- Trump’s WLFI partners Re7 Labs for USD1 stablecoin on BNB Chain.

- Re7 Labs secures up to $10M from VMS Group.

- USD1 circulation exceeds $2B with significant DeFi focus.

World Liberty Financial, backed by the Trump family, is partnering with Re7 Labs to establish a USD1 stablecoin liquidity pool on DeFi platforms Euler and Lista announced on June 28th.

This collaboration aims to promote the USD1 stablecoin on the BNB Chain, signaling increased institutional interest and support for the DeFi sector.

WLFI and Re7 Labs Introduce $2.20 Billion USD1 to DeFi

World Liberty Financial (WLFI) has announced a partnership with Re7 Labs to establish a liquidity pool for its USD1 stablecoin on the DeFi lending platforms Euler and Lista. The announcement on Friday marks a significant move for USD1, aiming to integrate into the BNB Chain ecosystem. Re7 Labs, a subsidiary of London-based Re7 Capital, provides the necessary infrastructure and risk management strategies to support this venture.

The USD1 stablecoin circulation has surpassed $2.20 billion, highlighting its growing role as a liquidity instrument among retail and institutional users. The establishment of new USD1 vaults on Euler and Lista is designed to enhance lending and borrowing services within the BNB Chain ecosystem.

Market reactions to this move are largely positive, interpreting this as a pivot towards more institutional adoption of DeFi. An insightful article about the trends in crypto relates to how this increased institutional backing signals confidence in WLFI’s strategy.

Trump Family’s Strategic Shift in WLFI Drives Regulatory Interest

Did you know? The Trump family’s involvement in WLFI has decreased from 75% to 40% ownership, reflecting a strategic shift yet maintaining their influential role in shaping USD1 and its DeFi narrative.

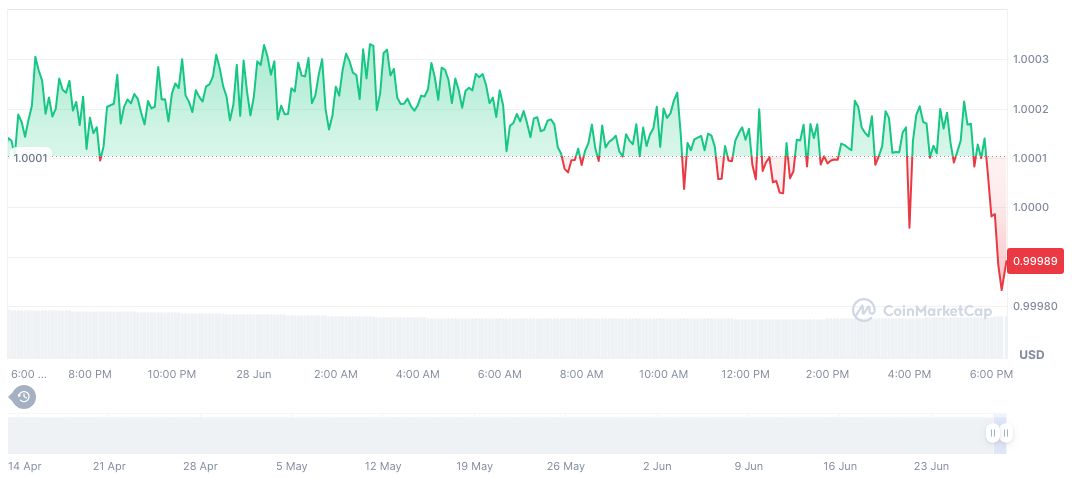

According to CoinMarketCap, the USD1 stablecoin, with a circulating supply of 2.20 billion, holds a price of $1.00 and a market cap over $2.20 billion. Despite a 24-hour trading volume drop of 13.27% and a recent 90-day price decrease of 16.80%, its continued growth signals resilience and ongoing utility in DeFi markets.

Insights from the Coincu research team suggest that the increased institutional backing and strategic alliances, such as with VMS Group, could accelerate regulatory acceptance and infrastructure robustness in the DeFi space. This could potentially lead USD1 towards a more stable future, reinforcing its market position against other stablecoins by ensuring capital efficiency and transparency.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345740-trump-wlfi-re7-labs-defi/