Traders are betting on the FOMC to make two more rate cuts this year following the release of the September CPI inflation data. This provides a bullish outlook for the crypto market ahead of next week’s FOMC meeting, where the committee could make the first of these two projected Fed rate cuts.

Traders Expect Two More Fed Rate Cuts This Year

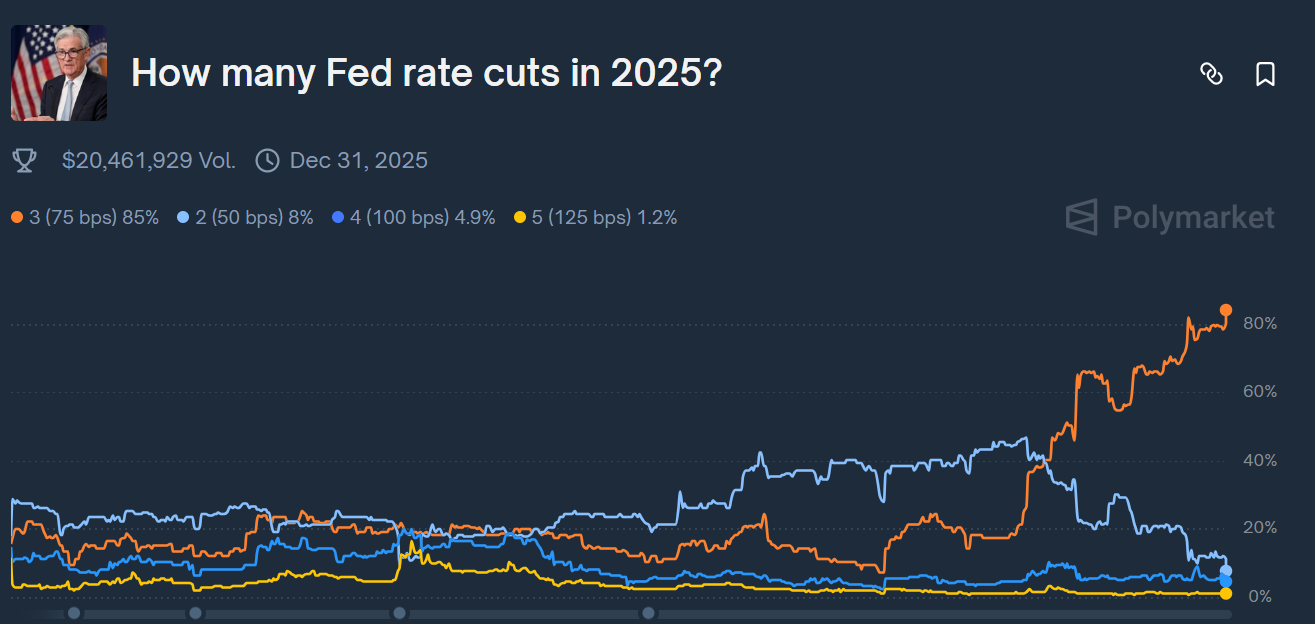

Polymarket data shows that traders expect the Fed to cut rates at this month’s FOMC meeting and the December meeting. This comes as the odds of three rate cuts this year have surged to a new high of 85%.

This follows the release of September CPI inflation data, which came in below expectations. Inflation rose to 3% year-on-year (YoY) last month, just below the expectation of 3.1%. The monthly CPI and Core CPI had also come in below expectations, boosting hopes of two more Fed rate cuts this year.

The Fed is likely to make the first cut at next week’s FOMC meeting, which holds between October 28 and 29. CME FedWatch data shows that there is currently a 96.7% chance that the committee will lower rates by 25 basis points (bps). This will mark the second cut this year after the committee lowered the benchmark rate for the first time at last month’s FOMC meeting.

Notably, Fed officials, including Chris Waller and Stephen Miran, have indicated that they support two more Fed rate cuts this year. However, while Waller believes that two more 25 bps cuts are enough, Miran has advocated for a 50 bps cut.

Market commentator The Kobeissi Letter stated that there is “no other option” for the Fed than to make the two additional cuts this year. They alluded to the fact that the labor market continues to weaken while inflation is cooler than expected.

The Catalyst For An Extended Bull Market

Market expert Fred Krueger has indicated that the two more Fed rate cuts this year could be the catalyst for an extended bull market. He also suggested that the four-year cycle theory may be over, even as some predict that BTC has topped.

Rate cut in 6 days. Then again in 48 days. Then again in 97 days. Then we have a new Fed Chair in May who will make Bernanke look like Paul Volker.

Enjoy missing out on the next bull market, cycle theorists.

— Fred Krueger (@dotkrueger) October 23, 2025

Notably, the BTC price surged to a new all-time high (ATH) above $126,000 earlier this month as the market priced in another rate cut this month. This was similar to what happened in August when the flagship crypto reached a previous high in anticipation of the September rate cut.

However, it is worth noting that experts such as veteran trader Peter Brandt have predicted a significant Bitcoin crash. Brandt suggested BTC could crash by as much as 50%, drawing parallels between the current chart structure and the 1977 soybean crash.

Source: https://coingape.com/traders-price-in-two-more-fed-rate-cuts-this-year-after-soft-inflation-data/