- Trump advisors review BLS employment data accuracy; potential economic implications noted.

- Leadership changes affect trust; potential USD impact observed.

- Market volatility expected with crypto price sensitivity to BLS revisions.

President Trump’s advisors are formulating a report detailing flaws in the Bureau of Labor Statistics’ employment data, following the dismissal of the agency’s leader.

This action may influence U.S. economic data credibility and impact cryptocurrency markets sensitive to such macroeconomic shifts.

Trump’s Advisory Team Scrutinizes Employment Data Credibility

President Trump’s advisors are compiling a report on perceived flaws in BLS employment data, after changes in its leadership. The Council of Economic Advisers is spearheading this analysis, anticipated in the coming weeks. BLS’s annual benchmark revision, scheduled today, could reveal substantial downward adjustments in job numbers.

Analysts express concerns over potential impacts on USD sentiment and market volatility. Kevin Hassett, Director of the National Economic Council, described a previous jobs report as disappointing. The National Association for Business Economics emphasized the need for leadership with “deep expertise and independence” at BLS to ensure public trust.

“We need a BLS commissioner with deep expertise and independence…to maintain public trust, ensure impartial analysis, and safeguard the credibility of U.S. statistics.” — National Association for Business Economics (Salon)

Bitcoin’s Market Dynamics Amid BLS Data Debate

Did you know? In 2020, similar controversies over BLS data accuracy led to short-term volatility in digital asset markets, highlighting the broader financial implications of government data integrity.

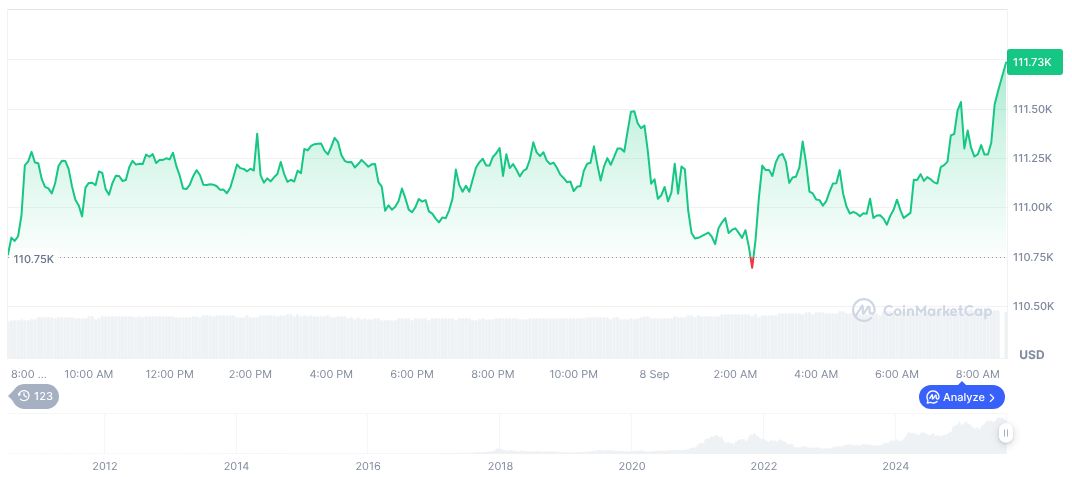

Bitcoin (BTC) prices reached $112,119.28, with a market cap nearing $2.23 trillion, according to CoinMarketCap. Notably, BTC’s market dominance was 57.61%, with a 24-hour trading volume surpassing $40.29 billion, reflecting a 0.64% price increase over the past day.

Coincu research suggests this event might foster cautious tactics in regulatory spheres, with possible increased scrutiny on governmental economic data transparency. These dynamics might yield shifts in market sentiment, requiring diligent observation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-bls-data-flaws-report/