Key Takeaways

What does the surge in TRON Futures Netflow indicate?

The 170% surge to $7.48 million shows buyers are dominating the TRON Futures market, hinting at strong bullish momentum.

How does the increase in USDT supply affect TRX’s potential?

The $23 billion spike in USDT supply on TRON signals rising demand and user activity, setting TRX up for possible price gains.

Since bouncing back to $0.3549 three days ago, TRON [TRX] has traded within a thin margin. Over this period, the altcoin has remained stuck between $0.34 and $0.35 range.

As of this writing, TRON was trading at $0.351, marking a 0.17% decline over the past 24 hours. Amid this market cooldown, investors have taken the opportunity to position themselves, awaiting the next move.

Buyers take over TRON’s Futures market

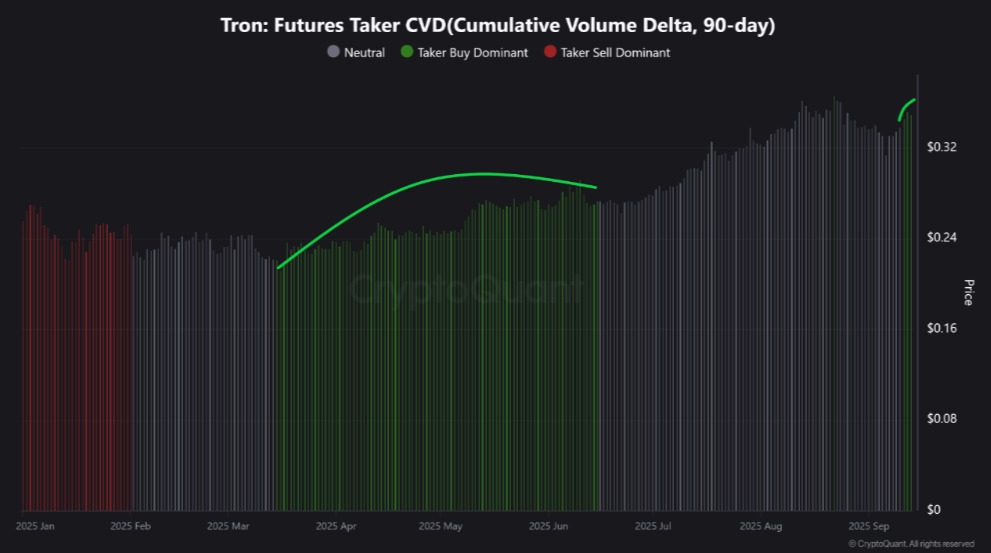

According to CryptoQuant analyst Burak Kesmeci, TRON Futures have experienced a significant shift in investor behavior.

Notably, the altcoin’s Taker CVD (90D) has been within green territory for three consecutive days — this is the second time in 2025.

Source: CryptoQuant

The last time TRON’s Taker CVD was in the green was between the 15th of March to the 15th of June, which saw price jump from $0.26 to $0.29.

This signals rising buyer dominance in the Futures market.

