- The Root Network surged 20% in one day amid broader market volatility, capturing stakeholders’ attention.

- What led to this extraordinary feat?

The Root Network [TRN] has recently gained attention due to several significant activities, pushing the price of its native currency, ROOT, to trend upwards by approximately 20% in the past 24 hours, to $0.02435 at press time.

The exceptional performance, despite broader market volatility, caught the attention of analysts at AMBCrypto, who explored the factors behind this surge.

The surge is rooted in a multichain agenda

A surge in developer activity on the root network has set it apart from other tokens struggling amid Bitcoin’s downturn.

For starters, Root’s integration with Futureverse, and services like Gen3 gaming is sparking the next phase of the digital economy, expanding its focus on AI applications within blockchain.

It is no surprise, the network aims to boost interoperability across the open metaverse, charting a path for the future.

Additionally, XRPL’s partnership with TRN has facilitated the use of XRP as the default digital asset for transactions in its multi-token gas economy.

Moreover, since then, the network has broadened its scope, incorporating new tokens such as ROOT, ASTO, and SYLO to access diverse services.

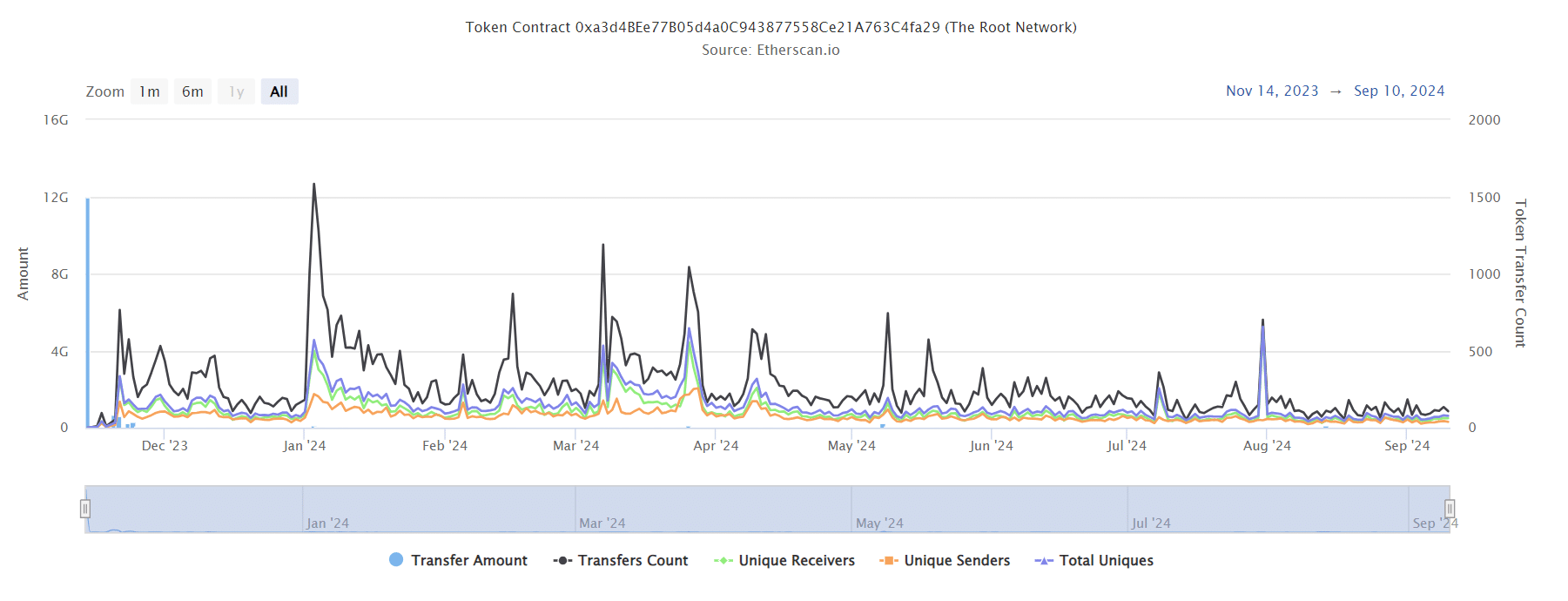

Source : Etherscan

The chart above revealed the impact of these listings on ROOT, showing its transaction count surge to $137 million earlier this year.

