SUI, a Layer 1 blockchain developed by Mysten Labs, has rapidly established its position in the industry thanks to its use of the Move programming language, parallel transaction execution, and exceptional scalability.

In Q1 2025, SUI continued to make headlines with impressive growth across several key network metrics. In this article, Coincu takes a closer look at the top standout projects shaping the SUI ecosystem in 2025.

Why the Sui Ecosystem Is Gaining Attention in 2025

Sui is gaining momentum in 2025 as one of the most promising blockchain platforms. Built with the Move programming language, it offers a safer, more flexible way for developers to build applications. Its unique ability to process transactions in parallel makes it exceptionally fast and scalable.

| Key Highlights | Details |

|---|---|

| DApp Revenue | $5.5 million in January 2025, the highest ever recorded. |

| All-Time High Market Cap | $15.9 billion on 5/1/2025, then dropped to $6.7 billion on 15/4/2025. |

| TVL Peak | $2.08 billion on 6/1/2025, up 100% from the end of 2024, then dropped to $1.43 billion on 10/2/2025. |

| DEX Trading Volume | $996 million on 29/3/2025, an ATH in Q1/2025, driven by Cetus and DeepBook. |

| SUI Token Price | ATH of $4.93 on 6/1/2025, dropped to $2.20 by the end of Q1/2025. |

| Low Gas Fees | Gas fees from 0.0001-0.001 SUI, encouraging frequent transactions and generating steady revenue. |

With over $330 million in value locked, Sui is quickly attracting developers and users. Experts believe its DeFi and gaming sectors could see massive growth, positioning Sui as a key player in the next crypto bull run. The platform is backed by Mysten Labs, a trusted name in blockchain innovation.

Sui also keeps costs low, making it affordable for everyday users. New technologies like Mysticeti and Raora aim to further boost speed and performance. Integration with Phantom Wallet makes using Sui even easier, helping newcomers join the ecosystem with confidence.

Top 5 SUI Ecosystem Tokens to Watch in 2025

Below is a basic summary table of 5 standout projects in the Sui ecosystem, giving you a quick overview before diving into detailed analysis:

| Project Name | Token | Category | Market Cap | Key Use Case |

|---|---|---|---|---|

| Walrus | WAL | General Utility Token | $682.44M | High-performance token within SUI dApps |

| DeepBook | DEEP | CLOB DEX | $646.07M | On-chain order-book trading engine on SUI |

| Sudeng | HIPPO | Meme Coin | $23.67M | Meme-based token with ecosystem utility |

| Cetus Protocol | CETUS | Decentralized Exchange (DEX) | $95.8M | CLMM-based DEX, swap & launchpad |

| NAVI Protocol | NAVX | Lending/Borrowing Platform | $25.8M | Lending, borrowing, staking (like Aave) |

1. Walrus (WAL)

Walrus (WAL) is a token within the SUI ecosystem, a blockchain platform focused on delivering high-performance, scalable solutions for decentralized applications (dApps). The project aims to empower developers to build applications with superior efficiency while maintaining security and decentralization.

Highlights

- SUI Ecosystem: Walrus leverages SUI’s technology, known for fast transaction processing and low fees, making it ideal for high-performance applications.

- Impressive Growth: WAL has surged 22% in the past 24 hours, reflecting strong interest from the community and investors.

- Liquidity and Scale: With a market cap of $682.44M and a circulating supply of 1.228B WAL, the project has a solid financial foundation.

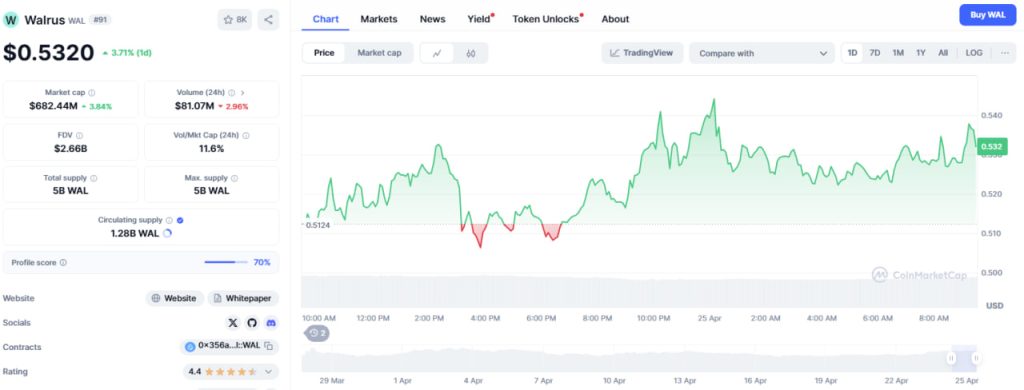

WAL trades at $0.5320, up 3.71%, showing volatility with a monthly range from $0.5124 to $0.547. It’s testing the $0.532 resistance, hinting at more upside if momentum holds. The 24-hour volume rose 2.96% to $81.07M, supporting the current bullish trend.

