Disclaimer: This content is a sponsored article. Bitcoinsistemi.com is not responsible for any damages or negativities that may arise from the above information or any product or service mentioned in the article. Bitcoinsistemi.com advises readers to do individual research about the company mentioned in the article and reminds them that all responsibility belongs to the individual.

Generating passive income has emerged as one of the most wanted financial objectives. Contributing to fast crypto and DeFi development, there are plenty of ways to get money without much effort from your side. Below we will see 9 smart and simple passive income ideas for 2024.

1. Crypto Staking

In summary, crypto staking can be considered one of the easiest and most effective means of passive income creation within the crypto world. By staking your crypto assets within a Proof of Stake network, you assist in the validation of transactions that happen over the network, where, in return, you are given staking rewards. That is a good way of making money off of your crypto holdings without necessarily needing to sell them.

What is Staking?

Staking is the process in which holders “stake” their cryptocurrency in a PoS blockchain network to validate block transactions and all other processes necessary for the operation of the network. The network rewards the stakers with new tokens or coins in return. Unlike traditional mining, which requires loads of computing power, staking simply means just locking up your coins in a wallet to generate passive rewards.

OkayCoin- The best staking platform

OkayCoin is among the biggest crypto exchanges with user-friendly staking. Users can easily stake their assets on OkayCoin and get on-chain rewards through it. Supported by a plethora of cryptocurrencies that can be staked for passive income, these include the likes of Ethereum, Polkadot, Solana, and more. Generally speaking, OkayCoin offers smooth, seamless staking to crypto investors who are both new and experienced.

How to Choose the Best Crypto Staking Platform

Knowing which platform to choose is crucial when it comes to maximizing your staking reward. Here’s what to consider:

Supported Cryptocurrencies: Be sure the platform in question supports the coins that you want to stake.

APY (Annual Percentage Yield): It is, in a sense, the comparison of staking returns across different platforms.

Fees: Check if there are any staking or withdrawal fees.

Lock-up Period: While most require you to lock up your assets in their system for a period of time, others offer flexible staking.

Security: operate with a platform that has robust security features and a good reputation.

Step-by-Step guide of How to Open Account with OkayCoin

- Visiting the website of OkayCoin: Go to access www.okaycoin.com

- Account Registration: Click on the “Sign Up” button. Upon completing the sign up process, you will receive a welcome bonus of $100.

- Entering your Details: According to registration form-mention your email address, password, confirming letter information with accepting terms of service.

- Email Confirmation: OkayCoin will send you a confirmation letter with a link for your account confirmation to your email box.

- Complete KYC: Upload identification documents, such as your ID or passport, and get them verified.

- Deposit Funds: Deposit the cryptocurrency you want to stake into the platform or buy it directly on the platform.

- Activate Staking: Once the funds are in your OkayCoin wallet, go into the staking area, select a plan that fits your needs, and start rewards.

