- The Dutch Central Bank warns ECB about possible stablecoin effects.

- Potential ECB interest rate adjustment due to stablecoins.

- Stablecoins like EURQ and USDQ gain regulatory focus.

The President of the Dutch Central Bank, Klaas Knot, warned on November 17th, 2025, about potential European Central Bank interest rate adjustments if a large-scale stablecoin run occurs.

This warning highlights growing financial stability concerns and regulatory scrutiny on private stablecoins, impacting ECB’s monetary policy amidst increasing digital currency adoption.

Dutch Central Bank Warns ECB of Stablecoin Vulnerabilities

The President of the Dutch Central Bank, Klaas Knot, has raised alarm bells regarding stablecoin vulnerabilities. The DNB has been pivotal in regulating financial innovations, specifically stablecoins under the MiCA framework. Recent conditions prompted this warning, considering stablecoins’ increasing role in financial markets. The ECB, led by Christine Lagarde, has acknowledged stablecoins’ impact on monetary transmission, emphasizing regulatory frameworks to mitigate systemic risks. MiCA-compliance among European stablecoins does aim to reduce such threats, but market participants remain watchful.

The ECB’s acknowledgment of potential interest rate adjustments underscores the regulatory complexities associated with stablecoin dynamics in currency stability. Institutions like Quantoz, supported by major industry players Kraken and Tether, are at the forefront of launching compliant stablecoins in Europe. Markets remain vigilant as regulatory bodies consider stability measures.

“Stablecoins…pose risks for monetary policy and financial stability. These assets are not always able to maintain their fixed value, compromising their usefulness as a means of payment and a store of value.” — Christine Lagarde, President, European Central Bank

Expert Analysis Highlights Stablecoin Market Stability

Did you know? Terraform Labs’ UST collapse in 2022 highlighted vulnerabilities in stablecoin design and triggered global regulatory scrutiny, reinforcing why stablecoins must be securely backed and fully compliant to mitigate financial contagion risks.

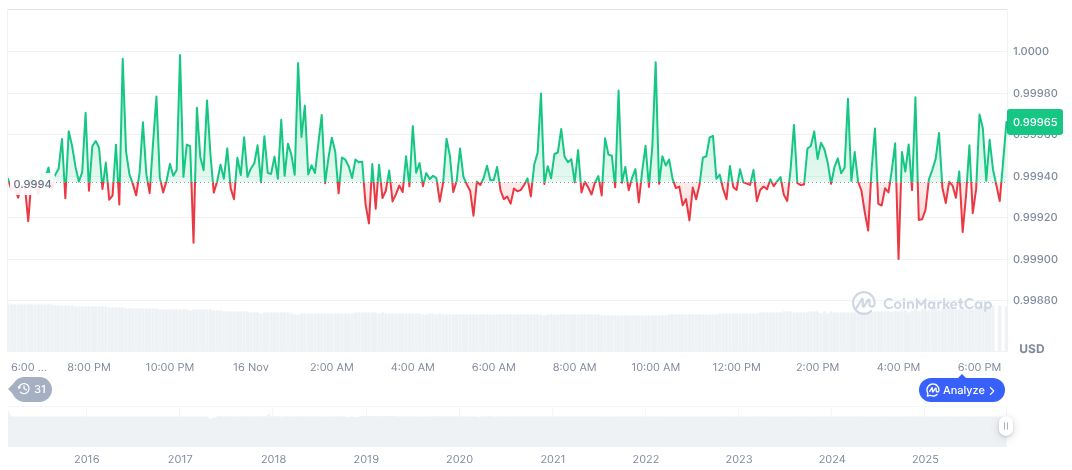

According to CoinMarketCap, Tether USDt (USDT) maintains its peg at $1.00, with a market cap of 183.92 billion dollars and a market dominance of 5.68%. Despite a 24-hour trading volume surge by 61.05%, price changes remain negligible, indicating market stability as of November 17, 2025.

Coincu researchers emphasize the essential role of robust regulatory oversight to prevent financial instability, particularly with stablecoins gaining traction. Historical precedents stress the importance of comprehensive guidelines to avert systemic threats affecting monetary policy and stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/dutch-central-bank-stablecoin-risks/