariff issues, impacting global markets.

- Oil prices rose 3% after Trump’s statement.

- Crypto markets saw increased on-chain activities and trading.

President Donald Trump hinted at a possible easing of the U.S.–China tariff dispute on April 18, affecting global financial markets.

This development indicates a possible relief in trade tensions, sparking positive reactions across oil, copper, and crypto markets.

Trump’s Tariff Hints Fuel Market Optimism

U.S. President Donald Trump suggested the U.S.–China tariff escalation may soon decrease, stating, “I don’t want to continue raising tariffs because at a certain point, people stop buying.” This comment came during a White House note concerning ongoing trade tensions.

Oil prices almost rose 3% following Trump’s remarks as global markets began to anticipate a possible resolution between the two economic titans. Copper prices also climbed, showing a notable rebound, reflecting optimism among investors in commodities sectors.

Market reactions were widespread. The Asia-Pacific stock markets displayed positive gains, with notable increases in Japanese, South Korean, and Australian indices. No major statements were made by key crypto industry figures; however, whale activities in crypto markets were observed, possibly influenced by the broader economic sentiment.

Crypto Sentiment Shifts Amid Trade News

Did you know? In previous U.S.–China tariff cycles, commodities and crypto often experienced immediate market volatility, with major announcements sparking price rebounds and liquidity shifts.

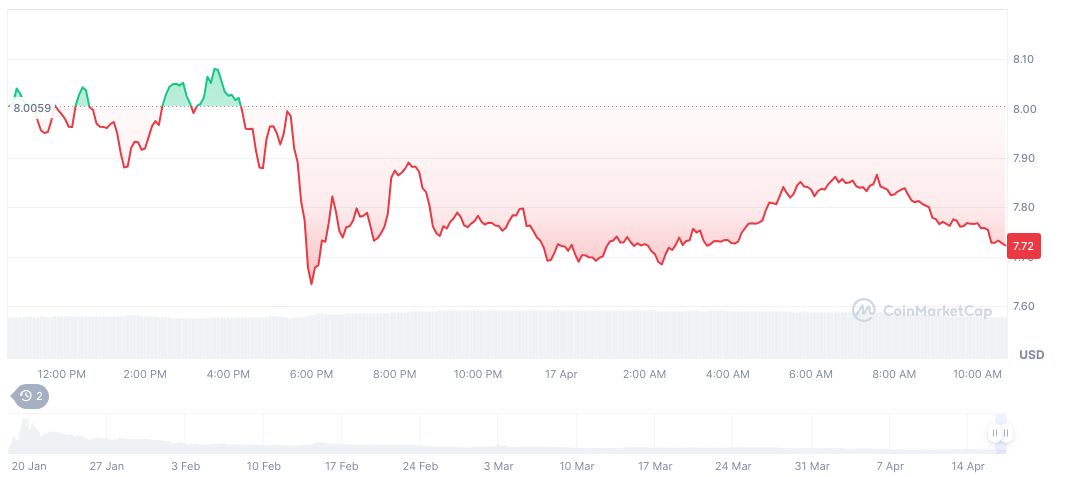

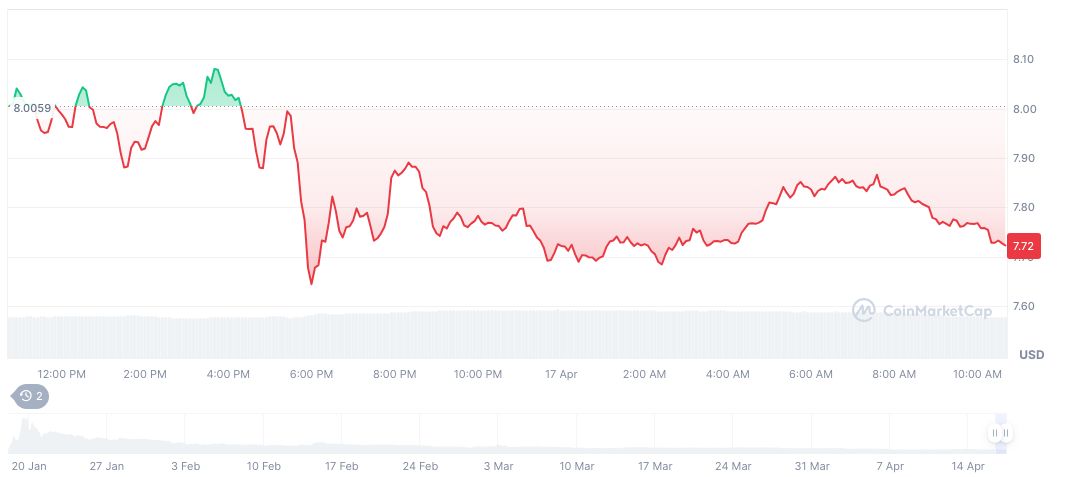

According to CoinMarketCap, the OFFICIAL TRUMP (TRUMP) token has seen shifts due to recent market dynamics and macroeconomic impacts. As of April 18, 2025, the token trades at $7.50 with a market cap just under $1.50 billion and a circulating supply nearing 200 million. In the past 90 days, the token’s price has decreased by 46.25%, exhibiting high volatility in reaction to global trade news.

Coincu research team anticipates that any extension of current tariff policies by the U.S. may delay a return to market stability, potentially influencing both traditional and crypto sectors. Long-term regulatory changes might also arise under evolving economic policies, affecting market conditions further.

Trump’s crypto policy raises concerns in the EU about potential economic shifts.

Source: https://coincu.com/332881-trump-easing-us-china-tariff/