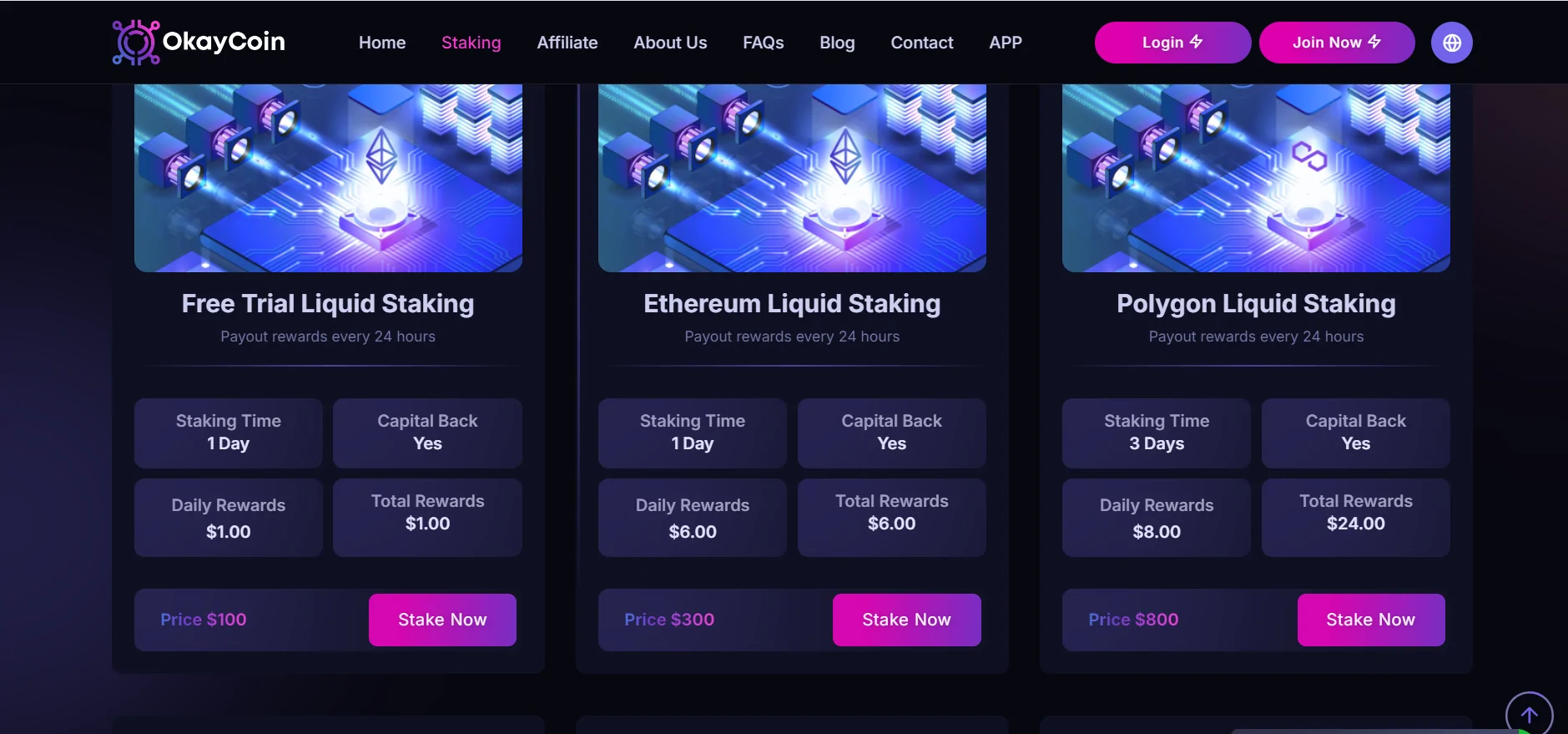

OkayCoin provides different kinds of staking for various cryptocurrencies as mentioned below.

- Free Trial Staking Plan: $100 for 1 day and earn $1 daily.

- Ethereum Staking Plan: $300 for 1 day and earn $6 daily.

- Polygon Staking Plan: $800 for 3 days and earn $8 daily.

- TRON taking Plan: $1200 for 7 days and earn $12 daily.

- Polkadot Staking Plan: $3000 for 7 days and earn $33 daily.

- Celestia Staking Plan: $6000 for 14 days and earn $72 daily.

- Aptos Staking Plan: $10,000 for 15 days and earn $140 daily.

- Sui Staking Plan: $20,000 for 15 days and earn $280 daily.

- Avalanche Staking Plan: $35,000 for 20 days and earn $525 daily.

- Cardano Staking Plan: $56,000 for 30 days and earn $896 daily.

- Solana Staking Plan: $78,000 for 30 days and earn $1,404 daily.

- Ethereum Staking Plan Pro: $100,000 for 45 days and earn $2,000 daily.

OkayCoin Referral Program

It is a way of earning some money by inviting one’s friends and relatives on OkayCoin. In fact, once an invitation is successful, then it gives a bonus to both the referrer and the invitee. That’s like some sort of passive income without necessarily having to put in more investment. All one has to do is share their unique referral link with friends, and the more joiners and users on the platform, the more rewards you are entitled to. You will get a 3.5% commission on every order.

2. Yield Farming

Another popular passive income source within the DeFi space is through yield farming. By providing liquidity to platforms such as Uniswap or PancakeSwap, you get lucrative returns on your crypto assets. Yield farming entails lending one’s assets to various liquidity pools, whereby this comes with interest or platform tokens as a form of return.

3. Crypto Lending

With crypto-lending platforms like Aave and BlockFi, one is able to lend one’s assets to the borrowers on their platform in exchange for interest. All it takes is to deposit your crypto on a website, and it gets lent out to other users. In return, you get interest payments. This can be a very consistent and risk-adjusted return for those dealing in stablecoins, such as USDC or DAI.

4. Liquidity Mining

Liquidity mining is similar to yield farming, but the approach involves providing liquidity to a decentralized exchange. You deposit your crypto into the DEX liquidity pool and receive in return some transaction fees and extra tokens as rewards. Among popular platforms that people use for liquidity mining are such ones as Uniswap and SushiSwap.

5. Dividend-Paying Tokens

Some cryptocurrency projects distribute dividends among token holders. Coins like KuCoin Shares (KCS) and NEO reward users for simply holding their tokens. KuCoin, for example, distributes part of the trading fees to the holders of KCS, while NEO creates “GAS” tokens for its owners. Dividends create a passive income that is very similar to the stock dividends.

6. Masternodes

Another investment in the passive income space is running a masternode. Conceived as a server to help validate transactions occurring on a blockchain network, a masternode works to solve some transaction-related puzzles. In return for their work, masternode operators are usually rewarded with some new coins. Coins like Dash and PIVX are known to give opportunities as masternode, but they require huge upfront investment.

7. Dividend Tokens

Then, there are those tokens that actually include staking with dividend-paying in them. For every staking you do with dividend-paying tokens, the rewards are extra tokens or dividends that you gain. It would be an excellent way to doubling up your earnings at the same time you gain dividends from it. You can look for such tokens at places like KuCoin.

8. Crypto Arbitrage

Crypto arbitrage refers to taking advantage of the price differences in the same crypto at different exchanges. You buy low on one exchange and sell high on another. These arbitrage opportunities may disappear rather quickly, but you can use bots and/or other monitoring tools to make the most of it.

9. Cloud Mining

Cloud mining allows users to participate in crypto mining activities without having to invest in expensive mining equipment. Renting out mining power from data centers will help you gain a share of the mining rewards. Although the returns on cloud mining have fallen over the years, when it comes to matching with some low-cost mining services, it could still turn out to be one of the most viable methods of passive income.

Conclusion

In 2024, generating passive income with cryptocurrency has never been easier. From staking crypto on OkayCoin to farming yields, mining liquidity, lending in crypto, and many other methods, the possibilities by which one can grow their wealth with minimal trading are limitless. To this end, take a closer look at ten smart and simple passive income ideas to build a diversified portfolio of growing wealth over time. Whether you’re a rookie or a seasoned crypto investor, these strategies represent some excellent opportunities to reach your financial goals.

Source: https://en.bitcoinsistemi.com/top-9-passive-income-ideas-for-2024/