- Tether reveals 99% profit margin and massive U.S. investments.

- Tether launches USAT token for U.S. instant settlements.

- $775 million invested in Rumble Inc; focuses on U.S. market.

Tether CEO Paolo Ardoino announced on social media the company’s profit margin reaches 99% alongside plans to launch a USAT token for instant settlement in the U.S. market.

Tether’s financial strategies and partnerships highlight its expansion beyond stablecoins, potentially influencing market dynamics and competition with Circle, amidst growing U.S. regulatory developments.

Tether’s Strategic Expansion: USAT Token and 99% Profit Margin

Tether confirmed its 99% profit margin, as revealed by CEO Paolo Ardoino, maintaining profitability without public listing plans such as its competitor Circle has done. In recent reports, Tether announced an innovative USAT token in collaboration with Hines and Cantor Fitzgerald LP, specifically designed for instant settlements within the U.S. market.

The new USAT token aims to reduce transaction costs and broaden professional and institutional engagement within U.S. crypto markets. Tether’s $4 billion investment strategy underscores its commitment to AI, renewable energy, and real estate. Paolo Ardoino highlighted, “Tether’s distinct advantage lies in its own distribution channels,” differentiating it from Circle’s revenue-sharing approach with platforms like Coinbase.

Crypto markets have reacted positively to Ardoino’s statements, showing continued strong support for USDT’s market position. No significant on-chain disturbances have been reported, reflecting steady investor confidence. The team echoes the sentiment that Tether’s strategy could consolidate its market dominance further.

Tether’s Influence on Market and Regulatory Landscape

Did you know? Tether’s operational independence, highlighted by its profit margin, parallels its early recognition as a stablecoin pioneer—a role it continues to expand by spearheading U.S. tokenization strategies today.

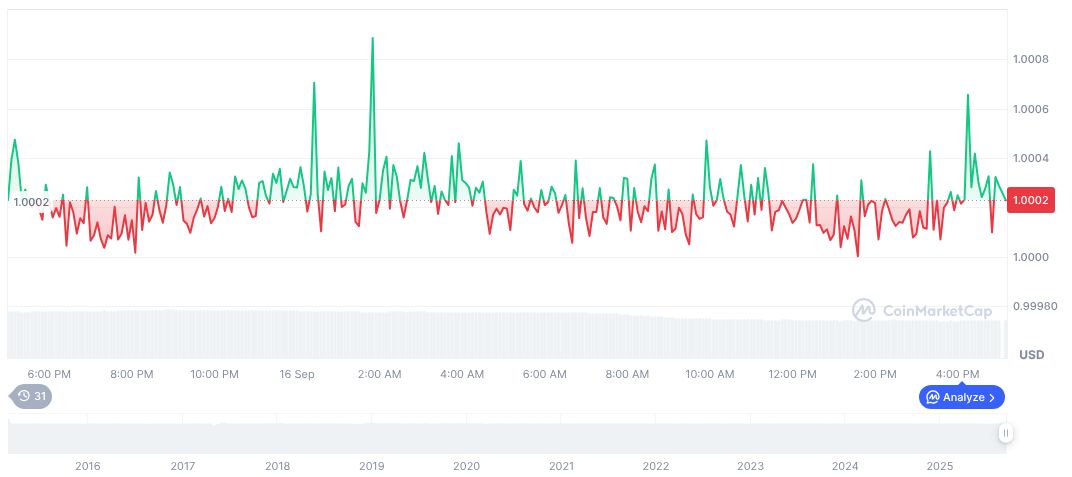

According to CoinMarketCap, Tether USDt (USDT) retains a market cap of $171.02 billion with a market dominance of 4.23%. The stablecoin remains pegged at $1.00, posting minimal price variation over the last 90 days, reinforcing its stability.

Coincu research indicates that Tether’s investments and focus on instant settlement technology may prompt regulatory revisions, enhancing stablecoin market standards. Tether’s strategic focus on in-house distribution channels could also positively impact its operational efficiency and market reach.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tether-profit-usat-token-strategy/