Key support lies at $0.505; dropping below may lead to $0.447 or $0.389 in a deeper fall. Resistance at $0.547 is crucial—breaking it could drive WAL to $0.600, but failure to clear $0.532 risks a decline to $0.447.

| Tips to farm WAL, users need to provide liquidity on supported pools like Cetus or DeepBook. Always verify APR and pool details before participating to ensure optimal returns. You can refer to the following article on how to farm Wal. |

2. DeepBook (DEEP)

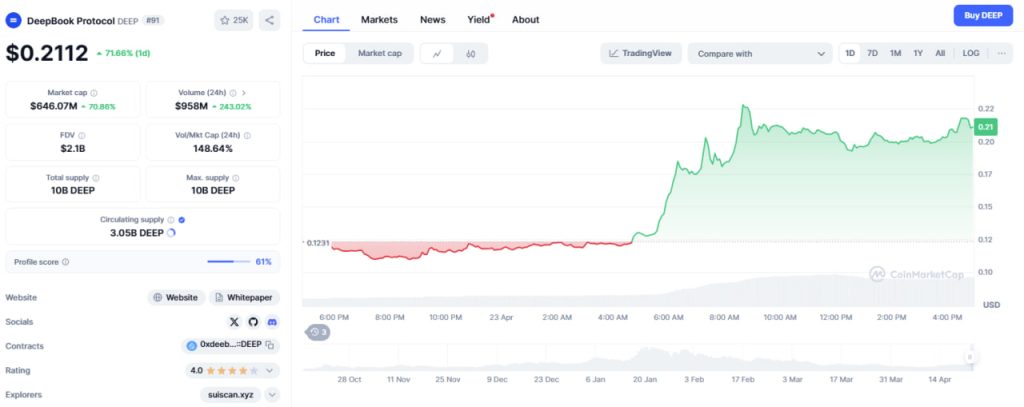

DeepBook is the first and only Central Limit Order Book (CLOB) DEX native to the Sui blockchain. It aims to deliver a CEX-like trading experience with decentralized infrastructure.

Highlights:

- Fast Order Matching: Execution speed around 390ms, rivaling centralized exchanges.

- CLOB Model: Matches buy/sell orders directly for efficient pricing.

- Utility Token: DEEP is used for governance, staking, and fee discounts. TVL currently sits at $21.6M, with a market cap of $219M.

DEEP is currently priced at $0.0875, showing stability amidst market competition. If momentum continues, the next resistance is around $0.0920. A break below $0.0840 could trigger a pullback toward $0.0800.

3. Sudeng ($HIPPO)

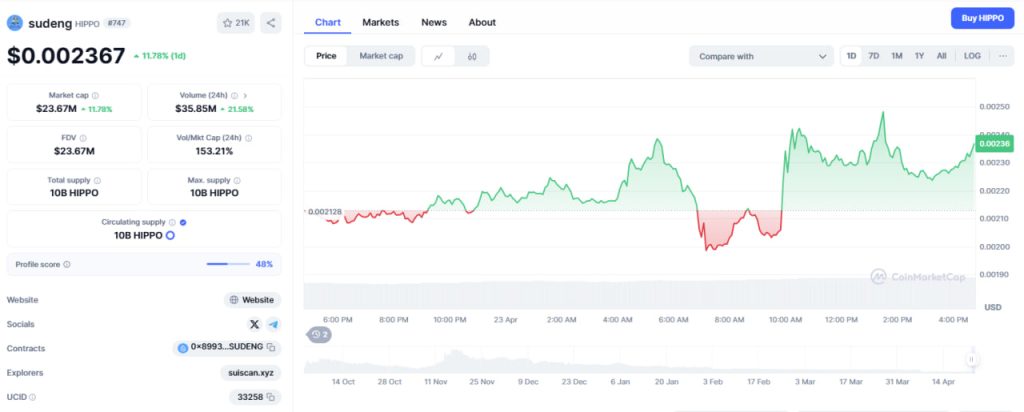

Sudeng ($HIPPO) is a notable meme coin in the Sui ecosystem, designed to engage the community while providing ecosystem utility. Priced at $0.002367 with a market cap of $23.67 million, it is one of the top SUI ecosystem tokens to watch in 2025.

Highlights:

- Strong Community Backing: Leveraging meme coin popularity for growth.

- Platform Integration: Works with Suilend and Pyth Oracle for added use cases.

- Retail-Friendly Price: Low entry point attracts small investors.

Sudeng (HIPPO) has shown volatility, recently recovering to $0.0227 after a drop. It’s nearing a key resistance at $0.0230. Breaking this could push the price to $0.0240 or $0.0250, signaling bullish momentum. Failure to breach $0.0230 may lead to a drop below $0.0220, potentially hitting $0.0210 or $0.0207, indicating a deeper correction.

