- US to impose tariffs on 10-12 countries from August.

- Scope includes tariffs from 10% to 70%.

- Potential ripple effects on global trade and markets.

US President Donald Trump announced imposing tariffs on 10 to 12 countries, with letters dispatched starting July 4. These tariffs will take effect on August 1.

The expected move could affect the global market and potentially ripple through to the cryptocurrency sector.

Tariffs on Up to 12 Nations Trigger Market Uncertainty

President Trump initiated a series of tariff letters affecting 10-12 nations. Tariffs are set between 10%-70%, aimed at economies not reaching agreements with the US Understanding Trump’s Tariffs in April 2025. While the exact list remains undisclosed, these actions are consistent with Trump’s longstanding trade tactics.

Changes following this move involve heightened market volatility. Global trade relations may experience stress, potentially influencing currency valuations Research on State U.S. Tariffs as of June 2025. Market uncertainty often leads to increased speculation, notably in digital currencies like Bitcoin and Ethereum.

“If the US does not strike a deal with a company or country, then ‘we’re going to set the tariff.’” — Source

Crypto Markets and Global Trade Tied to Tariff Consequences

Did you know? During Trump’s 2018-2020 trade tensions with China, Bitcoin and Ethereum frequently experienced volatility as traders sought relative safety amid market uncertainties.

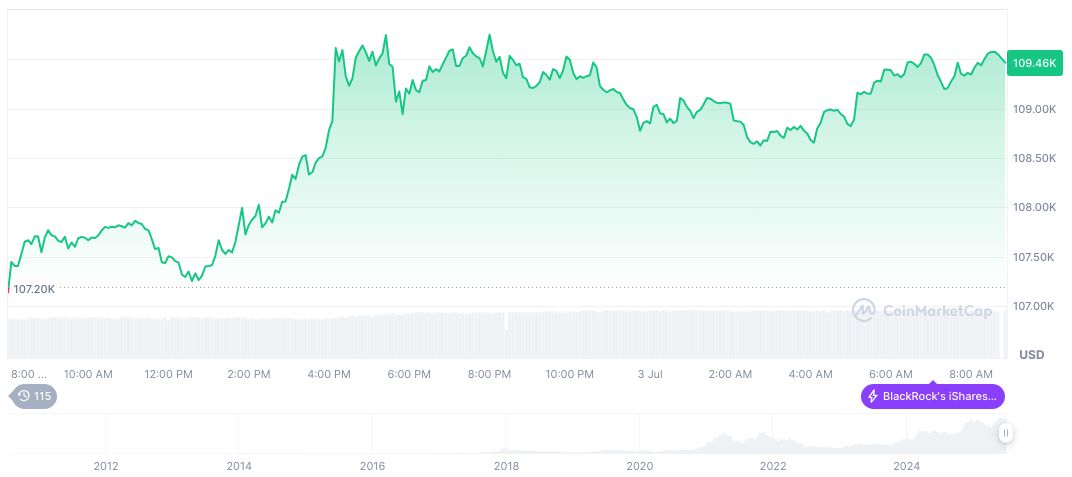

On July 4, 2025, Bitcoin (BTC) stood at $109,175.02, revealing a market cap of $2.17 trillion. Maintaining a market dominance of 64.47%, its 24-hour trading volume showed a decrease of 11.14% to $48.77 billion, as recorded by CoinMarketCap.

Coincu’s research team suggests these tariffs might indirectly influence crypto markets through traditional financial stress. Historically, trade tensions have prompted shifts in crypto trading volumes and prices Analysis: U.S.-China Trade War Consequences. Past instances showed digital currencies being used as hedge strategies during macroeconomic disruptions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346739-trump-tariffs-affected-countries-august/