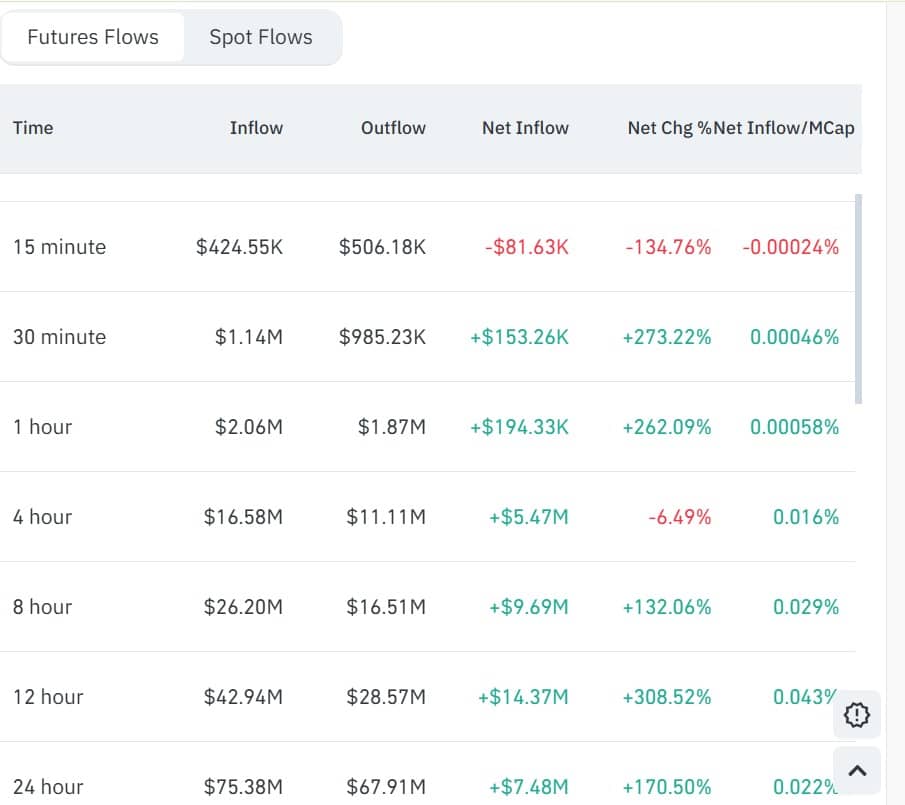

In fact, Futures have recorded significant capital inflow. According to CoinGlass, Futures inflow jumped to $75.38 million compared to $67.91 million in outflows.

Source: CoinGlass

As a result, TRON’s Futures Netflow surged 170% to $7.48 million, a clear sign of rising buyers’ dominance.

Spot market takes a different path

Interestingly, while Futures have recorded increased buying pressure, sellers have dominated the Spot market. According to CryptoQuant, Spot Taker CVD (90) has remained in the red over the past 30 days.

Source: CryptoQuant

Thus, sellers have been hitting the bid more aggressively than buyers lifting the ask. This often signals seller dominance in the Spot markets, a clear sign of bearish sentiment.

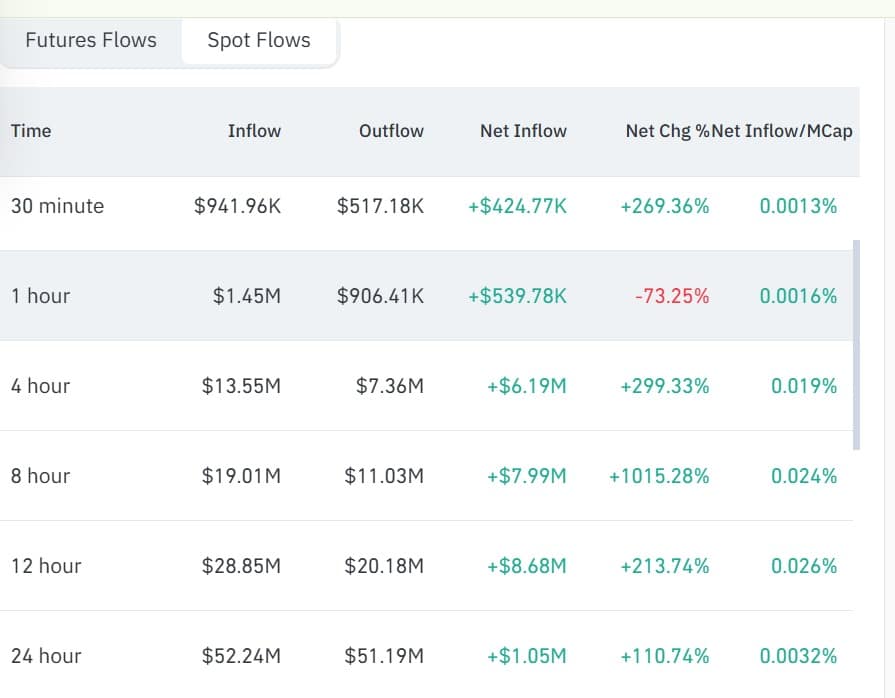

On top of that, TRON’s Spot Netflow just flipped positive after being negative for two consecutive days.

