The crypto market today was on edge as traders waited for Donald Trump’s reaction to TACO accusations and the decision by a court to halt his reciprocal tariffs. Bitcoin (BTC) price remained at $108,000, while Ethereum (ETH) jumped to its highest level since February, and liquidations jumped by 50% to $298.2 million per CoinGlass data. There is a risk that Trump’s response to the TACO accusations and the tariff ruling could trigger a crypto and stock market crash, putting trillions at risk.

Crypto Market Today Waits for Trump’s Response to TACO and Trade Ruling

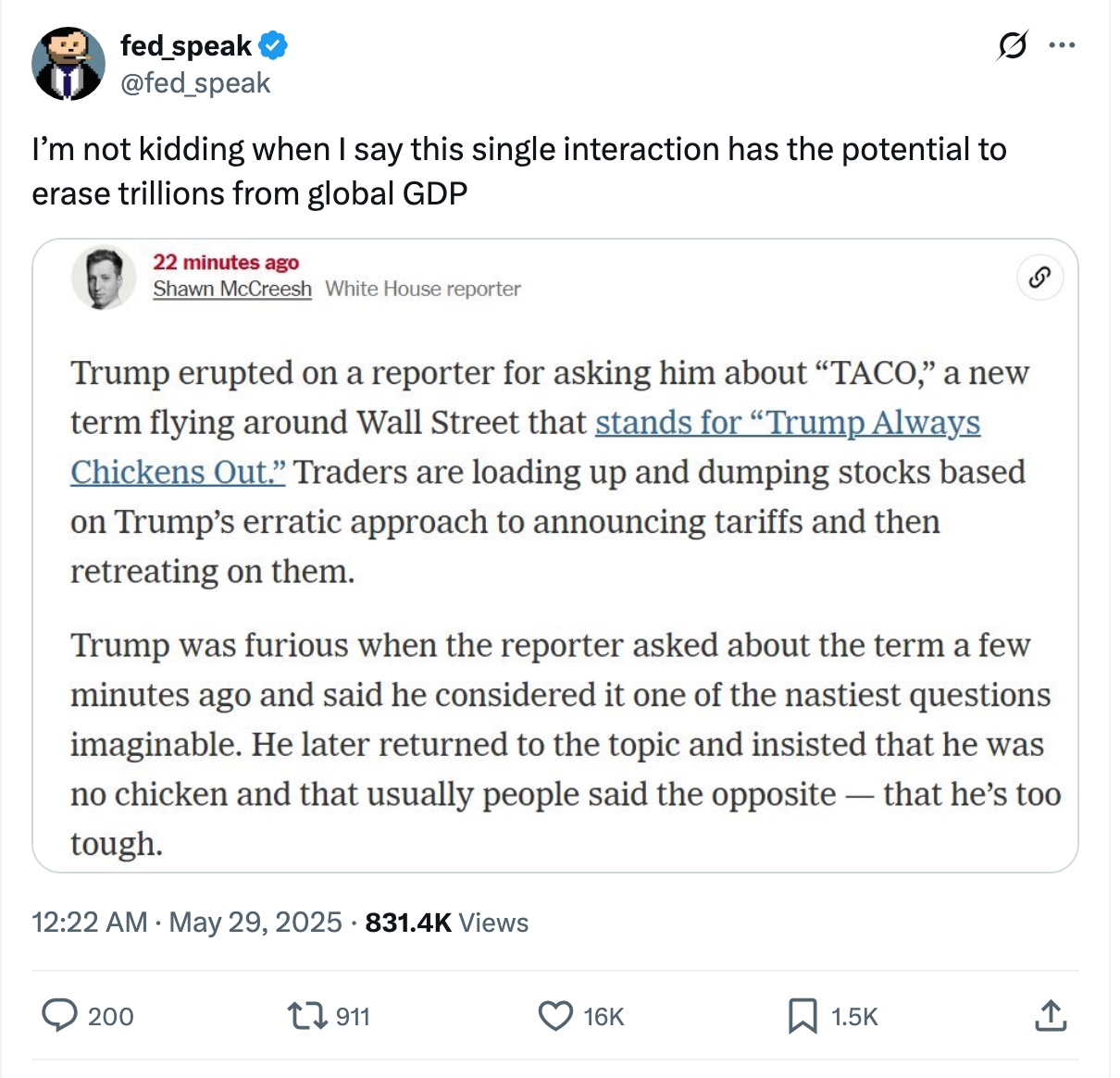

A potential catalyst that puts the crypto market at risk is TACO, a new term meaning Trump Always Chickens Out. The term means that Trump makes a big announcement and then cools down after a while.

He pushed tariffs on Chinese goods to 145% in April, only to lower them after the first round of negotiations in Switzerland. Last week, he threatened to implement a 50% tariff on European goods starting on June 1, only to postpone them to July after talking with Ursula von der Leyen.

Trump has rejected these claims and noted that he was ready to push up tariffs again if talks don’t lead to more gains for the US.

The challenge, however, is that a US court ruled that Trump’s reciprocal tariffs were illegal, in a victory for Americans and other countries. The administration is expected to appeal the ruling, all the way to the Supreme Court. A likely scenario is that Trump’s tariffs will be allowed to remain in place, pending the final decision at the Supreme Court.

Crypto prices often react to tariff news. Most of them crashed in April when he announced his Liberation Day tariffs and started rising when he announced a three-month pause. Last week, Bitcoin price retreated after he announced a 50% tariff on European goods.

If the Trump administration wins the tariff legal battle at the Supreme Court, he will likely follow through on most of his threats as he tries to remove the TACO tag, Such a move would likely lead to trillions of dollars in losses in the stock and crypto market. For example, his Liberation Day tariff announcement led to trillions in losses as these assets plunged.

Crypto Prices Waver as JD Vance Touts Bitcoin

The crypto market also reacted mildly to a speech by Vice President JD Vance at a Bitcoin Conference. He made the case for Bitcoin and assured attendees that the industry was well represented in the White House.

