- Trump criticizes Federal Reserve Chair Jerome Powell for not lowering interest rates.

- Financial and crypto markets react to political interventions in monetary policy.

- Bitcoin sees a price increase amid potential regulatory changes.

On April 18, U.S. President Donald Trump expressed his dissatisfaction with Federal Reserve Chair Jerome Powell, urging for lower interest rates amidst falling European rates.

Trump’s comments spark interest as they reflect ongoing global monetary discussions and introduce volatility to financial and crypto markets.

Trump Criticizes Powell, Calls for Lower Interest Rates

U.S. President Donald Trump has publicly criticized Federal Reserve Chairman Jerome Powell, stating, “Powell is playing politics, the interest rate should now be lowered.” Trump mentioned the decline of European interest rates and called for similar action in the United States, aligning with his prior calls for a more accommodative monetary policy.

Trump’s remarks have raised expectations for potential interest rate cuts, generating significant attention in financial circles. This aligns with historical trends where comments from key public figures impact market sentiment and policy speculation.

Market participants remain watchful for potential monetary adjustments from the Federal Reserve. While increased institutional flows into Bitcoin and stablecoins reflect growing anticipation, investor sentiment seems cautious, awaiting more definitive signals from Chair Powell and the Federal Reserve.

Bitcoin Price Rises Amid Speculative Fed Response

Did you know? Former President Trump’s pressures for rate cuts in 2019 and 2020 paralleled a crypto market rally, demonstrating how political interventions can influence both traditional and digital financial landscapes.

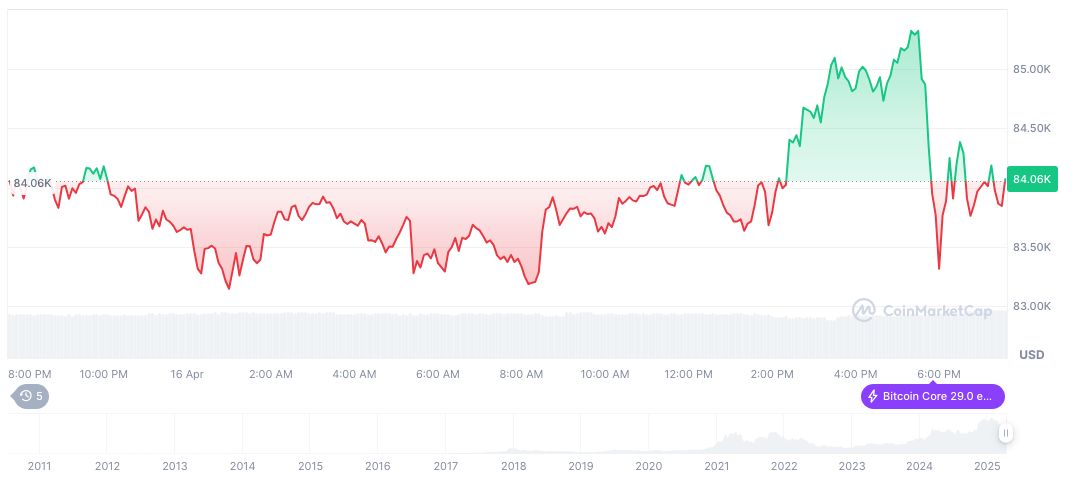

According to CoinMarketCap, Bitcoin (BTC) is currently valued at $85,178.72 with a market cap of approximately $1.69 trillion. Its market dominance stands at 63.07%. Over the past 24 hours, Bitcoin’s trading volume reached $23.27 billion, showcasing a 1.60% price increase amidst broad market fluctuations.

Coincu researchers suggest potential regulatory openings could arise if the Federal Reserve opts for an accommodative stance. Historical patterns indicate that such shifts typically boost investor confidence in crypto as a hedge against traditional financial uncertainty. Meanwhile, recent regulatory signals provide insight into ongoing policy debates. Carlos Guzman, Research Analyst at GSR, emphasized, “If the global economic situation looks bad, the Fed may do more stimulus. This could be a tailwind for cryptocurrencies in the medium term…”

Source: https://coincu.com/332784-trump-interest-rates-crypto-reacts/