- Tether targets U.S. institutional market with stablecoin focus.

- Tether will not pursue public listing to focus on growth.

- Potential market shifts with increased stablecoin adoption.

Paolo Ardoino, CEO of Tether Holdings SA, announced a strategic move to concentrate on the U.S. institutional market, focusing on stablecoins for payments and trading.

Tether’s strategy could influence the U.S. market, affecting liquidity and competition among other stablecoin issuers.

Tether’s U.S. Institutional Strategy Unveiled

Tether Holdings SA has outlined a focused strategy to integrate efficient stablecoins into the U.S. institutional framework. The company aims to enhance non-public operations by leveraging Ardoino’s leadership, considering the advantages in emerging markets. Paolo Ardoino highlighted the commitment to provide stablecoins facilitating payments and interbank settlements.

The decision shapes Tether’s trajectory, reducing the likelihood of public listing ambitions. This adjustment reflects a commitment to institutional partnerships, potentially impacting existing stablecoin regulations. The shift dovetails with the Genius Act, fostering legal clarity for crypto ventures.

“We are well in progress of establishing our US domestic strategy… It’s going to be focused on the US institutional markets, providing an efficient stablecoin for payments but also for interbank settlements and trading.” — Paolo Ardoino, CEO, Tether Holdings SA

Industry responses emphasize high expectations among analysts and executives. The Genius Act represents a welcoming framework, opening doors for stablecoin issuers. Public reactions are mixed, yet the institutional focus aligns with broader market trends.

Tether’s Market Influence and Expert Predictions

Did you know? The Genius Act is regarded as a U.S. milestone in stablecoin regulation, offering similarities to the EU’s MiCA for crypto asset adoption.

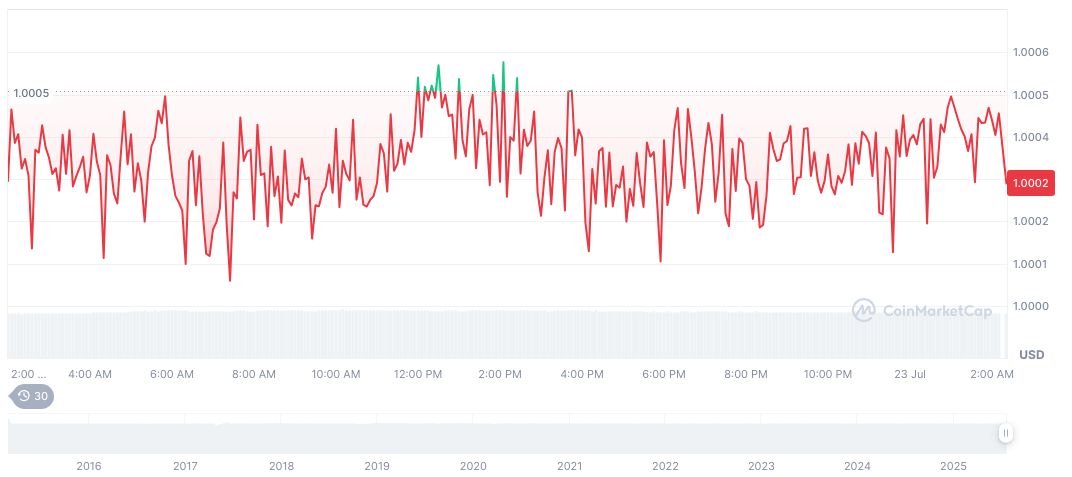

As of July 24, 2025, Tether USDt (USDT) remains valued at $1.00. According to CoinMarketCap, it holds a market cap of $162.04 billion with 4.17% market dominance. Its 24-hour trading volume saw a 7.27% decline, recording $140.72 billion. Monthly price variations spanned from 2.02% increase over the last 24 hours to a 1.64% decrease over 30 days.

The Coincu research team predicts that Tether’s strategic pivot may spur a ripple effect in the stablecoin ecosystem, urging other issuers to adjust strategies within legal frameworks. Long-term impacts could involve liquidity shifts, favoring compliant issuers significant positioning within U.S. financial markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/tether-us-strategy-stablecoins/