- Tether reports $10 billion profit and tops US bond holdings.

- Tether holds over $135 billion in U.S. Treasuries.

- Tether’s USDT circulation exceeds $174 billion globally.

Tether reported over $10 billion in net profits for Q3 2025, confirming its dominant position in the cryptocurrency market, with significant holdings in U.S. Treasury bonds and digital asset reserves.

The robust financial performance highlights Tether’s expanding influence, positioning it as a key player globally, particularly in the stablecoin and digital currency ecosystem.

Tether Reports $10 Billion Profit and Tops US Treasury Rankings

Tether’s third-quarter report underscores the company’s robust financial performance, with a net profit topping $10 billion. This development cements Tether’s position as one of the largest holders of U.S. Treasury bonds, surpassing South Korea in national rankings.

The record levels of U.S. Treasury holdings and issuance of $17 billion USDT highlight Tether’s continued growth and adaptability in the market. The impact extends across crypto markets, enhancing liquidity and availability of USDT.

Market reactions vary; retail investors, showing a skeptical tone, contrast with strong institutional interest. Tether’s CEO, Paolo Ardoino, anticipates $15 billion in profits by year-end, reflecting investor confidence despite bearish retail sentiments.

Tether’s Strategic Growth: Market Data and Regulatory Outlook

Did you know? Tether has become the 17th largest holder of U.S. government debt, surpassing several countries’ national treasuries, reflecting its significant influence in global financial markets.

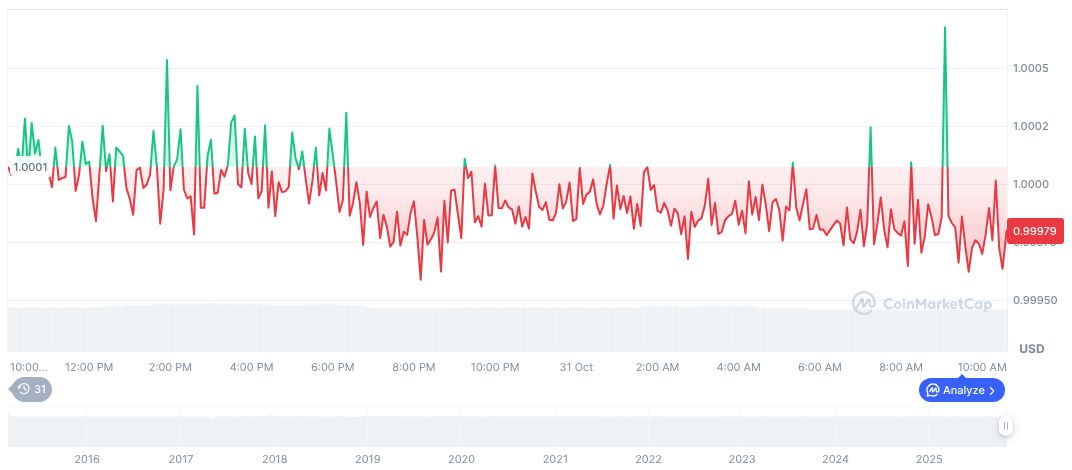

According to CoinMarketCap, Tether USDt (USDT) holds a market cap of $183.34 billion, with a dominance of 4.96% as of October 31, 2025. Daily trading volumes reach $139.04 billion, showcasing Tether’s critical role in market liquidity. Prices have slightly declined over the past 90 days, indicating stability.

Coincu’s analysis suggests Tether’s financial strategy could spur regulatory scrutiny while increasing reliance on U.S. debt markets. The technological initiatives in AI and P2P communication may reshape finance’s landscape, with potential long-term benefits for Tether’s ecosystem. As stated by Paolo Ardoino, CEO of Tether, “This year we’re going to approach another $15 billion profit. That’s very rare. There is no other company in the world that has that.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tether-record-profits-us-bond/