- Trump criticizes Powell’s rate policy; BTC reacts by rising to expectations.

- Market holds without immediate rate cuts; eyes on September guidance.

- Fed independence questioned with no July policy shifts.

U.S. President Donald Trump criticized Federal Reserve Chair Jerome Powell on July 31, accusing him of being too slow and politicized in implementing interest rate cuts.

Trump’s comments highlight tension between political pressure and Fed independence, affecting market sentiment and expectations for future monetary policy decisions.

Bitcoin Spikes as Trump Slams Fed’s Inaction

On July 31st, Donald Trump publicly expressed his criticism towards Jerome Powell, Chairman of the U.S. Federal Reserve, accusing him of delaying interest rate cuts. Trump noted Powell as too angry and foolish in his capacity as Fed chairman. Powell, emphasizing independence and a data-driven approach, maintains that decisions are made on a meeting-by-meeting basis.

Despite Trump’s comments, the Federal Reserve opted not to implement immediate changes in its July meeting. Markets have largely priced in the continuation of the Fed’s current stance through to the next meeting. “The Fed remains committed to evaluating economic data on a meeting-by-meeting basis, with no commitment to a predetermined rate path,” said Jerome Powell, Chair, Federal Reserve.

Most reactions from financial analysts and traders were cautious. Institutional sentiment reflects restrained expectations in the short term but an eye toward September. Financial firms and policy experts echoed concerns over political pressures, emphasizing the central bank’s commitment to professionalism and independence.

Bitcoin Holds Steady Amid Fed Policy Uncertainty

Did you know? Trump’s history of pressuring the Fed on rate decisions dates back to his first presidential tenure, impacting not just policy discussions but also market behavior, especially in sectors sensitive to liquidity.

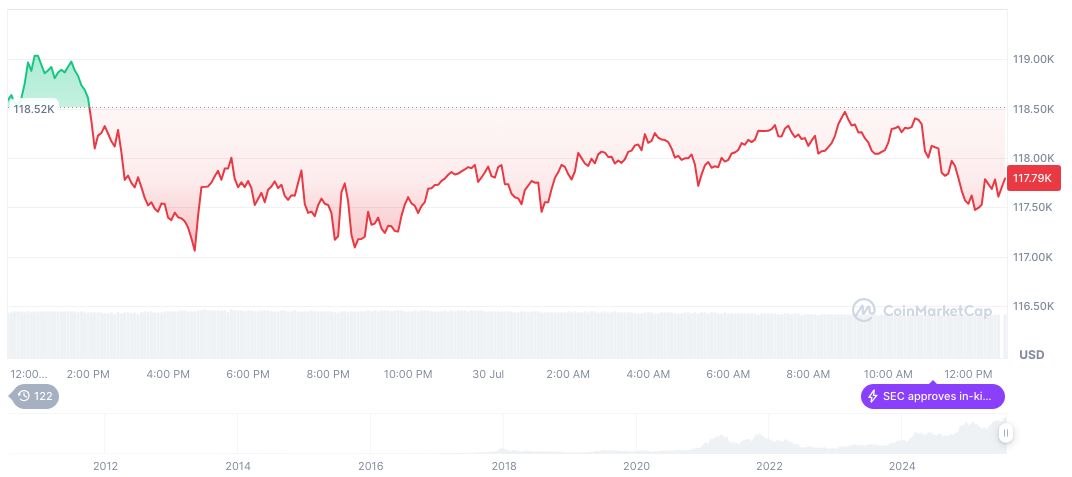

As of July 31, 2025, Bitcoin (BTC) is valued at $118,425.30, with a market cap of 2.36 trillion and a dominance of 60.61%. Its 24-hour trading volume reached $69.28 billion with an uptick of 0.51% over the past day, as noted by CoinMarketCap. Recent market stability was observed amid no immediate policy shifts.

Analysts from the Coincu research team suggest potential impacts on asset prices hinge on subsequent financial policy changes from the Federal Reserve. Historical trends indicate that proactive dovish signals can trigger marked shifts in liquidity-sensitive markets and prices of key assets, including Bitcoin.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-criticizes-powell-rate-cuts-2/