- Federal Reserve rate cut speculation boosts crypto market sentiment.

- Traders expect at least two rate cuts by 2025.

- BTC and ETH could see positive market response.

Traders anticipate at least two Federal Reserve rate cuts by 2025, according to a report from PANews on July 2. This expectation could influence cryptocurrency markets, potentially increasing demand for assets like Bitcoin and Ethereum.

The Federal Reserve interest rate policy is under scrutiny as traders prepare for potential rate cuts by the end of 2025. This anticipation stems from market analyses and trader expectations rather than official declarations by Federal Reserve Chair Jerome Powell or top governors. Official communications remain focused on forthcoming economic indicators.

Historical Impacts and Cryptocurrency Market Performance

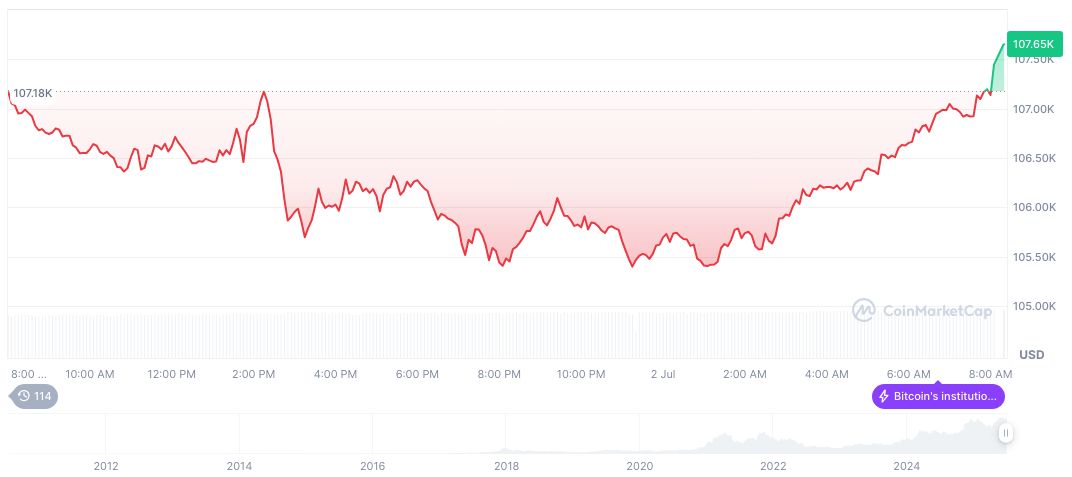

According to CoinMarketCap, Bitcoin (BTC) maintains a current price of $107,293.80 with a market cap of 2.13 trillion. Dominating 64.84% of the market, Bitcoin’s 24-hour trading volume reached $46.83 billion, reflecting a 0.75% price increase over the same period. Price momentum has been observed over the last 90 days, with a 31.01% increase.

Coincu research team suggests the potential impact of Federal Reserve rate cuts could transform the financial landscape for cryptocurrencies. Historically, lower borrowing costs and increased market liquidity have correlated with substantial crypto asset growth, particularly affecting high-volatility governance tokens and Ethereum-based protocols.

“It’s too early to determine whether inflation or unemployment will emerge as the greater concern… The central bank can afford to be patient, monitoring incoming data and adopting a wait-and-see approach.” — Jerome Powell, Fed Chair, Federal Reserve

Market Reactions and Future Outlook

Did you know? The last significant Federal Reserve rate easing cycle in 2020-2021 resulted in rapid growth for crypto-assets and DeFi tokens, marking a pivotal moment in digital finance.

Traders’ anticipation of reduced rates generally supports cryptocurrencies, as cuts typically translate to increased liquidity and risk appetite among investors. Historically, similar scenarios facilitated surges in sectors like DeFi and major cryptos.

Market analysts and financial expert estimates highlight that any indications toward monetary easing promote positive sentiment in crypto markets. While specific reactions from key regulatory players remain absent, industry observers expect notable shifts should rate reductions materialize.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346440-traders-expect-fed-rate-cuts-2025/