4. Cetus Protocol (CETUS)

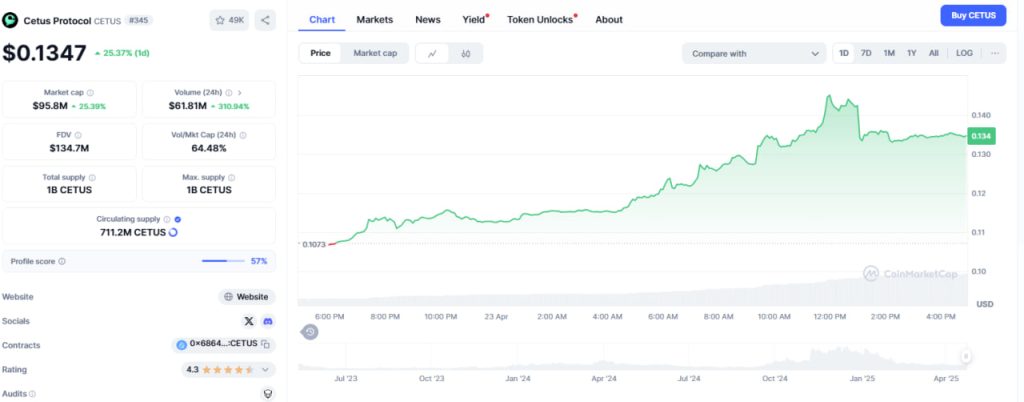

Cetus is the leading decentralized exchange (DEX) on Sui, utilizing a Concentrated Liquidity Market Maker (CLMM) model to optimize trading efficiency and reduce slippage. Features include swap, earn pools, farms, and a launchpad for new projects.

Highlights:

- Cetus’s TVL grew 25% in Q4 2024, outpacing early-stage DEXs on other chains.

- Partnerships with DeepBook and new features like Cetus Vaults enhance liquidity.

- Challenges include competition from larger DEXs and complexity for new users.

- Strong developer activity (active GitHub) and 2M users signal robust adoption.

Cetus (CETUS) has shown significant upward momentum, rising from around $0.1065 to a peak of approximately $0.1430 within 24 hours. This sharp surge highlights strong short-term bullish sentiment. However, after reaching its peak, the token saw a minor pullback and is currently trading around $0.135.

CETUS is now testing a key resistance zone between $0.137–$0.140. A successful breakout above this level could push the price further towards $0.145 or even $0.150, signaling sustained bullish momentum.

5. NAVI Protocol (NAVI)

NAVI Protocol is the leading liquidity platform on Sui, inspired by Aave. It provides lending, borrowing, liquid staking, and leveraged vaults—all with customizable interest rates and security-focused features.

Highlights:

- Token Launched: The native token NAVX is now live, trading at $0.05274 with a $25.8M market cap and daily volume of $7.75M (+192.78%). Circulating supply is 489.31M NAVX out of a max supply of 1B.

- Explosive TVL Growth: NAVI’s total value locked soared from just $4.4M in 2023 to $480M in April 2025, signaling rapid adoption and trust.

- Powerful Features: Includes leveraged vaults, isolation mode for asset risk segmentation, and integration with oracles like Pyth Network.

NAVX has rallied +26.84% in the past 24 hours, recovering from a local low of $0.04154 to trade near $0.052. The token is showing consolidation below a minor resistance at $0.055. A successful breakout could send NAVX toward $0.060 or even $0.065.

Upcoming Plans for Sui Ecosystem in 2025

Sui has outlined an ambitious roadmap for 2025, focusing on scalability, developer experience, security, and real-world adoption. Here are the key initiatives the ecosystem is pursuing this year:

- Walrus: A decentralized storage protocol for large files like videos and images, offering 80% lower costs than Filecoin and Arweave, using SUI’s Move smart contracts. The community is now eagerly awaiting the second airdrop.

- Passkey Login Integration – In a bid to create “invisible blockchain” UX, Passkey will allow users to authenticate using biometrics and temporary session keys—enabling smooth DeFi swaps and gaming without repeated signatures.

- SuiPlay0X1: A handheld gaming device for Web3 and traditional games, expected to launch in Q2/2025 with 10,000 pre-orders, also collaborating with ONE Championship on a Web3 mobile game.

- Sui Basecamp 2025: A major event in Dubai on 1st-2nd May 2025, featuring key figures like Mysten Labs CEO Evan Cheng and blockchain analyst Raoul Pal, focused on SUI’s development and attracting global developers and partners.

- SEAL Encryption Framework – SEAL enables fine-grained access control, allowing developers to define advanced cryptographic policies and unlock use cases like secure document workflows or private video streaming.

- Friendly Environment – Sui plans to simplify on-chain data querying, Move code verification, and dev onboarding with less boilerplate and smarter infrastructure support, targeting both experienced and AI-assisted developers.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/333834-top-sui-ecosystem-tokens-to-watch-in-2025/