Key Takeaways

What do current market conditions suggest about TRX’s price direction?

With low volatility and buyer dominance, TRX is positioned for a potential breakout toward $0.37.

What signals indicate Tron may be forming a local bottom?

Declining volatility, exhausted selling pressure, and stable Spot activity suggest TRX is entering a cooling phase before a possible rally.

Since bouncing back from a dip below $0.3, Tron [TRX] has traded within a thin margin and remains stuck between $0.33 and $0.34 range.

In fact, at press time, Tron was trading at $0.339, after moderately rising by 0.74% on daily charts.

Amid this market slowdown, the altcoin’s volatility has dipped as buyers step in.

TRX volatility hit July lows

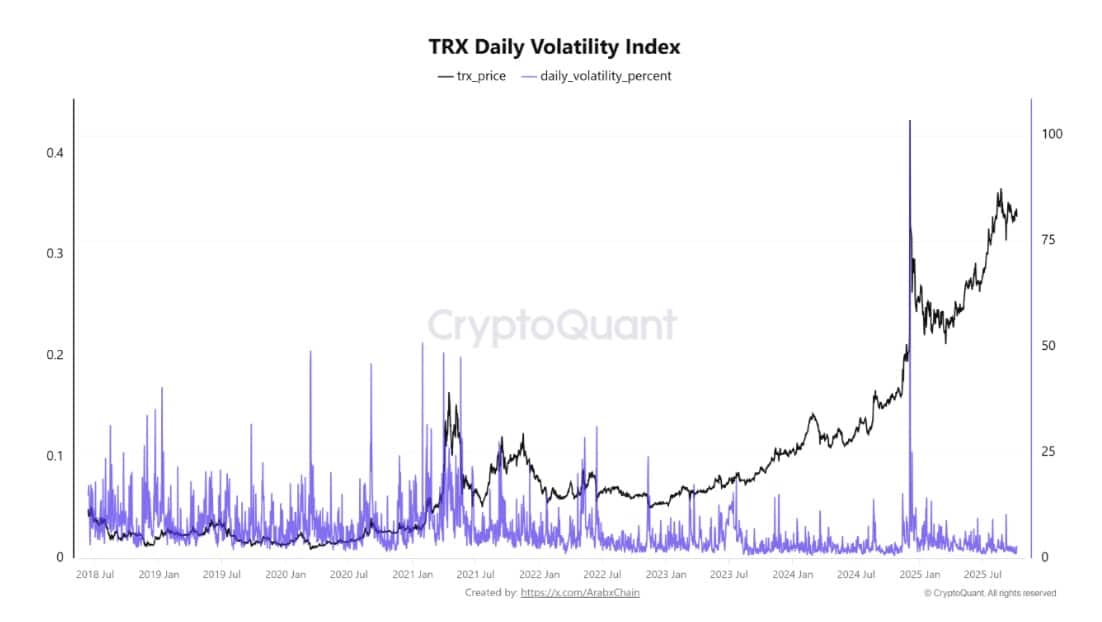

According to CryptoQuant, TRX’s Daily Volatility Percent has declined from 10% peaks in mid-July to below 1%.

This continued decline reflects volatility compression, which usually precedes significant moves to either upside or downside.

Source: Cryptoquant

Amid this decline, TRX has remained above the 2-month Moving Average, suggesting buyers are currently dominating the market.

In fact, buyers have dominated both the Spot and the Futures markets.

At the time of writing, Spot Netflow held within the negative zone at -$5.86 million as per CoinGlass data. Often, a negative Netflow indicates higher outflows, a clear sign of buyer Spot dominance.

Source: CoinGlass

Likewise, on the Futures side, buyers have taken total control, as evidenced by Futures Taker CVD.

This metric has remained green throughout the past week, reflecting Taker Buy Dominant, indicating investors continue to open new positions.

Source: CryptoQuant

At the same time, Perpetual’s Volume has remained around $63 million for four consecutive days, further validating this demand.

Therefore, the prevailing market behavior indicates that short-term speculators exited while mid-term investors hold their positions strong.

Source: Defillama

Thus, with buyers dominating the market, amid low volatility, it makes an upside scenario more likely when liquidity returns.

Tron is cooling off

On top of market stability, Tron has entered a cooling phase in spot activity. According to CryptoQuant’s analyst Burak Kesmeci, the Tron Spot Volume Bubble Map has signaled a market cooldown.

Source: CryptoQuant

Current market conditions suggest that TRX is gradually forming a potential local bottom. With selling pressure fading and momentum stabilizing, the altcoin appears well-positioned for new investors to enter.

Tron is entering a cooling phase, which often signals the early stages of a bullish reversal.

If trading activity picks up and buyer interest holds steady, TRX could be primed for a strong upward move.

A breakout for TRX?

AMBCrypto’s analysis shows that TRX is currently in one of its most stable phases in the past three months. Volatility remains low, and buyers continue to dominate both the Spot and Futures markets.

If these conditions persist, TRX could break out of its current range, surpass the $0.34 resistance, and potentially target $0.37.

However, if market sentiment shifts and sellers re-enter, the price could drop to $0.32.

Source: https://ambcrypto.com/tron-bulls-lead-but-can-trx-break-out-of-0-34-range/