- U.S. tariff pause leads to significant crypto market fluctuations.

- Cryptocurrency markets rebound after Trump’s announcement.

- Bitcoin surges over 8%, reflecting market optimism.

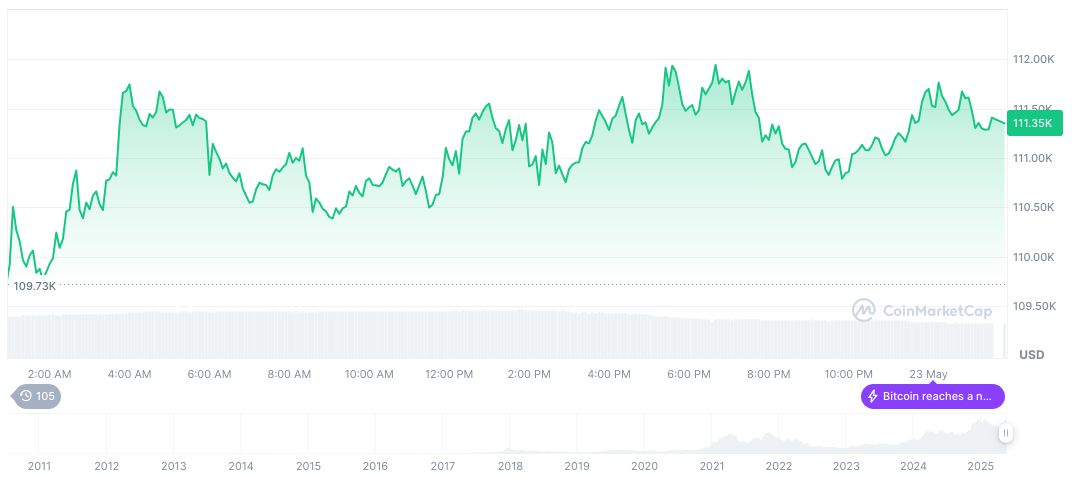

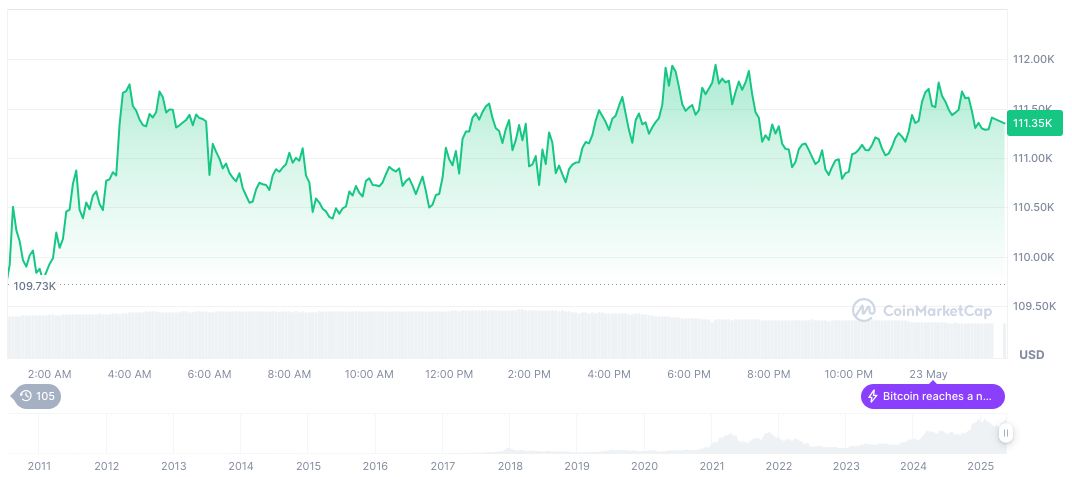

The U.S. announced a 90-day pause on tariffs, aiming to encourage EU negotiation improvements, sparking notable cryptocurrency market movements on May 23, 2025.

The pause allowed global markets to recover, notably the cryptocurrency sector, which experienced increased optimism and price surges.

Tariff Pause Sparks 8% Bitcoin Surge

On April 2, 2025, the U.S. introduced a 90-day tariff pause following negotiations. U.S. Treasury Secretary Yellen described the proposals as sincere, while President Trump sought better terms from the EU. President Donald Trump stated, “I believe the quality of the EU’s proposal was not high; this temporary reprieve aims to incentivize the EU to take decisive action.”

Cryptocurrency markets experienced considerable fluctuations, with Bitcoin surging over 8%, alongside rebounds in Ethereum and Solana. Market optimism surged, reflecting improved economic conditions. The markets perceived the tariff pause as a positive economic indicator, signaling potential future growth.

Significant reactions followed the announcement, including notable statements from key financial players and analysts. Market sentiment improved, driven by the suspension’s potential to moderate trade tensions. Arthur Hayes, Chief Investment Officer of Maelstrom, mentioned, “Positive dollar liquidity may offset disappointments from legislative failures, suggesting that cryptocurrency markets could find stability in such environments.”

Traditional markets mirrored these changes, as reflected in the S&P 500 and Nasdaq Composite gains.

Historical Context Shows Crypto Resilience

Did you know? The suspension led to Bitcoin’s surge, mirroring reactions seen during previous financial crises, highlighting the historical correlation between economic policies and crypto market responses.

As per CoinMarketCap, Bitcoin currently trades at $109,542.76 with a total market cap of $2.18 trillion and a 63.06% dominance in the market. While facing a 1.79% drop in 24 hours, Bitcoin showed 7-day gains of 5.37%.

Analysts from Coincu suggest financial markets may stabilize further if current trade policies remain consistent, with potential growth in cryptocurrencies driven by increased market confidence. Data trends indicate historical parallels in response to increased liquidity events.

Source: https://coincu.com/339333-trump-tariff-pause-crypto-impact-2/