- TIA has seen a 7.6% price increase over the past week, with analysts predicting a breakout at $4.6.

- Open interest and development activity show positive trends, suggesting further bullish potential for the token.

TIA, the native token of Celestia, a modular data availability network, has been gaining attention due to its recent price movements. Celestia aims to simplify the process of launching blockchains, making the technology more accessible and user-friendly for developers.

Over the past week, TIA has shown a notable increase in price, rising by 7.6%. This bullish trend continued into the past 24 hours, with the token climbing another 7.4% to a current price of $4.32 at the time of writing.

Break above this key level spells further surge

Despite this upward momentum, prominent crypto analyst Micheal Van De Poppe has offered a cautious perspective on TIA’s price action.

In a recently uploaded post on X, Van De Poppe expressed his belief that TIA may still experience a decline before making a meaningful recovery. He noted,

“TIA is going to make new lows before we can reverse. The trend remains to be downwards.”

Source: Micheal Van De Poppe on X

However, he added that a breakout above the $4.60 level could signal a potential trend reversal. This outlook suggests that while TIA may face short-term challenges, a key resistance level could serve as a turning point for the token.

Fundamental analysis of TIA’s market performance

In light of Van De Poppe’s technical analysis, it is important to consider TIA’s underlying fundamentals to assess whether the token has the potential to break through the $4.60 resistance level.

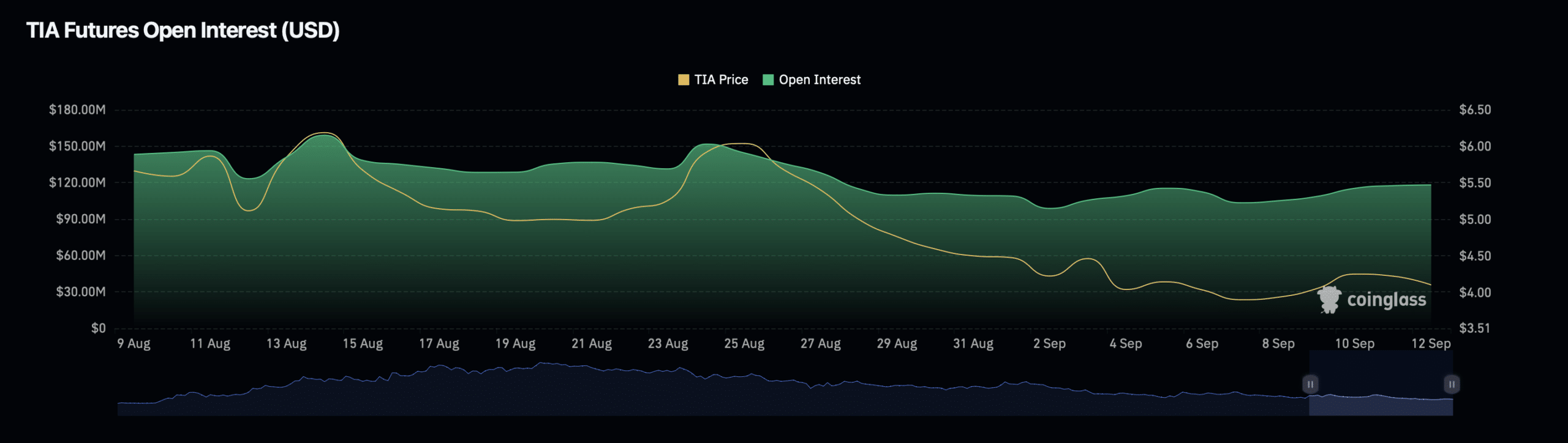

One key metric to examine is the token’s open interest, which refers to the total number of active contracts in the market. According to data from Coinglass, TIA’s open interest has increased by more than 15%, reaching a current valuation of $127.55 million.

Source: Coinglass

This growth in open interest suggests that there is heightened interest in TIA among traders, which could provide the liquidity necessary to push the token’s price higher. Additionally, TIA’s open interest volume has surged by 38.84%, now standing at $249.65 million.

These increases in both open interest and volume indicate that more market participants are taking positions on TIA, which could contribute to further price volatility in the near future.

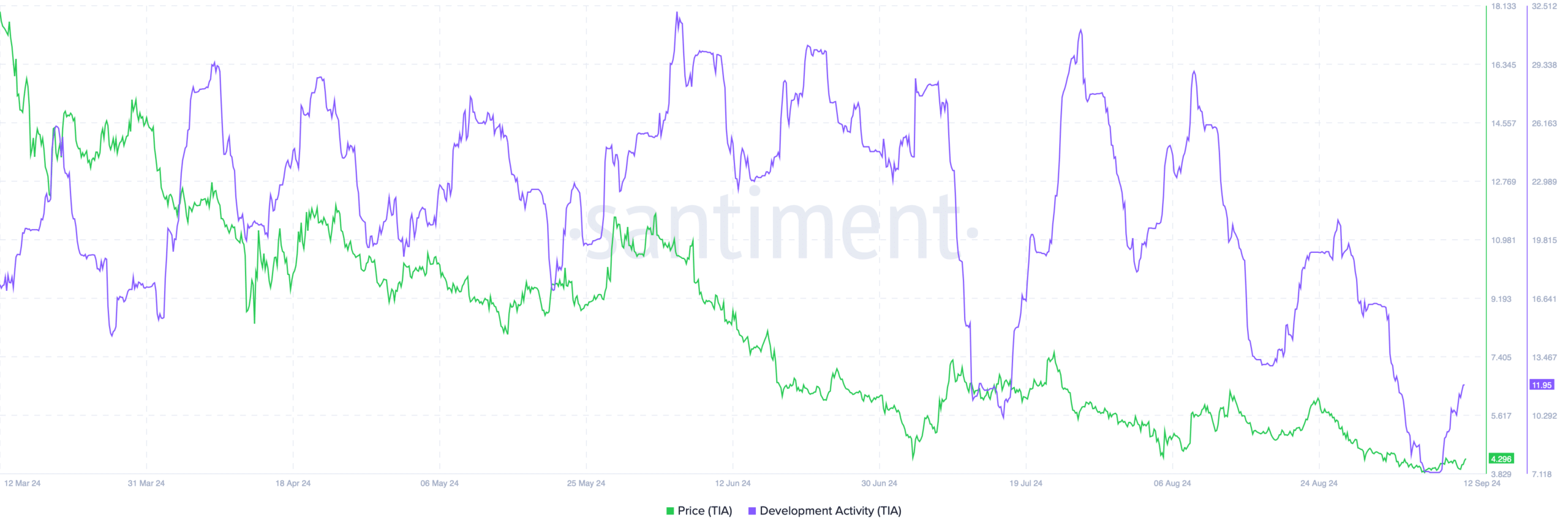

Another key factor to consider is TIA’s development activity, which can serve as an indicator of the ongoing efforts to improve the Celestia platform.

Data from Santiment showed that TIA’s development activity experienced a significant decline in late August, dropping from a peak of 11 to a low of 7.1 in early September.

Source: Santiment

Is your portfolio green? Check out the TIA Profit Calculator

However, this metric has recently seen a recovery, climbing to 11.95 as of today.

This increase in development activity suggests that the team behind Celestia is actively working on enhancements to the network, which could bolster investor confidence and potentially drive demand for the token.

Source: https://ambcrypto.com/celestia-analyst-predicts-major-rebound-for-tia-if-this-level-is/