- Tether CEO retweets analysis valuing the company at 515 billion dollars.

- Valuation suggests Tether could be 19th largest company globally.

- CEO Paolo Ardoino emphasizes no immediate IPO plans are in place.

Summarizing a June 8th announcement, Tether’s CEO Paolo Ardoino retweeted an analysis projecting a $515 billion public market valuation for the company if it were to go public, ranking it the 19th largest globally.

This scenario underscores Tether’s dominant role in the stablecoin sector. While this hypothetical valuation is noteworthy, Ardoino emphasized the company’s commitment to maintaining its current solid business model and stated there are no plans for an initial public offering.

CEO Ardoino: No IPO Despite $515 Billion Valuation

Tether’s CEO Paolo Ardoino retweeted a valuation analysis estimating the company’s market capitalization at $515 billion if it goes public. This projection would position Tether as the 19th largest company worldwide, surpassing well-known organizations like Costco and Coca-Cola. Ardoino described the figure as a “beautiful number.”

Despite the impressive valuation estimate, Ardoino reaffirmed Tether’s solid business operation. He clarified the desire to remain humble, emphasizing no immediate plans for an IPO, thus suggesting continuity in Tether’s operational strategies. The analysis reflects Tether’s substantial influence in the stablecoin market, underscoring its importance in digital finance ecosystems.

“If Tether were to go public, it would reach a market value of $515 billion. This is a beautiful number.” — Paolo Ardoino, CEO of Tether

Market observers noted the CEO’s reaction but saw no regulatory or institutional shifts. Ardoino’s reiteration of Tether’s steady strategy has not yielded immediate responses from major crypto figures or significant regulatory comments. Analysis of social media and forums indicates ongoing discussions but lacks formal industry responses.

Tether’s Hypothetical Valuation and Market Implications

Did you know? The valuation exercise suggests Tether’s hypothetical market cap could place it above global giants like Costco and Coca-Cola, showcasing its potential influence if it pursued an IPO.

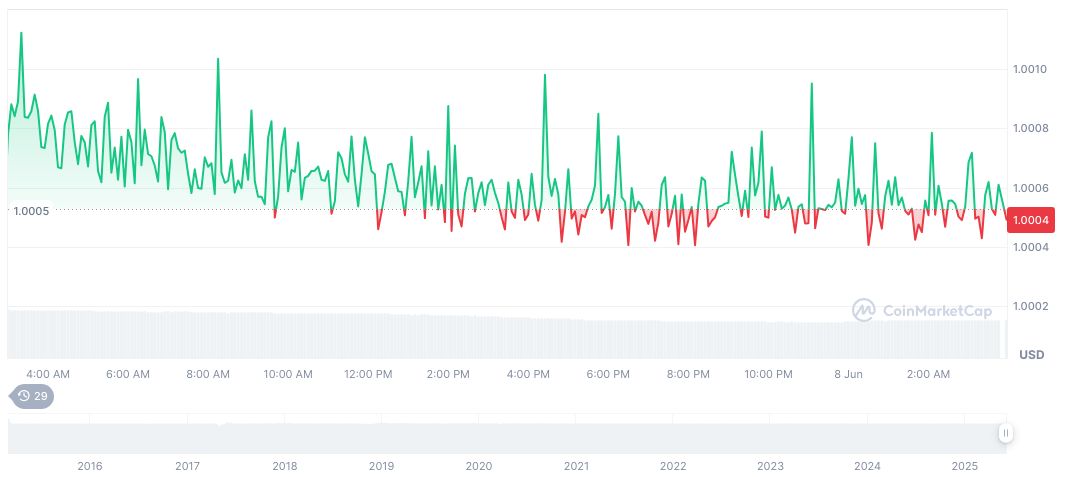

As of now, Tether USDT is priced at $1.00 with a market cap of $154.82 billion, representing a 4.71% market dominance. According to CoinMarketCap, its 24-hour trading volume decreased by 21.16% to $54.00 billion.

Coincu research suggests potential financial implications if such a valuation becomes a reality. Historical trends reveal that speculative valuations tend to influence market sentiment more than actual price changes immediately. Tether’s continued dominance may prompt future regulatory evaluations, considering its role in global financial interactions. Insights maintain caution over ambitious speculative analyses.

Source: https://coincu.com/342157-tether-valuation-market-discussions/