- Trump criticizes Fed over renovation costs.

- Market volatility increases amid Fed independence concerns.

- Internal divisions within the Trump administration about Fed policies.

Donald Trump’s administration challenges the Federal Reserve’s independence amid a $2.5 billion renovation dispute, sparking economic policy tensions in Washington.

The ongoing controversy highlights the struggle between Trump’s desire for lower interest rates and the Fed’s emphasis on maintaining policy autonomy to ensure financial stability.

Trump vs. Federal Reserve: $2.5 Billion Renovation Clash

Donald Trump’s administration has intensified efforts to influence the Federal Reserve following a substantial $2.5 billion renovation cost overrun. Internal divisions are apparent, with some Trump officials pushing for changes and others, such as Treasury Secretary Bessant, advocating for the Fed’s autonomy.

The political pressure aims to compel the Federal Reserve to lower interest rates, potentially reducing debt-servicing costs. While the Fed, led by Jerome Powell, anticipates maintaining rates this month, future adjustments hinge on inflation and labor market indicators.

“No one is willing to make major renovations to a historic building during their term, let alone two historic buildings that need extensive repairs.” – Jerome Powell, Chair of the Federal Reserve (Politico)

Public reaction has been sharply polarized. Federal lawmakers criticize the renovation’s financial implications, underscoring the need for fiscal transparency. Powell defends the work as crucial, detailing the challenges in congressional testimony, which underscores executive tensions about fiscal control.

Historical Pressures on Fed and Market Sentiment

Did you know? The U.S. has a historical tradition of maintaining central bank independence, with political pressures often inducing market reactions, influencing both fiat and cryptocurrency markets.

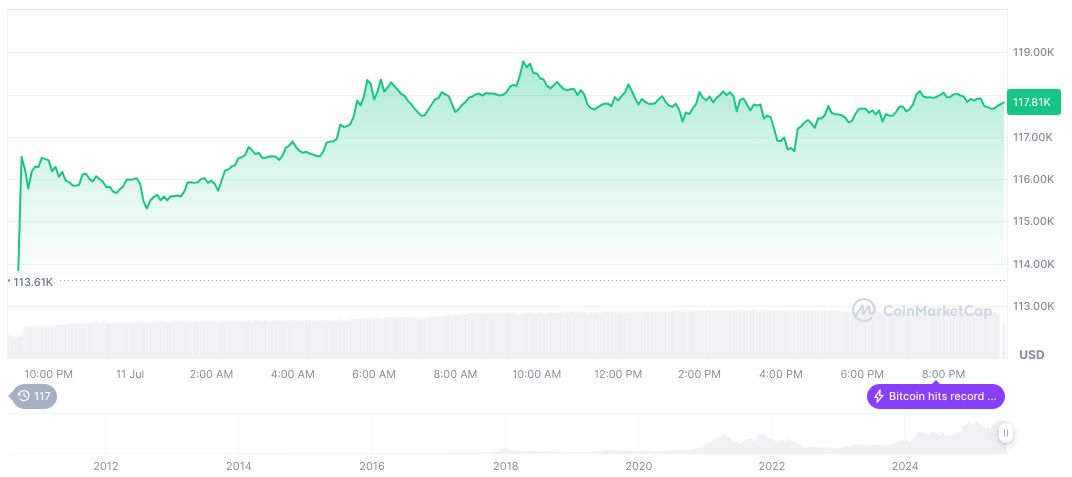

CoinMarketCap reports that Bitcoin (BTC) is currently priced at $117,512.47, with a market cap of $2.34 trillion and a 24-hour volume of $50.48 billion, registering a decrease of 58.94%. Over 90 days, Bitcoin shows a price increase of 38.74%, highlighting its resilience despite market fluctuations.

Coincu’s research team indicates that Trump’s push for Fed oversight could raise regulatory scrutiny and affect market sentiment. Historical trends suggest such political interventions often lead to volatility, especially in emerging financial technologies and cryptocurrencies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348297-trump-pressure-federal-reserve-renovation/