- The upcoming FOMC meeting may spark a “sell-the-news” moment.

- Analyst expects a market rise beforehand.

- $2.04 billion was withdrawn from digital assets this week.

On August 26, crypto analyst @IamCryptoWolf projected that the upcoming Federal Reserve FOMC meeting could lead to market pullbacks after steady gains.

This prediction aligns with historical market behaviors preceding FOMC meetings, often resulting in increased volatility and subsequent sell-offs, impacting key cryptocurrencies like Bitcoin, Ethereum, and Solana.

Market Movements Anticipated by Crypto Analyst

As an experienced crypto analyst, @IamCryptoWolf’s forecast regarding the next Federal Reserve FOMC meeting gained attention on August 26. His prediction identifies the meeting as a “sell-the-news” opportunity, with markets anticipated to rise beforehand, potentially marking a critical event for investors.

Such market anticipation is mirrored by significant outflows from digital assets, as reported by Coinshares. This suggests a strategic rebalancing by investors in response to macroeconomic conditions. While the analyst highlights ETH’s recent correction after a substantial surge, market dynamics continue to be shaped by these developments.

The cryptocurrency community and stakeholders are closely monitoring these movements. Many expect substantial adjustments in portfolios following the FOMC meeting. Meanwhile, governments and other financial entities have yet to release official statements regarding this forecast, leaving investors cautious but prepared for potential volatility.

Past Meetings’ Impact on Crypto Markets Explored

Did you know? Prior Federal Reserve FOMC meetings often resulted in crypto market fluctuations, typically displaying rallies followed by corrections.

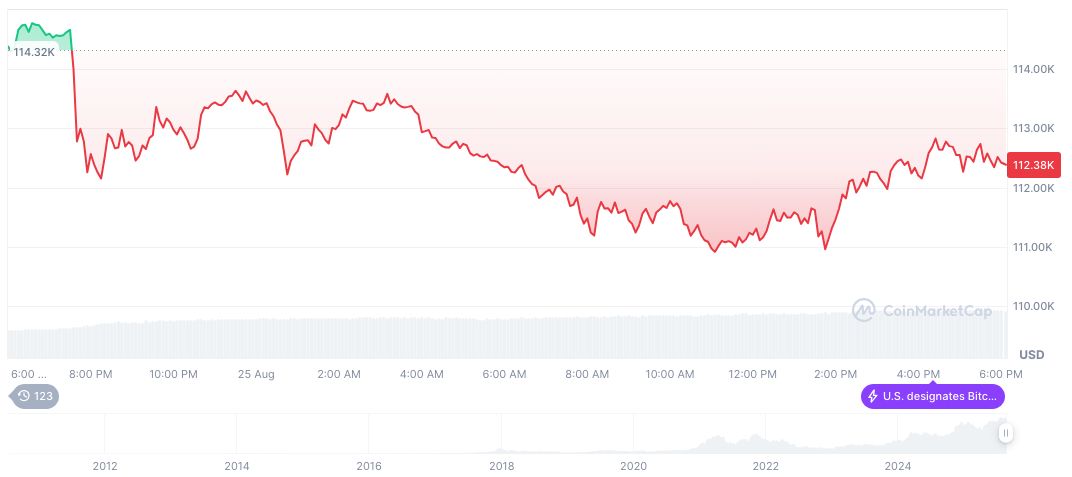

Bitcoin (BTC) recently traded at $109,755.27 with a market cap of $2.18 trillion, reflecting a minor price retreat over 24 hours, per CoinMarketCap. This follows a 7.16% decline over 30 days but maintains a 2.48% rise over 60 days, showcasing BTC’s inherent volatility amidst prevailing market trends.

Coincu’s research indicates that the projected “sell-the-news” event aligns with previous patterns seen during macroeconomic announcements. Historical volatility data suggests investors often engage in speculative trading before such pivotal events, aiming to capitalize on short-term movements. Regulatory responses, however, remain a wildcard, potentially influencing financial dynamics further.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fomc-meeting-market-speculation/