- U.S. President Trump appeals trade ruling; emergency meeting planned for tomorrow.

- Tariff decision labeled as “economic disaster” by Trump.

- Expected impact on global trade, stocks, and possible crypto volatility.

U.S. President Trump labels a recent tariff court ruling as an “economic disaster” and plans an emergency meeting to address potential global trade impacts.

This ruling could influence equity markets and select cryptocurrencies, underscoring the significant geopolitical stakes at play.

Cryptocurrency Market Holds Strong Amid Trade Volatility

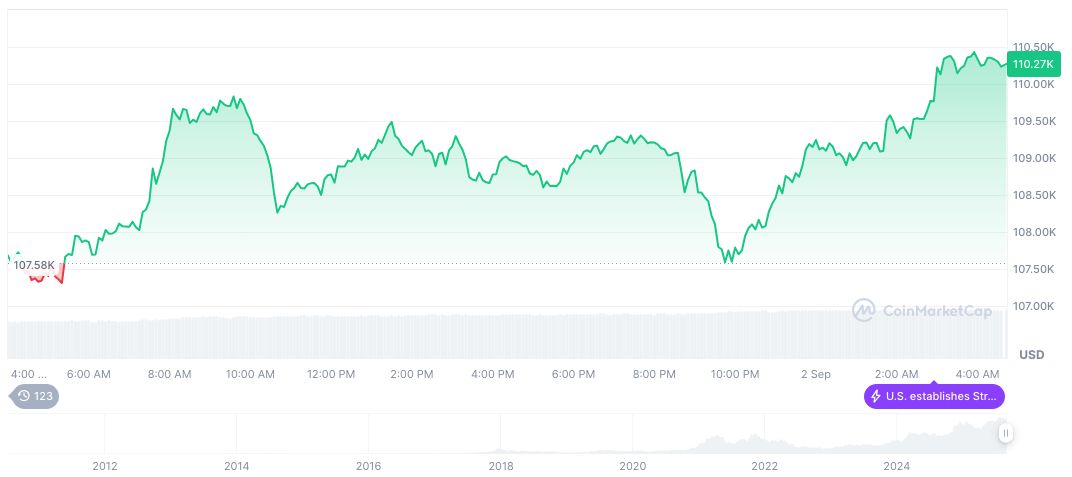

As of the latest update from CoinMarketCap, Bitcoin (BTC) is priced at $110,831.34 with a market cap of 2.21 trillion dollars. The asset commands 58.02% dominance, with a fully diluted market cap of 2.33 trillion dollars. Despite recent price variations, BTC shows a 1.41% rise over 24 hours and a 5.61% increase over 90 days, adding context to its resilience amid broader market shifts.

Insights from the Coincu research team suggest potential outcomes including increased scrutiny on executive tariff authority by U.S. courts and a cautious approach by traders to hedge against further macroeconomic shifts. Observers anticipate potential regulatory adjustments and liquidity changes in response to ongoing fiscal uncertainties.

President Trump has asserted that the failed tariff appeal could initiate widespread economic repercussions, describing the court’s ruling as politicized. Market participants are assessing the potential impact, with S&P 500 and Dow experiencing volatility amid increased uncertainty. Notably, Tesla CEO Elon Musk has publicly advocated for “zero tariffs” to mitigate trade war escalation, emphasizing free trade benefits. As President Trump said, “If the tariff war fails to win, it will trigger a chain reaction.” The China Ministry of Commerce confirmed intentions to counter new U.S. tariffs, heightening geopolitical tensions and further market instability.

Market Implications and Future Outlook

Did you know? The U.S. has a long history of using tariffs as a tool for economic policy, often leading to trade wars that can impact global markets.

As market reactions unfold, analysts are closely monitoring the effects on cryptocurrency prices and overall market stability, with Bitcoin showing resilience amidst the turmoil.

Experts suggest that the ongoing tariff issues could lead to significant shifts in market dynamics, urging investors to stay informed and prepared for potential regulatory changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/trump-appeals-tariff-ruling/