Source: CoinGlass

TRON saw $52.24 million in inflows compared to $51.19 million in spot outflows. As a result, its netflow jumped to 110% to $1.05 million, a clear sign of aggressive spot selling.

User activity and demand soar too

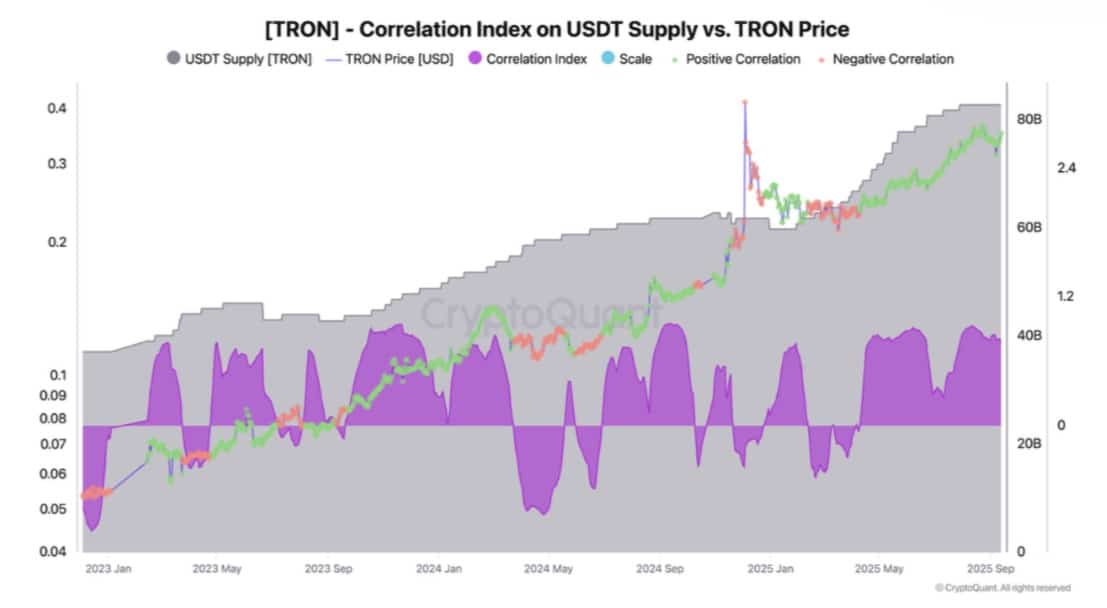

Besides market activity, TRON has recorded a massive spike in USDT supply. According to Darkfost, USDT supply on the network has surged to $23 billion in 2025, reflecting growing demand.

Source: CryptoQuant

Historically, increased USDT supply has preceded a substantial uptick in TRX’s price charts. Likewise, when supply drops, TRX prices tend to consolidate or decline, a clear sign of correlation.

Significantly, the surge in USDT supply on TRON signals increased user activity and demand for the network.

Is a rally coming for TRX?

Undoubtedly, TRON has experienced strong demand in the Futures market, while USDT supply has spiked significantly, indicating strengthening demand.

These two market conditions position TRX for more gains.

If Futures demand holds, backed by an increased user base, TRX will break out and target $0.37.

However, if sellers in the spot cause significant pressure, TRX will continue to trade within a consolidation range, with $0.344 acting as support.

Source: https://ambcrypto.com/tron-stuck-near-0-35-can-rising-futures-demand-break-trx-free/