In the emergence of modern finance systems, global finance is at the beginning of the most consequential transformation of the 21st century.

With the adoption of blockchain technology, the tokenization of real-world assets is the next big global unlock.

In fact, according to Boston Consulting Group and ADDX, asset tokenization is projected to reach $16 trillion by 2030. According to Calastone research, tokenized funds commanded over $24 billion in assets under management at press time.

Amid this growth, institutions, sovereign funds, states, and other key players are eyeing tokenized gold to complete the power shift in digital space.

Tokenized gold: a $29 trillion revolution

In 2025, gold has been on a remarkable run, climbing more than 50% year‑to‑date. This rally comes despite a pullback from its October all‑time high of $4,381.

The surge has been fueled largely by global market turbulence since the beginning of Donald Trump’s second term. Heightened tensions and uncertainty have strengthened gold’s role as a safe‑haven asset.

As a result, demand has surged, driving its total market value to an astonishing $29 trillion.

Source: Visual Capitalist

Despite the surge, owning physical gold has required extensive compromise and is even more challenging. Therefore, as blockchain adoption and advancement increase, the need for tokenized gold has become clear.

Gold tokenization makes ownership simple, enables instant transfers, and is easily accessible to investors of all sizes. This evolution has quickly accelerated, with a sector eyeing a $29 trillion asset.

Institutions in a digital gold rush

Much like a modern‑day gold rush, major players from traditional institutions to digital platforms are racing to secure gold through tokenized assets.

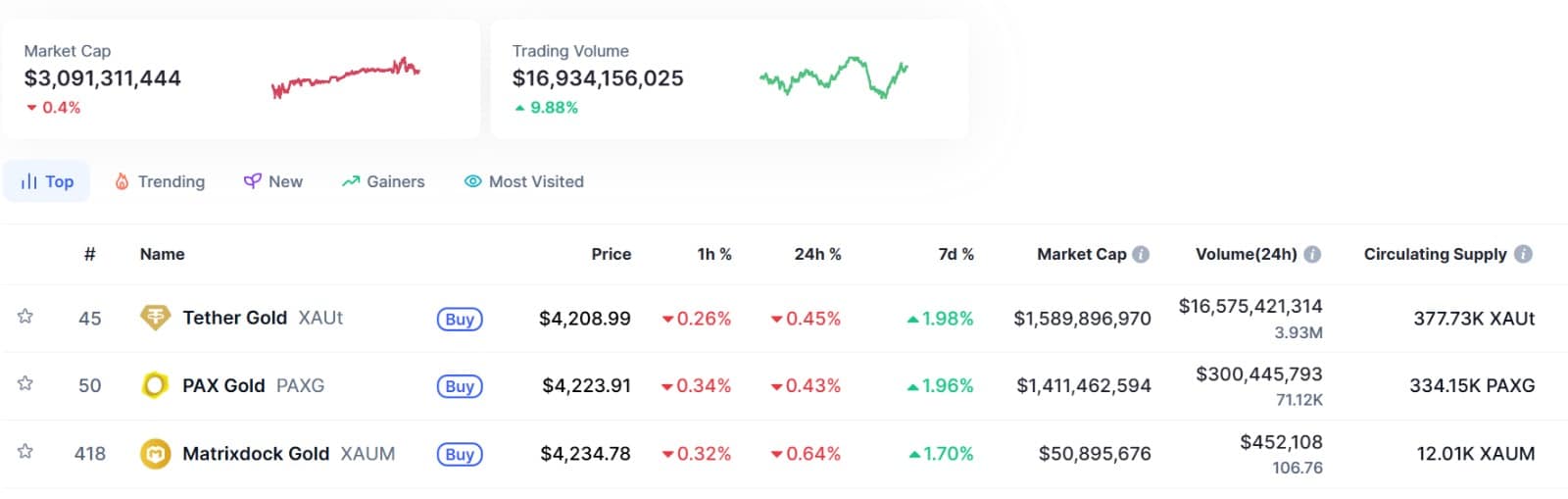

Tokenized gold has seen explosive growth, with its market cap climbing past $3 billion and trading volume reaching $16.9 billion.

Leading the charge is Tether, whose XAUt token dominates the space. Its market cap has surged to $1.5 billion, while trading volume has soared to $16 billion. This underscores Tether’s strong position as it captures early gains in the gold tokenization market.

Source: CoinMarketCap

In November 2025, Switzerland’s MKS PAMP relaunched DGLD, a gold‑backed token aimed primarily at institutional investors.

Meanwhile, PAX Gold, introduced by the New York‑based blockchain firm PAXOS, has continued to grow and expand its presence.

Coupled with that, traditional banking players have also entered the race. As such, HSBC, a central multinational bank and gold custodian, is eyeing the evolution and currently testing its gold token.

Even more importantly, the race is not limited to institutions, as Central Banks are also attempting to keep pace. Last month, Kyrgyzstan launched USDKG, a gold-backed stablecoin, backed by the country’s gold reserves.

Could tokenized gold dominate global finance?

Undoubtedly, the global markets are moving away from how and where assets are stored, but to how accessible they are.

Amid concerns about inflation, currency debasement, and market volatility, gold offers a solution. With that security becoming liquid, yield enabled via DeFi and borderless, it becomes the most compelling investment vehicle available.

This gives tokenized gold an advantage against other funds and tokenized assets. For that reason, tokenized gold is seeing massive capital rotation.

As global markets continue to evolve, assets backed by verifiable value, utility, and trust are set to lead the next phase, with gold firmly at the center.

Crucially, this is still the early stage of a digital gold rush, making it essential for everyone to take note and prepare for the wave ahead.

Final Thoughts

- Gold’s historic rally continues, with total supply now valued at $29 trillion.

- Tokenized gold sees significant capital rotation, surpassing $3 billion in market cap and $19 billion in trading volume.

Source: https://ambcrypto.com/is-tokenized-gold-the-next-revolution-people-should-be-ready-for/