- TRON’s burn of over 10 million tokens shows commitment to value growth and bullish momentum.

- The balanced Funding Rate and Long/Short Ratio indicates cautious optimism among traders.

Tron [TRX] has made headlines by burning 10,136,282 TRX, showcasing a strong commitment to deflation and value growth.

This move resulted in a net negative production ratio of -5,069,243, effectively removing $809,558.11 from circulation.

As TRON continues to implement its deflationary strategy, the pressing question remains: Can this latest burn propel TRX towards a new upward trajectory in the crypto market?

What about TRON’s momentum?

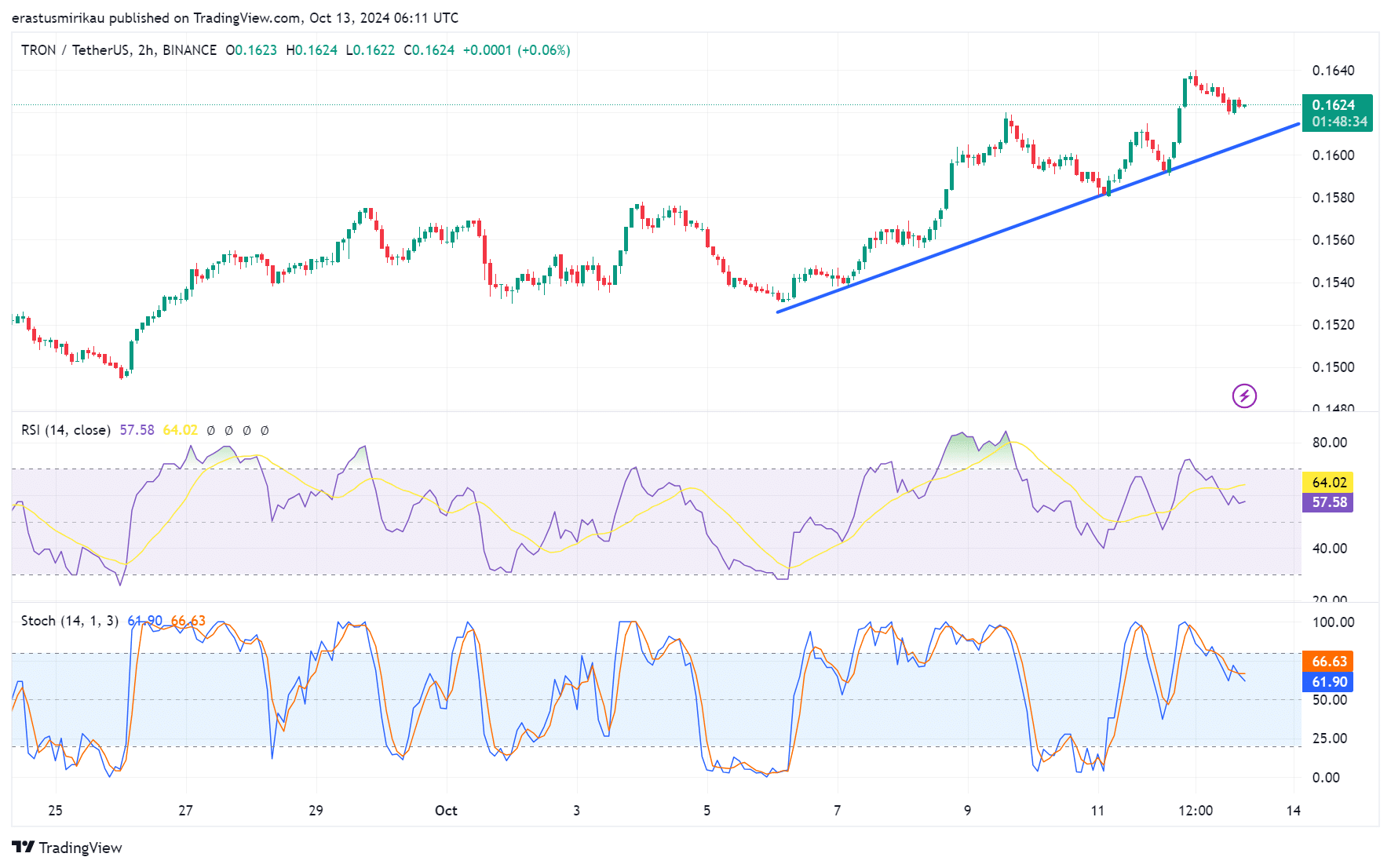

The TRON price chart revealed a slight upward trend, with TRX trading at $0.1623 at press time, reflecting a 0.98% change at press time.

The Relative Strength Index (RSI) sits at 57.58, indicating that TRX is nearing the overbought territory; however, it still retains room for growth.

Additionally, the Stochastic indicator was 66.63 at press time, confirming bullish momentum without signaling immediate exhaustion. These indicators suggest that TRX may continue its ascent in the near term.

Source: TradingView

TRON: Does THIS mean growing interest?

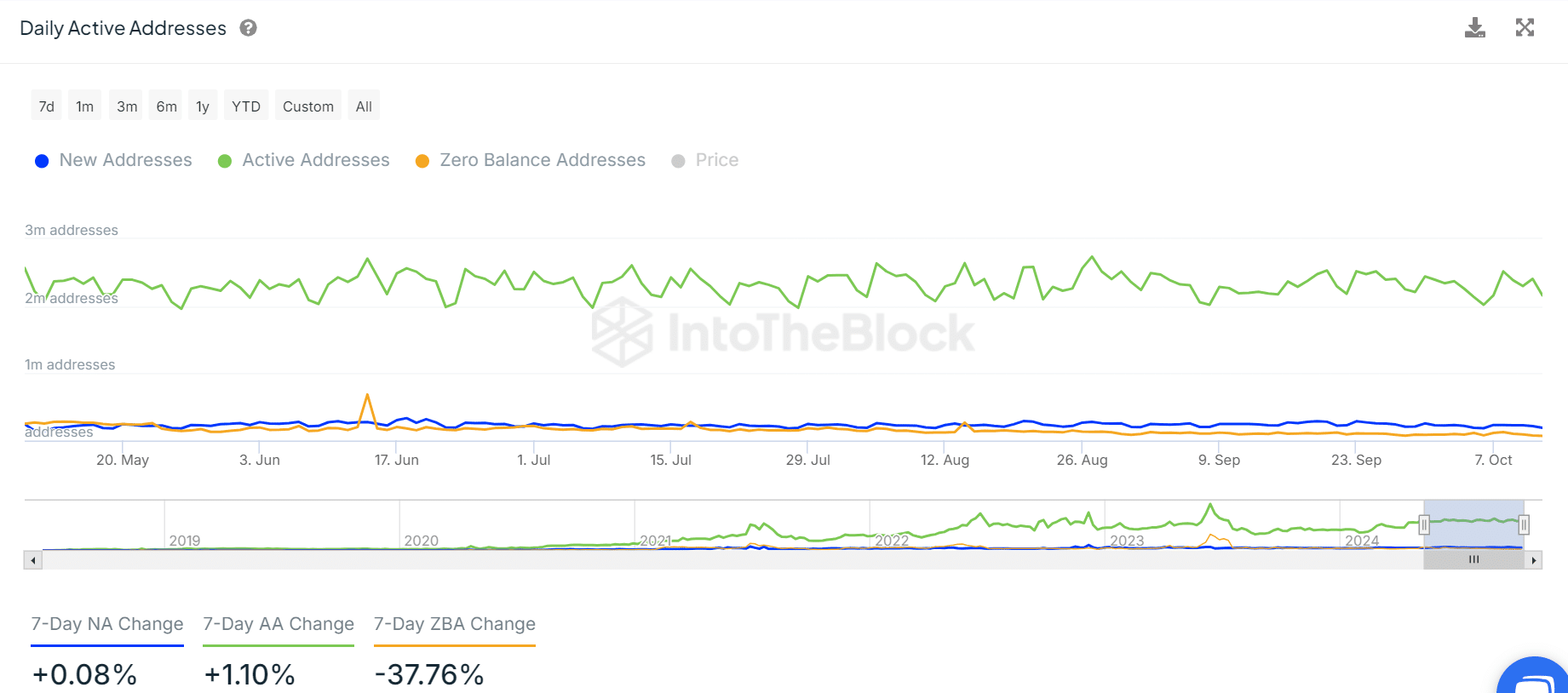

In recent weeks, TRON has witnessed a modest increase in daily active addresses. While the overall trend appears stable, the slight uptick in new addresses signifies growing interest among investors.

With a 7-day change in active addresses of +1.10%, TRON demonstrates consistent engagement within its ecosystem. This steady growth in participation can enhance the network’s robustness and value proposition.

Source: IntoTheBlock

What does the Funding Rate say?