However, activity has since slowed, dropping to $4.4 million at press time. Despite this, the recent surge has rekindled investor optimism – But will it hold?

The Root Network draws new interest

The recent ROOT surge is distinctive, fueled by unique factors rather than Bitcoin’s bullish appeal.

The developers’ numerous innovations within the network have clearly yielded significant rewards.

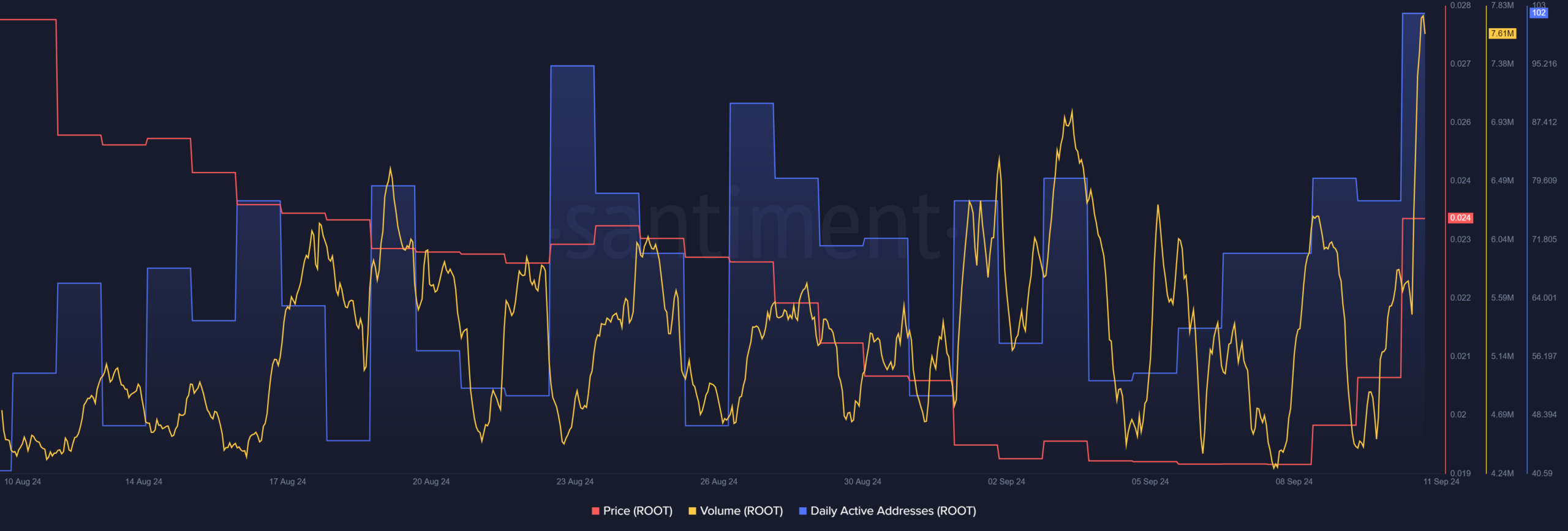

Source : Santiment

Hence, the network’s success in attracting new stakeholders is evident from the surge in daily active addresses.

Adding to the optimism, total volume has rebounded to early August levels, when ROOT tested the $0.027 ceiling.

Moreover, the root could be capitalizing on Bitcoin’s volatility, distinguishing itself with its meticulously crafted Tokenomics model.

The model plans to distribute its 12 million ROOT tokens as rewards to various communities, leveraging its staking capabilities effectively.

Overall, despite the market downturn, the root network has cultivated a robust community, evidenced by its 20% price surge.

If the trend persists, ROOT could soon revisit its previous $0.27 peak.

Source: https://ambcrypto.com/the-root-network-surges-20-in-24-hours-heres-why/