- Jerome Powell faces criticism from Trump, Pulte calls for investigation.

- No substantiated evidence of criminal charges against Powell.

- Market remains largely unaffected by the political rhetoric.

Donald Trump criticized Federal Reserve Chair Jerome Powell on Truth Social, demanding his resignation, following allegations of financial misconduct related to the Federal Reserve’s headquarters renovation project.

The accusations lack official corroboration, leaving the financial markets largely unaffected amidst political tension surrounding Powell’s leadership and the Federal Reserve’s operational expenditures.

Trump-Powell Tension Sparks Call for Congressional Investigation

Donald Trump has called for Federal Reserve Chair Jerome Powell’s resignation while allied federal officials issue letters implying financial missteps. Bill Pulte, Director of the Federal Housing Finance Agency, seeks a congressional investigation into perceived deceptive actions related to a $2.5 billion renovation project. Jerome Powell continues to defend the project, highlighting stringent oversight in congressional testimony. Claims of “mortgage fraud” lack verification from official sources.

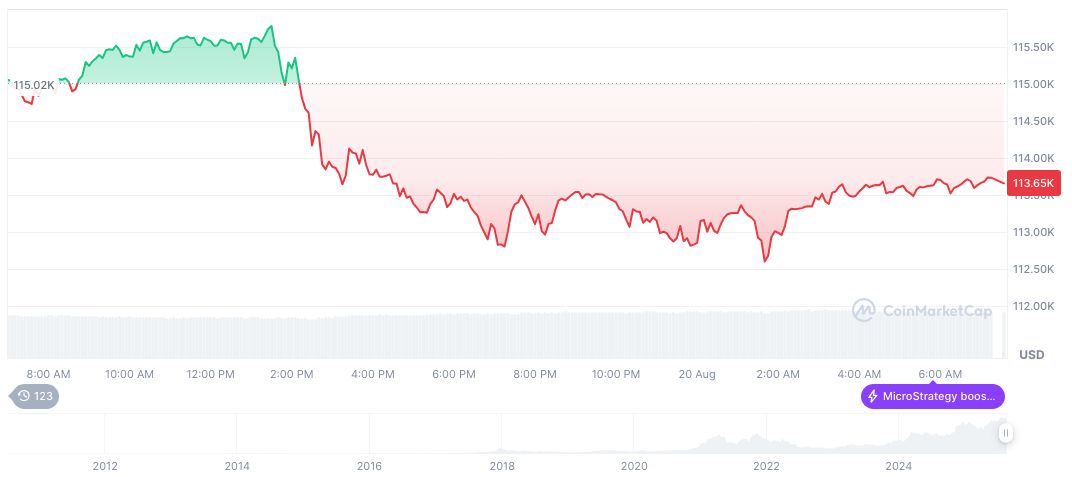

Market players, analysts, and industry officials show limited reaction due to the absence of formal charges or DOJ actions against Powell. Financial markets, including major cryptocurrency assets like BTC and ETH, have not exhibited significant shifts, aligned with the status quo. Analysts and officials remain measured, focusing on confirmed actions rather than speculative claims.

“I am asking Congress to investigate Chairman Jerome Powell, his political bias, and his deceptive Senate testimony, which is enough to be removed ‘for cause.’ Jerome Powell’s $2.5B in capitalizations of Building Renovation Scandal stinks to high heaven, and he lied when asked about the specifics before Congress. This is nothing short of malfeasance and is worthy of ‘for cause.’ … Chairman Powell needs to be investigated by Congress immediately.”: FinTech Business Weekly

Bitcoin Market Stability Amidst Political Allegations

Did you know? Political scrutiny of U.S. Federal Reserve leaders, amplified during the Trump administration from 2019 to 2023, rarely resulted in substantial market fluctuations without accompanying policy changes. The latest allegations against Powell continue this trend, with similar minimal market reactions observed.

Bitcoin (BTC) trades at $113,539.74, with a substantial market capitalization of $2,260,459,296,587.68 and dominating 58.94% of the market. Despite recent price declines of 1.80% over 24 hours, it has exhibited a positive 9.31% movement over the past 60 days. Data sourced from CoinMarketCap indicates strong interest but limited immediate impact from external political factors.

Coincu research analysts suggest that continued political scrutiny could affect confidence in Federal monetary oversight. However, without evidence of corroborating charges or regulatory shifts, broader market dynamics may remain stable. Monitoring official monetary policy actions will continue to guide market sentiment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-powell-resignation-demand/