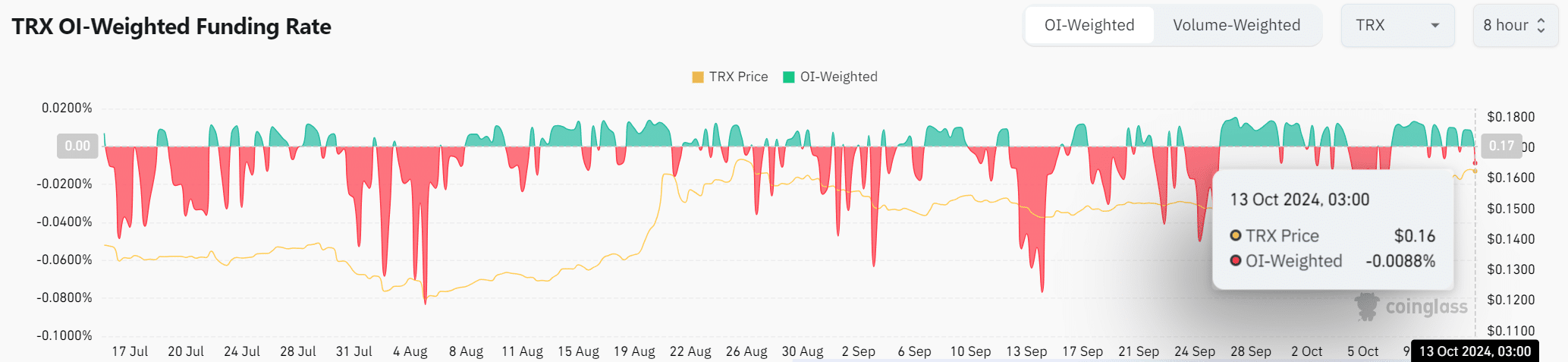

The TRX OI-Weighted Funding Rate has experienced slight fluctuations but remained close to zero, indicating balanced sentiment between long and short positions.

At press time, the Funding Rate is -0.0088%, suggesting that the market remained cautiously optimistic about TRX’s short-term price movements.

This equilibrium can attract both bullish and bearish traders, maintaining liquidity within the market.

Source: Coinglass

Long/Short Ratio analysis

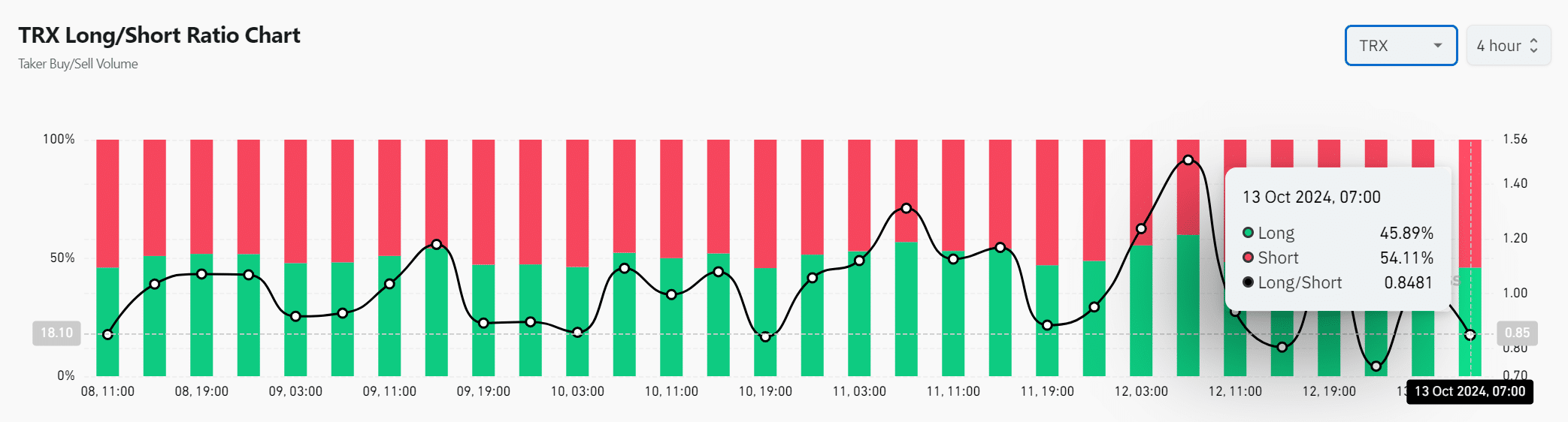

Recent analysis of the Long/Short Ratio revealed that short positions slightly outweighed long positions, with shorts at 54.11% and longs at 45.89%.

This situation reflected a cautious stance among traders, who may be anticipating potential volatility in TRX’s price.

Nevertheless, as long as TRX maintains its recent bullish trend, the sentiment can shift quickly in favor of the bulls.

Source: Coinglass

Conclusively, TRON’s recent actions, including its substantial token burn and positive momentum indicators, suggested a commitment to enhancing its market presence.

Realistic or not, here’s TRX market cap in BTC’s terms

While the current price at $0.1623 and the slight increase in daily active addresses signal potential growth, traders remained cautious with their long/short positions.

Therefore, if TRON can sustain this upward momentum, it may capitalize on its deflationary strategy and pave the way for significant growth in the coming weeks.

Source: https://ambcrypto.com/tron-burns-10m-tokens-will-this-help-trxs-price-rise/