- Trump challenges court ruling on tariffs, plans Supreme Court appeal.

- Ruling affects U.S. trade policies and market conditions.

- Broader economic repercussions, including possible dollar fluctuations.

Former U.S. President Donald Trump announced plans to appeal a court ruling blocking his ‘Liberation Day’ tariffs on September 3, as he calls for an emergency meeting.

The ruling challenges Trump’s tariff strategy, potentially influencing global trade dynamics, with broader market implications if upheld, including possible impacts on U.S. economic stability and international relations.

Trump’s Appeal Tests U.S. Trade Strategies

On September 3, former President Donald Trump stated he would appeal the U.S. court’s decision that halted his administration’s tariff plan, claiming it threatens the U.S. economic stability. Trump’s previous policies involved imposing extensive tariffs under the International Emergency Economic Powers Act.

Market analysts highlight concerns that the ruling could influence global trade dynamics and lead to varying economic responses. While Trump emphasized potential negative effects on U.S. policies, his administration stressed a commitment to appealing to the Supreme Court. “If allowed to stand, this Decision would literally destroy the United States of America,” said Trump, underlining his strong opposition to the ruling as reported.

Reactions have spanned governmental and trade sectors, with U.S. Trade Representative Grier indicating continued negotiations. President Trump’s firm opposition is echoed through statements on social media platforms, underscoring significant political tension.

Trade Tensions Could Affect Bitcoin and Dollar Stability

Did you know? The 2018-2019 U.S.-China trade war led to increased Bitcoin trading volumes as investors sought digital assets as hedges against economic uncertainty.

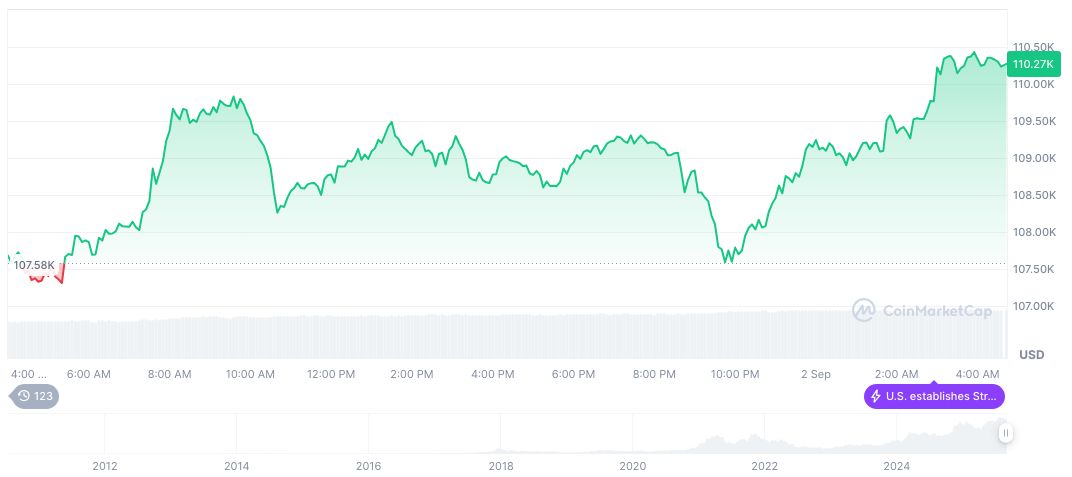

As of September 2, 2025, Bitcoin (BTC) is priced at $110,498.69, holding a market cap of $2.20 trillion with a 57.98% market dominance, as reported by CoinMarketCap. The 24-hour trading volume reached $76.80 billion, reflecting a 1.29% increase over the same period.

Insights from the Coincu research team suggest the ongoing trade tensions could potentially cause volatility in global markets. Should U.S. dollar fluctuations persist, ripple effects may manifest in the value of dollar-pegged stablecoins, influencing financial systems and digital asset markets worldwide. The ongoing economic pressures might explain why some analysts believe that Bitcoin’s potential could see a rise to $150k. For more insights, check out Bitcoin’s potential rise to 150k.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-challenges-tariff-ruling/