The recent Pi Network price crash has lost momentum, but technicals and fundamental factors point to an eventual bearish breakout, potentially to its lowest point in April.

Technically, the coin is forming a bearish pennant pattern. Fundamentally, there are concerns that it is a ghost chain, and its centralization means that top exchanges will likely not list it anytime soon.

Pi Network Price Technical Analysis: Bearish Pennant Forms

The eight-hour chart shows that the Pi Network price has slumped since May 12, when it surged to $1.6631 ahead of the ecosystem news. Pi Coin has now plunged below the 50-period moving average.

Most importantly, the ongoing consolidation is part of the formation of a bearish pennant pattern. A pennant is made up of a vertical line resembling a flagpole and a triangular pattern.

A bearish breakout will point to a drop to the key support at $0.5580, the lowest swing on April 9 and 30. Losing that support level will point to more downside to its April low of $0.40, down by 45% from the current level.

The bearish Pi Coin price forecast will become invalid if the coin rises above the psychological point at $1.

Pi Coin Exchange Listings Unlikely to Happen Without Major Changes

The Pi Network price may also keep falling because the much-anticipated listing by top exchanges like Binance and Upbit is unlikely to happen unless the developers implement changes.

This view is based on the fact that Pi Network is a highly centralized cryptocurrency where the obscure Pi Foundation has so much power. As shown below, the foundation holds at least 72.7 billion tokens valued at over $53 billion in seven wallets.

The foundation also holds more tokens in thousands of wallets. All this exposes holders to risk since these wallets are not audited. Also, the Pi Coin price would likely crash if the foundation dumped the tokens willingly or if hackers infiltrated the wallets. Most exchanges will unlikely list a crypto project with all this centralization.

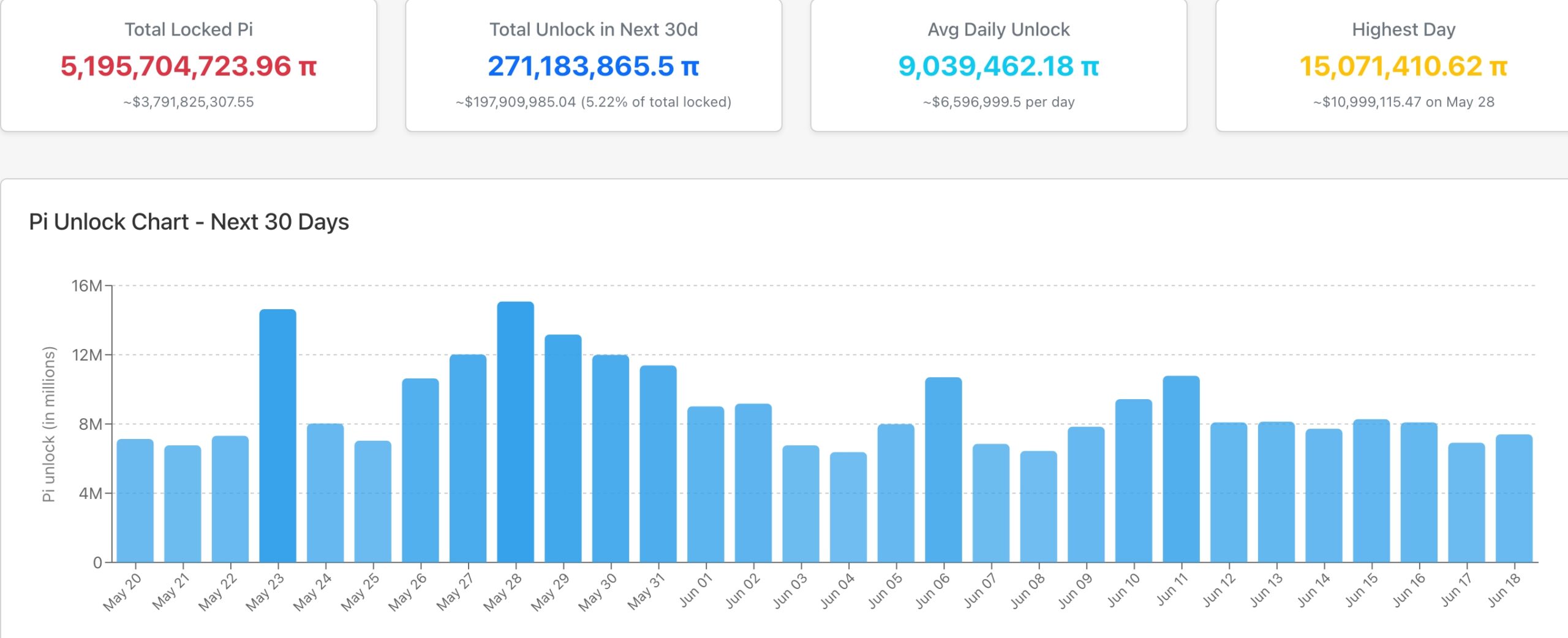

Pi Network Token Unlocks

Further, Pi Coin price may also struggle because of the ongoing token unlocks. Data shows that the network will unlock 271.18 million tokens in the next 30 days. The daily average of these unlocks is over 9 million. It will unlock 1.49 billion tokens in the next 12 months.

With Pi having a maximum supply of 100 billion and a circulating supply of 7.9 billion, it means that the supply will grow by over 92 billion over time. Unlocks increase the supply, which is risky, especially when there is no demand to buy it.

Pi is a Ghost Chain

A ghost chain is a blockchain network that has no developers building applications. While Pi’s mainnet launched with 100 apps, most of them have not become popular.

Also, it is too early to predict whether the projects that will be funded by the $100 million Pi Network ventures will succeed. Therefore, with no apps in the network, chances are that the Pi Network token will not have any utility.

Frequently Asked Questions (FAQs)

Pi Network is at risk of a big dive because of its weak technicals and fundamentals, which signal a potential 45% drop.

Data shows that Pi Network is a ghost chain since it has just a few developers and there are no apps in the ecosystem.

Odds are that many tier-1 exchanges like Binance and Coinbase will not list the token because of its centralization.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/top-4-reasons-pi-network-price-could-crash-45-soon/

✓ Share: