- Tether invests in Parfin for institutional USDT adoption in Latin America.

- Boosting blockchain settlement solutions regionally.

- Reactions highlight potential for increased USDT usage.

Tether announced on November 20, an investment in Parfin to boost institutional adoption of USDT in Latin America and enhance blockchain settlement solutions.

This partnership aims to strengthen financial infrastructure, expanding access to USDT and potentially increasing market efficiency throughout Latin America’s burgeoning digital asset sector.

Tether’s Strategic Investment Boosts Latin American Blockchain

Tether, a leading stablecoin issuer, has invested in Parfin, a digital asset custody and management platform. This partnership aims to accelerate USDT adoption and provide efficient blockchain settlement solutions in Latin America, enhancing financial operations’ security and transparency.

With Parfin’s recent $10M Series A funding, the collaboration is set to improve access to blockchain solutions, expanding Parfin’s infrastructure capabilities in financial institutions. This, in turn, will support revenue growth and maintain relevancy in digital asset transactions across the region.

“With this new funding, we can help more banks and financial institutions realize new sources of revenue and stay relevant by leveraging the efficiency, security, and transparency of digital assets.” – Marcos Viriato, CEO, Parfin

Overall, community sentiment is favorable towards increased blockchain integration.

Tether USDt Dominates Market Amid Parfin Partnership Impact

Did you know? Tether’s investment in Parfin might signal an era of enhanced interoperability and liquidity for Latin American and local digital coins, paralleling the region’s increasing blockchain adoption.

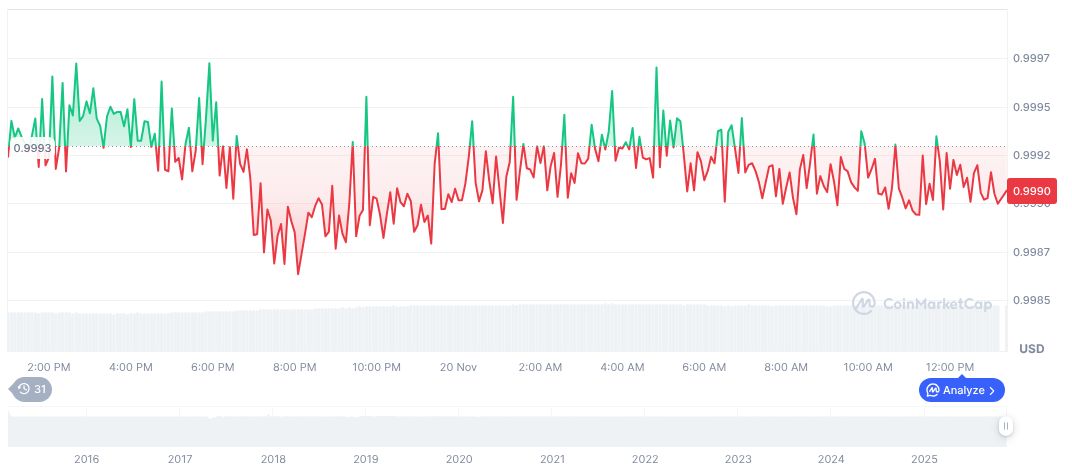

Tether USDt (USDT) remains a pivotal stablecoin with a market cap of $183.70 billion, according to CoinMarketCap. The trading volume reached $142.66 billion, showing a 19.33% change within 24 hours. Minor price fluctuations are observed over recent months, maintaining its market dominance at 5.86%.

Insights from the Phemex news article about Tether’s $15B credit deployment suggest that the Tether-Parfin partnership could facilitate significant technological advancements and increased adoption of blockchain among financial institutions in Latin America. The focus on institutional engagement is expected to spark further innovation in tokenization and secure transactions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/tether-parfin-usdt-expansion/