- Tether becomes 18th largest U.S. Treasury holder with $127 billion.

- Q2 profits recorded at $4.9 billion amid strategic shifts.

- No immediate adverse effects seen on DeFi protocols.

Tether, led by CEO Paolo Ardoino, has become the 18th largest U.S. Treasury bond holder, surpassing South Korea with over $127 billion in holdings as of June 30, 2025.

This milestone for Tether indicates significant positioning in global finance, highlighting increased trust and demand for its stablecoin USDT, with no immediate negative impact on major DeFi protocols.

Tether’s Treasury Holdings Exceed $127 Billion, Profits Soar

Tether has strengthened its market position by becoming one of the world’s largest holders of U.S. Treasury securities. The company’s increased U.S. Treasury exposure underscores its commitment to maintaining robust asset backing and enhancing user trust.

The latest financial disclosures indicate a shift in Tether’s strategy. The company reported a substantial $4.9 billion net profit for Q2, emphasizing a reduced reliance on U.S. government debt.

Community and industry reactions reflect a largely positive sentiment. No significant negative impact on major DeFi protocols was reported, highlighting market stability.

Tether’s Growing Influence Sparks Potential Regulatory Interest

Did you know? Tether’s ascent to becoming a significant U.S. Treasury holder reflects a growing trend since 2024 when the company significantly boosted Treasury purchases following new regulations in Europe.

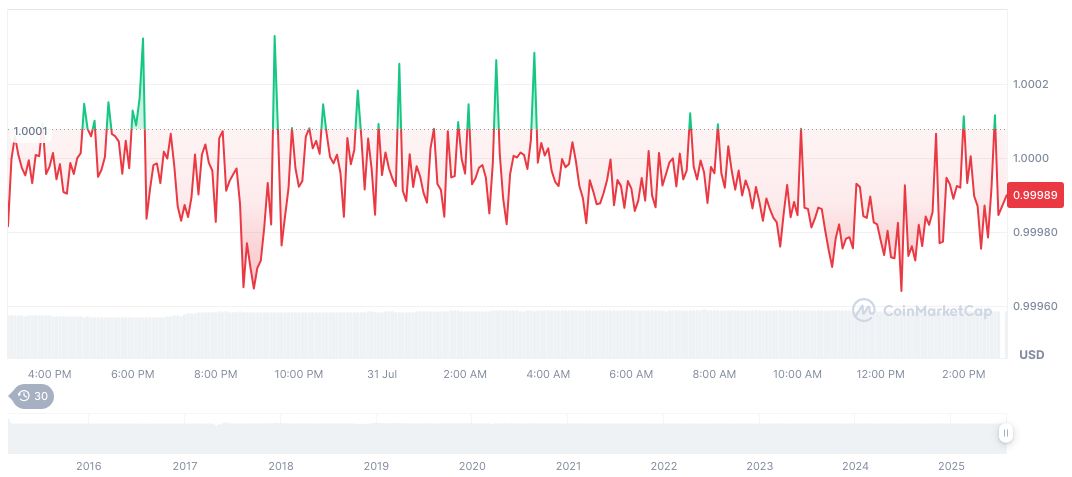

As of August 1, 2025, Tether USDt (USDT) holds a current price of $1.00, with a market cap of $163.68 billion, based on CoinMarketCap data. The 24-hour trading volume noted at $138.46 billion, a 14.13% increase, with recent modest price changes reflecting stable conditions.

Coincu suggests that Tether’s position could prompt further regulatory interest as crypto assets intertwine with traditional finance. Continued transparency and strategic diversification will likely play a crucial role in maintaining stakeholder confidence and market stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tether-us-treasury-surpasses-south-korea/