- Record USDT supply, Tether leadership focus, blockchain shifts.

- USDT groundbreaking $160 billion circulation.

- Tether strengthens presence in emerging markets.

Tether’s USDT supply reached an unprecedented 160 billion USD, with key contributions from Tron, Ethereum, and Solana blockchains.

Paolo Ardoino, CEO of Tether, highlighted USDT’s role as a digital dollar in emerging markets, marking Tether’s continued expansion and focus on transparency.

USDT Circulation Hits Record $160 Billion Milestone

According to transparency data from Tether, USDT circulation has reached $160 billion. Key blockchains include Tron, Ethereum, and Solana, holding significant shares in this issuance, with respective circulations of $81 billion, $74 billion, and $18 billion each. CEO Paolo Ardoino celebrated this milestone, emphasizing USDT’s practicality for digital transactions.

This significant growth in USDT issuance aligns with Tether’s strategy to support high-activity blockchains, prioritizing resources for these networks. The shift includes plans to phase out support for less active chains, indicating a strong refocus on maximizing blockchain utility and liquidity.

The market’s response to Tether’s expanded USDT supply has been portrayed as positive, with major exchanges like Binance receiving significant $1 billion allocations. Tether’s dominant position attributes to a 65% market share of stablecoins, illustrating its pivotal role in centralized and decentralized finance.

Tether Enhances Blockchain Strategy Amid Market Growth

Did you know? Tether’s strategy to shift USDT issuance from under-utilized blockchains has been key in solidifying its market dominance, mirroring similar patterns during past crypto surges.

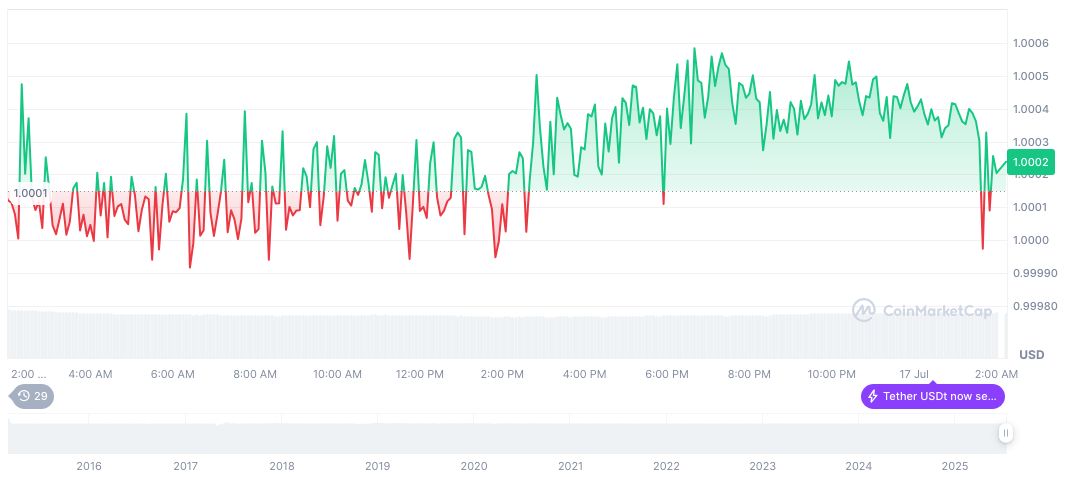

As reported by CoinMarketCap, Tether’s USDT maintains a stable price of $1.00 amidst its record circulation, boasting a market cap of $160.29 billion. Despite recent fluctuations, USDT’s significant trading volume, reported at $135.61 billion over 24 hours, demonstrates its liquidity importance in digital finance markets.

Insights from the Coincu research team suggest Tether’s strategy of focusing on active blockchains, coupled with its extensive U.S. Treasury holdings, may bolster regulatory credibility. Historical trends show correlation between USDT supply increases and enhanced market liquidity, likely influencing ongoing blockchain adoption.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349097-tether-usdt-record-circulation/