- Trump advocates tariffs for economic revenue and Fed rate reduction.

- White House confirms 10% tariffs active from April 5, 2025.

- Tariffs generate interest, but no direct crypto impact noted.

Donald Trump affirms tariffs have generated substantial revenue, urging the Federal Reserve to reduce rates. The White House confirms these tariffs started in April, expecting significant fiscal impacts.

Trump’s tariffs are expected to boost U.S. revenues and push economic adjustments. Market speculation rises with these policy shifts.

Trump’s 10% Tariffs to Generate Major U.S. Revenue

Donald Trump’s push for increased tariffs is a marked effort to reshape trade policy. In April, the U.S. confirmed a 10% global tariff, heightened by 20% on Chinese imports. The administration targets opioid issues as part of trade strategies. “Using his IEEPA authority, President Trump will impose a 10% tariff on all countries. This will take effect April 5, 2025 at 12:01 a.m. EDT.” The intentions behind President Trump’s approach include seeking economic advantages through U.S.-focused trade policies and increasing government revenues significantly. The measures in effect represent significant federal moves to reinforce domestic economic interests. The White House emphasized the tariffs’ role in revenue generation, detailing significant collection spikes as fiscal goals.

Federal Reserve behavior related to tariffs remains under review. No recent comments were found from agency members. However, Trump’s emphasis on interest reduction could aim to mitigate any negative side effects of heightened tariffs. Trump’s call for lower interest rates suggests potential economic recalibrations, hinting at federal monetary balancing to accommodate ongoing tariff effects.

Coincu research suggests that Trump’s policies might indirectly influence cryptocurrency markets, as investors hedge against fiat inflation or tariffs’ global economic ripple effects. Bitcoin and similar crypto assets are often seen as refuges amidst traditional market uncertainties.

Trump’s Interest Rate Call: Economic Recalibration Expected

Did you know? Trump’s tariff policies historically coincide with shifts in investor behavior towards Bitcoin as a safe haven, reflecting its frequent role during economic policy shifts.

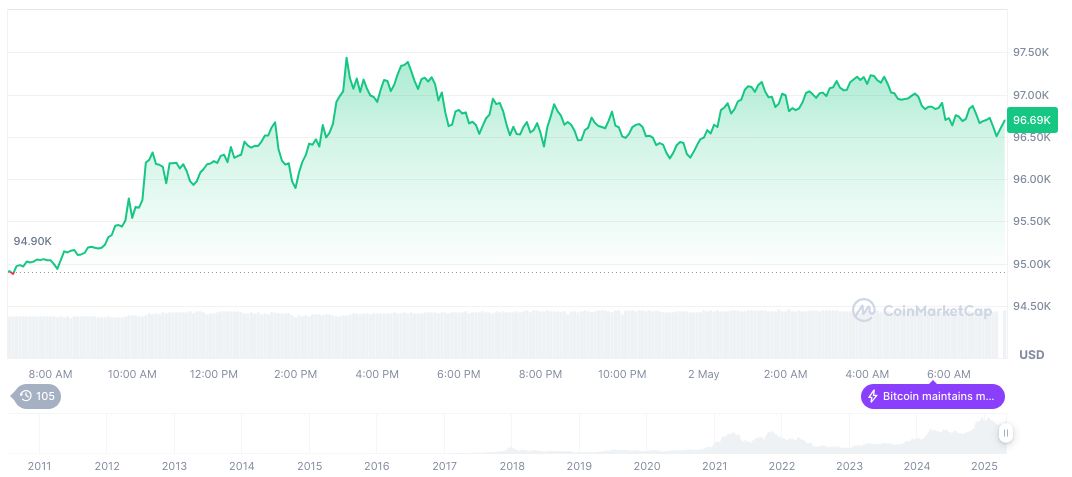

Bitcoin reports around a $96,529 price with a decline of 0.41% in 24 hours. Market dominance stands at 63.73% with a 1.94% increase over a week. Current market cap is approximately $1.92 trillion, according to CoinMarketCap.

Trump’s policies might indirectly influence cryptocurrency markets, as investors hedge against fiat inflation or tariffs’ global economic ripple effects.

Source: https://coincu.com/335444-trump-tariffs-federal-rates/