Eric Trump and Donald Trump Junior attended the conference and gave bold predictions. Trump Junior believes that the BTC price will end the year between $150,000 and $175,000, while his brother estimated that it will hit $170k by 2026.

These statements came as the Trump family is getting more involved in the crypto market. This week, Trump Media said that it was raising $2.5 billion to buy Bitcoin as it seeks to replicate Strategy’s success.

Circle Freezes $57 Million Tied to LIBRA Meme coin

The other top crypto market news today was that Circle, the creator of USDC, froze $57 million funds tied to LIBRA following a court order. The court case revolves around the sudden surge and collapse of LIBRA, a coin that Javier Milei, the president of Argentina, promoted.

This freeze came at an important time for Circle as it prepares to go public in the United States. BlackRock, the biggest asset manager, is said to be contemplating buying a 10% stake in Circle as it seeks to have a big market share in the stablecoin industry.

In other news, the Trump administration made a major change on Wednesday that could boost crypto price predictions. It reversed a Biden-era policy that barred Americans from investing their retirement funds in crypto. By doing that, there is a likelihood that billions will flow to Bitcoin and other coins.

Summary and Next Catalysts for Crypto Market

The crypto market today is reacting to the latest trade news in the United States following the recent court ruling. From a macro level, the US will publish the latest GDP data today. It will then publish the personal consumption expenditure report on Friday. These numbers come after the Federal Reserve published hawkish minutes of the last meeting.

Frequently Asked Questions (FAQs)

The main catalysts for the crypto market today are the Trump TACO claims, trade issues, and macro data.

The market action is fairly muted as investors anticipate that Trump and his administration will appeal to the Supreme Court.

He expressed confidence in the crypto industry and said that the sector was well-represented in the White House.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/crypto-market-today-trillions-at-risk-as-investors-await-trumps-reaction-to-taco/

✓ Share: