- The TrueUSD team has linked the recent TUSD depegging to Binance Launchpool activities.

- The team reiterated that TUSD redemption services “are always accessible.”

The team behind TrustToken-issued stablecoin TrueUSD (TUSD) has issued a statement linking the recent depegging incident to “activities associated with Binance Launchpool.”

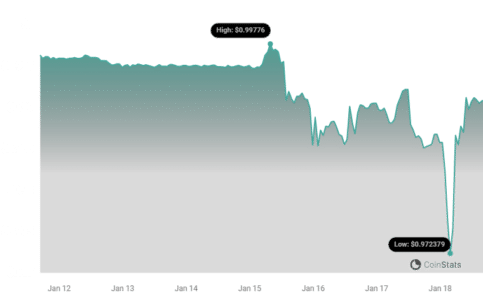

The stablecoin fell below its $1 peg to trade at $0.985 on January 16 amid an outsized trading volume of the pair TUSD-USDT on Binance.

During the incident, the trading pair faced a shortfall of $369.3M in buy orders against $435M sales, leading to about $67M net outflow.

TrueUSD Team Addresses Depegging Incident

In an X (formerly Twitter) post shared on January 18, the TUSD team noted that it had observed recent community mining activities linked to Binance Launchpool, which had led to “short-term arbitrage opportunities.”

See Also: TrueUSD (TUSD) Depegs Further, Hits Low Point Of $0.97

“These are considered a normal aspect of market dynamics and liquidity adjustments. Furthermore, our TUSD redemption channels, involving various global banks, are functioning smoothly as always.” The team wrote.

The TUSD team consistently focuses on and continues to enhance TUSD services through cutting-edge technologies and strategic industry partnerships, such as with Binance.

— TrueUSD (@tusdio) January 18, 2024

Noting that it would continue to further broaden collaboration with Binance, the team reiterated that TUSD minting and redemption services “are always accessible” via the stablecoin’s official website.

At press time, TUSD had recovered from its early Thursday price of around 96 cents and is now trading at $0.99, according to Coinstats data. Still, the price is not pegged.

As of January 18, TUSD’s market cap stood at $1,891,851,560, making it the fifth largest stablecoin in the market behind USDT, USDC, BUSD, and DAI.

Source: https://bitcoinworld.co.in/trueusd-tusd-links-recent-depegging-to-binance-launchpool-activity/